In the ever-evolving world of cryptocurrencies, Ethereum has faced turbulent times, with its value touching new lows and causing concern among investors. This article delves into the recent shifts in Ethereum’s market position, exploring the challenges and potential indicators for recovery. By understanding the current market climate and key data points, investors can make more informed decisions regarding their cryptocurrency portfolios.

Ethereum Faces Unprecedented Market Challenges Amid Global Economic Uncertainty

Ethereum has experienced a significant downturn, reaching a fresh low of approximately $1,380, a level unseen since March 2023. The ongoing market turbulence has stirred worries regarding Ethereum’s long-term viability as a promising investment. The present downturn is a result of persistent macroeconomic challenges, global instability, and the ever-changing fiscal and trade policies in the U.S.

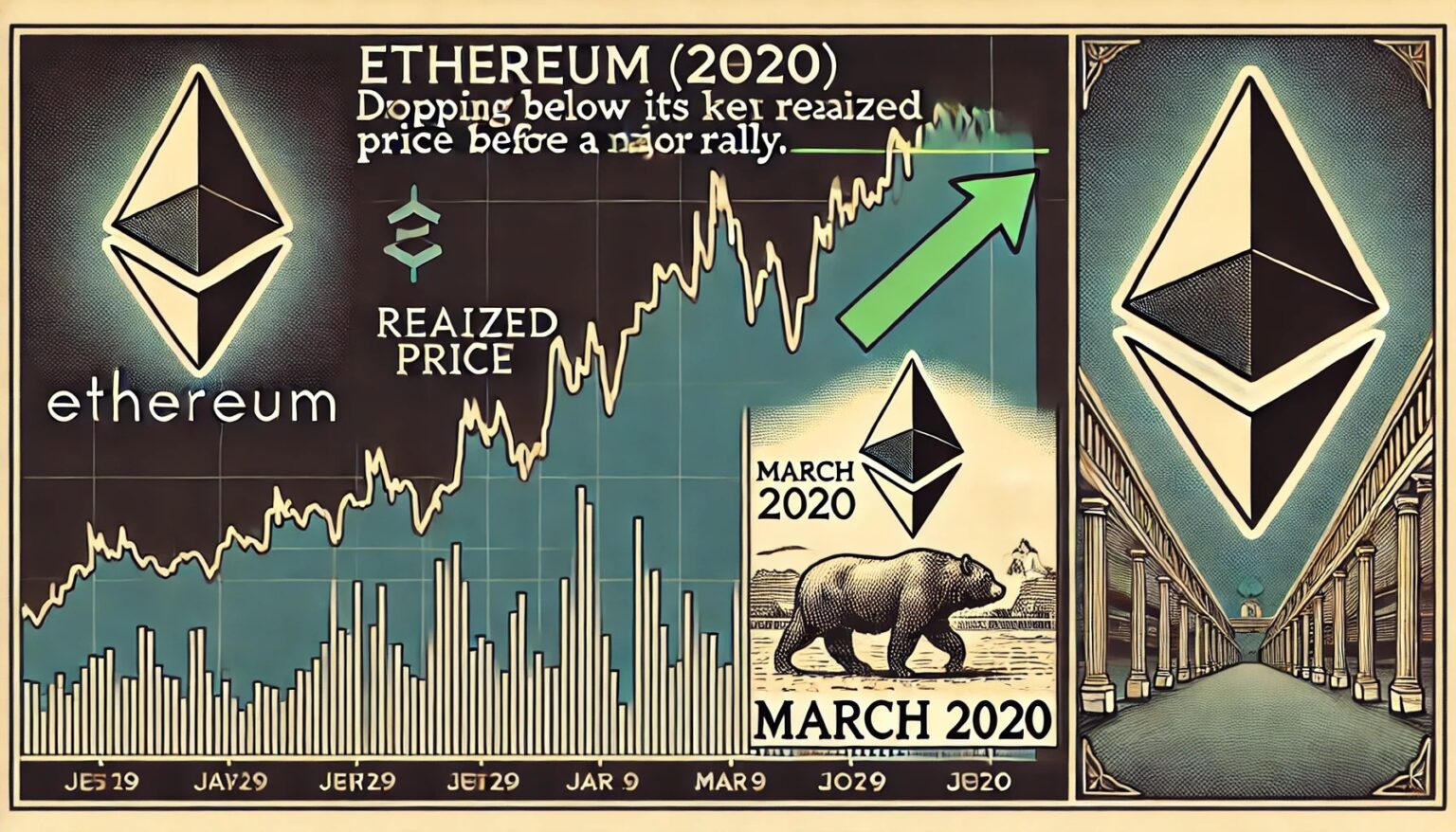

The sentiment within the cryptocurrency community has become increasingly pessimistic, with Ethereum’s price movements mirroring this anxiety. Having struggled to maintain critical support levels for several months, Ethereum’s fall below $1,500 has intensified fears of a further decline. Yet, amidst the uncertainty, there could be room for optimism. According to insights from Finances Zippy, Ethereum is now trading below its realized price, an infrequent occurrence that has historically aligned with market bottoms and potential recovery phases.

Ethereum Dips Below Realized Price as Market Fear Escalates

Since late March, Ethereum’s value has diminished by over 33%, causing significant apprehension among investors and market analysts. The descent has dragged ETH to two-year lows, igniting panic among stakeholders who anticipated 2025 as a pivotal year for altcoins. However, Ethereum now exemplifies market fragility as global economic conditions worsen.

Global trade tensions, inflation threats, and risks of a worldwide recession are unsettling financial markets. In this volatile environment, high-risk assets like Ethereum are especially vulnerable. As investors shift towards safer alternatives, the selloff of ETH has intensified, deeply impacting confidence.

Nevertheless, there is a glint of optimism in the data. Carl Runefelt, a prominent crypto analyst, recently highlighted that Ethereum is currently trading below its realized price of $2,000, a rare pattern that has often predicted turning points in its price history.

Historically, Ethereum’s decline below its realized price, as last witnessed in March 2020, saw a fall from $283 to $109, followed by a strong recovery. Though the current conditions are unpredictable, on-chain metrics suggest Ethereum could be entering a new accumulation phase.

Ethereum Battles to Recover Above $1,500 Amid Uncertain Support Levels

Ethereum is navigating below the $1,500 threshold following a drastic 50% drop since late February. This severe downturn has wiped out months of gains, leaving investors in a state of ambiguity as ETH shows no recovery signs. The prevailing market sentiment leans toward bearishness, with little sign of having reached a bottom.

Currently, Ethereum lacks a defined support level, with the bulls losing grip and the price trending downward amidst weak demand and escalating fear. For any substantial rebound to occur, Ethereum must first surpass the $1,850 level, a significant resistance point that was once support.

Until this level is reclaimed, any upward momentum is likely to face substantial selling pressure. The situation may worsen if Ethereum dips below the $1,380 mark, a psychological barrier. Dropping past this could lead to further declines, potentially reaching the $1,100 to $1,200 range.

Given the ongoing macroeconomic stresses and anticipated volatility, market participants will closely monitor whether Ethereum can stabilize or if its value will continue to decline.

FAQs

Is Ethereum’s current price decline a good opportunity for investment?

Investing in Ethereum during a price decline can be tempting due to potential long-term gains. However, it is crucial to conduct thorough research, considering market trends, economic conditions, and Ethereum’s developmental progress before making any investment decisions.

What are the factors affecting Ethereum’s price drop?

The primary factors influencing Ethereum’s recent price drop include global economic tensions, rising inflation rates, potential recession fears, and the shift of investor capital from riskier assets like cryptocurrencies to more secure alternatives.

Could Ethereum’s realized price indicate a potential market bottom?

Historically, trading below the realized price has signaled significant market bottoms and potential recovery phases. However, this should be viewed as one of many indicators. Comprehensive market analysis and consideration of broader economic factors should drive investment decisions.

As the editorial team at Bitcoinist, we are committed to providing well-researched, precise, and unbiased content. Our editorial process rigorously upholds integrity and ensures our readers benefit from valuable, reliable information.