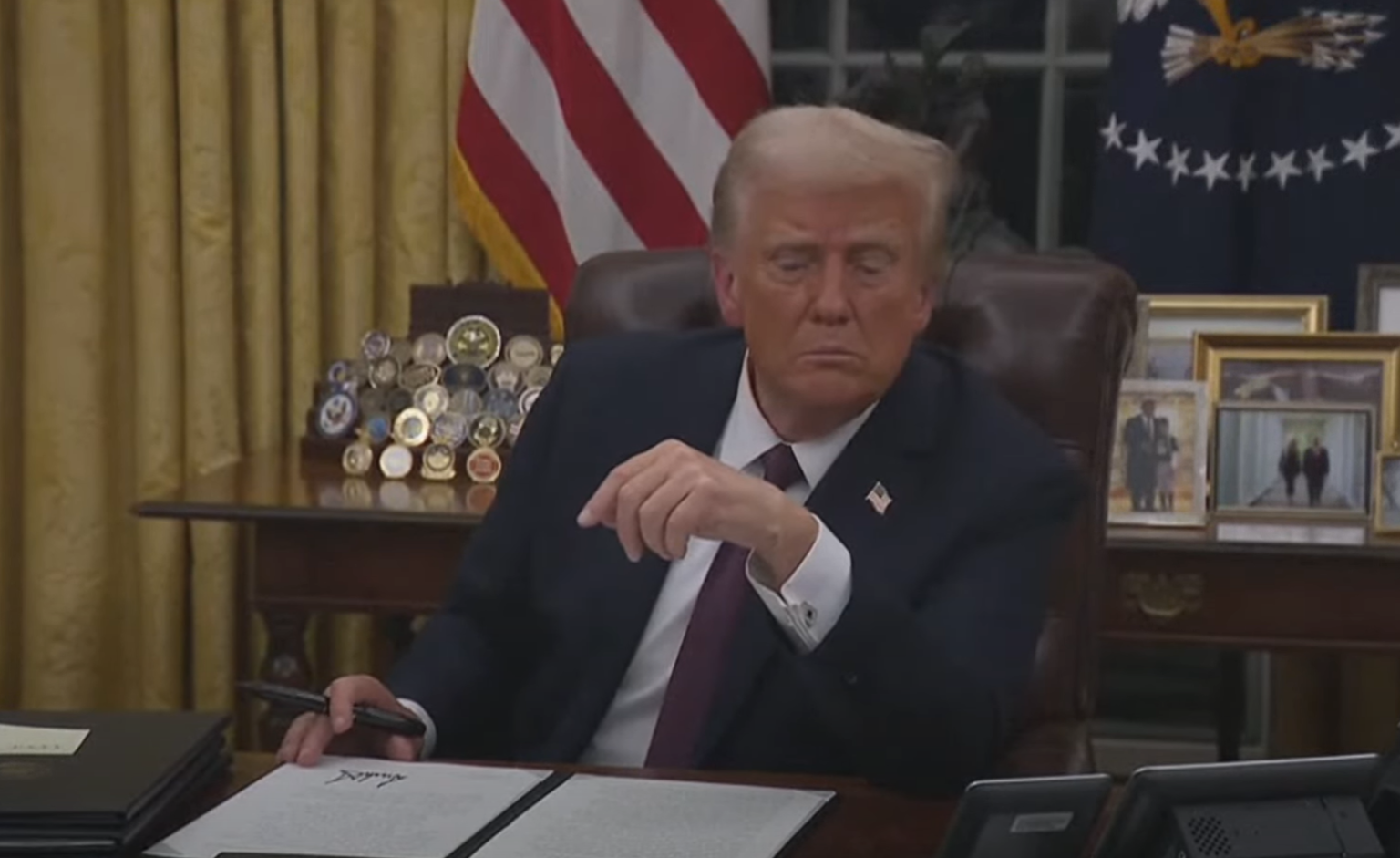

Get ready for a breathtaking ride, as the world of cryptocurrencies is about to experience an unprecedented level of funding inflow, potentially in the range of $150 billion to $500 billion. This comes as the President of the United States, Donald Trump, inked an executive order earlier this week, championing the establishment of a new sovereign wealth fund. Interestingly, the declaration didn’t directly mention Bitcoin, yet the fans of this digital currency have reasons to be optimistic. The US Secretaries of Commerce and Treasury, Howard Lutnick and Scott Bessent respectively, who are known for their bullish stance on Bitcoin, are expected to lead this initiative jointly.

Possible $150 Billion Inflows into Bitcoin

Prominent Bitcoin supporter, Florian Bruce-Boye, shared a comprehensive perspective on platform X. He expressed strong faith that the impending US sovereign wealth fund could become the world’s largest in the long run. He commented:

“With H. Lutnick and S. Bessent at the helm, who have expressed their firm belief in the potential of Bitcoin, it’s highly likely that Bitcoin will be part of this sovereign wealth fund.”

Bruce-Boye drew attention to the investment histories of Lutnick and Bessent, both of whom are known advocates of Bitcoin. He substantiated his claim by stating that Bessent sees the digital currency as a “freedom technology”. In a similar vein, Lutnick has been quite vocal about his substantial investments in Bitcoin.

Aiming Higher – $500 Billion?

This sense of positivity was echoed by Thomas Fahrer, co-founder of Apollo, who conjectured that the American sovereign wealth fund might soon hit a whopping $5 trillion. Fahrer’s projections pushed the potential inflow even higher, alluding to a multi-year wave of institutional demand triggered by a strategic allocation of Bitcoin in the US fund.

The Founder of True North, Jeff Walton, spotlighted the critical role of Howard Lutnick’s leadership in the fund’s development. Lutnick, who also holds the position of CEO at Cantor Fitzgerald, is known for his substantial personal investment in Bitcoin.

Despite the uncertainties, the global Bitcoin market is anticipating this development with bated breath. It is aware that even a modest allocation from the incoming US Sovereign Wealth Fund could reshape the financial landscape by sparking a new wave of global institutional participation.

How Will This Impact the Future of Bitcoin?

If you’re keen to keep a close eye on these developments and their potential influence on Bitcoin’s future, consider downloading an esteemed cryptocurrency application like Finances Zippy. It provides insightful price forecasts and market trends that can help you make informed decisions.

BTC was valued at $99,450 at the time of writing.

FAQs:

Question: Can this sovereign wealth fund influence the price of Bitcoin?

Answer: Yes, the substantial capital inflow from the incoming US Sovereign Wealth Fund could potentially boost Bitcoin’s price by triggering a wave of institutional demand.

Question: How accurate are predictions made by applications like Finances Zippy?

Answer: While these applications provide insightful forecasts and market trends, their predictions should be taken as guidance, not certainty.

Question: How can one stay updated with these developments?

Answer: Following cryptocurrency news platforms, reading expert opinions, and using applications like Finances Zippy can help you stay informed about the latest market trends.