In an era where digital currency dominates the financial landscape, safeguarding investments becomes paramount. The rising sophistication of cyber theft has placed cryptocurrency investors on high alert. This narrative delves into a notable incident involving the theft of XRP, exploring the mechanisms and vulnerabilities exposed in the process. Our aim is to provide a well-rounded analysis that educates and empowers readers to make informed decisions surrounding their cryptocurrency security and investment strategies.

The Anatomy of a $3 Million XRP Heist: Lessons for Cryptocurrency Investors

Unraveling the $3 Million XRP Cyber Theft

A significant theft of over $3 million in XRP recently shook the cryptocurrency community. The incident, meticulously traced by on-chain investigator ZachXBT, highlights the risks inherent in digital currency management. The stolen amount was funneled through a series of complex laundering tactics, ultimately linking to the Cambodian financial network Huione, recently blacklisted by the US government due to its alleged illicit activities.

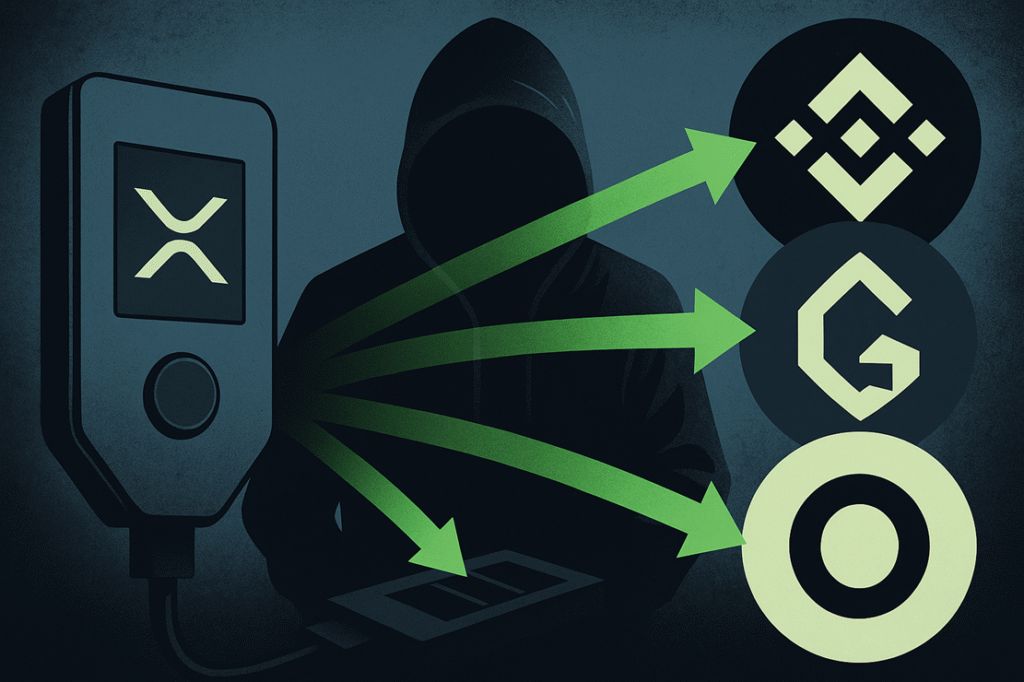

ZachXBT’s investigation revealed the theft from a US-based user’s Ellipal wallet, identifying the address involved through extensive analysis of transaction dates and amounts visible in public forums. The attacker quickly converted the XRP to different cryptocurrencies via Bridgers, a multi-chain aggregator previously associated with SWFT. This allowed for rapid movement across blockchains and, ultimately, the laundering of funds through over-the-counter (OTC) networks affiliated with Huione.

The Complexity of Cross-Chain Laundering

The theft leveraged Bridgers’ cross-chain swap capabilities to maneuver the stolen assets efficiently. This method of laundering aligns with patterns US authorities have cautioned against, as such tactics are frequent in professional scam operations across Southeast Asia. The funds were swiftly consolidated on the Tron blockchain before being moved to OTC platforms linked to illicit activities.

The US Treasury’s recent sanctioning of Huione underscores the seriousness of these laundering schemes. The network was labeled a key money laundering outlet, severing its ties to the US financial system to curb its role in facilitating fraudulent flows tied to scams and human trafficking operations.

Navigating the Challenges of Cryptocurrency Security

The incident underscores a crucial misunderstanding among users regarding the security of different wallet types. Ellipal, the wallet in question, clarified that the user mistakenly imported their cold wallet’s seed phrase into a hot wallet, exposing their assets to online theft. This mix-up highlights the broader issue of product confusion within the industry, where users may misinterpret the security features of custodian and non-custodian wallets.

ZachXBT emphasized the need for better user education to prevent such vulnerabilities, drawing parallels to past incidents where users moved funds to compromised wallets following social engineering attacks. Ellipal has since reiterated the importance of maintaining strict separation between cold and hot wallets and ensuring recovery phrases remain offline.

The Road to Recovery: Insights and Challenges

Efforts to recover the stolen funds are fraught with challenges. Reports indicate that contacting law enforcement for cryptocurrency thefts remains difficult, with only a handful of jurisdictions equipped to manage such cases effectively. ZachXBT also criticized the so-called “crypto recovery” industry, warning against predatory practices that exploit victims with exorbitant fees while offering minimal actionable insights.

With the likelihood of recovering the stolen XRP deemed low, rapid reporting and collaboration with credible parties in the private sector are crucial. The absence of robust support systems for XRP victims, compared to those within the Bitcoin and Ethereum communities, further complicates restitution efforts.

What measures can be taken to enhance cryptocurrency wallet security?

Ensuring wallet security involves using hardware wallets for cold storage, maintaining offline recovery phrases, and being vigilant against phishing attacks. Users should also regularly update their security protocols and stay informed about potential vulnerabilities.

How can users distinguish between custodial and non-custodial wallets?

Custodial wallets are managed by third-party services which hold the user’s private keys, offering convenience but less control. Non-custodial wallets provide users with full control over their private keys, enhancing security but requiring increased user responsibility in managing their funds.

Is it possible to trace stolen cryptocurrency and recover it?

While tracing stolen cryptocurrency is achievable with blockchain analysis, recovery is often complex and uncertain. Successful restitution typically requires quick reporting and cooperation with seasoned blockchain investigators and law enforcement agencies.

Why is Huione significant in cryptocurrency laundering activities?

Huione has been identified as a major facilitator of funds connected to illicit activities such as scams and trafficking in Southeast Asia, primarily due to its ability to integrate with numerous OTC networks and provide a veil of legitimacy to dubious financial transactions.

This comprehensive guide delves into the intricate details of the XRP theft incident, illustrating the essential lessons and proactive measures necessary for safeguarding digital assets. With practical insights and expert analysis, readers are better equipped to navigate the complex landscape of cryptocurrency investments and security.