Bitcoin, altcoins, and the vast ecosystem of cryptocurrencies continue to revolutionize the financial landscape. With blockchain technology at their core, these digital assets offer a potent mix of peer-to-peer transactions, decentralization, and the possibility of substantial returns for investors willing to shoulder the accompanying risk. Amidst these dynamics, one name that continues to capture headlines is XRP. Its journey, marked by significant regulatory hurdles and market volatility, provides crucial insights for both seasoned and novice investors in the crypto space. Today, we delve deep into the world of XRP, assessing its performance amidst external factors and its potential as an investment asset.

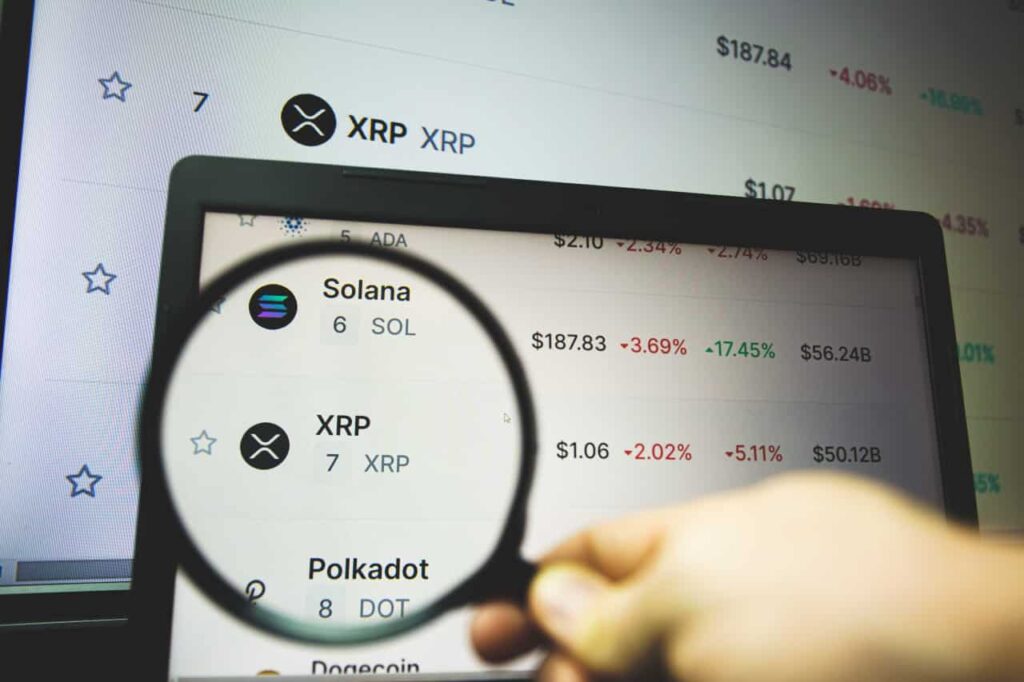

A Closer Look at XRP’s Performance Amidst External Factors and Market Headwinds

The Impact of Presidential Politics and Regulatory Challenges on XRP

Significant political and regulatory events can send ripples across the global financial markets, and cryptocurrencies like XRP are not immune. The re-election campaign of former President Donald Trump and the news of former Securities and Exchange Commission (SEC) Chair Gary Gensler’s resignation had dramatic impacts on the value of XRP. It surged from a modest $0.51 to highs nearing $3.31 in January, resulting in an impressive 549% rally.

An equally influential event was the SEC’s landmark decision to drop its lawsuit against Ripple Labs, which initially ignited a positive reaction in the market. XRP experienced a 14.35% rally from lows of roughly $2.23 to highs of nearly $2.55, pushing the token’s market capitalization to a staggering $149.18 billion.

XRP and Broader Cryptocurrency Market Trends

However, the euphoria was short-lived, with subsequent trading revealing a harsh reality. Within 48 hours, XRP lost a whopping $11.4 billion, shrugging off what was arguably its biggest bearish constraint since the lawsuit’s inception in 2021.

This volatility resonated with broader market trends, as the entire cryptocurrency market experienced a similar, albeit delayed, ripple effect. The total valuation of digital assets saw a brief surge, peaking at $2.81 trillion before retracting by approximately $110 billion to settle around $2.7 trillion.

What are the implications of XRP’s performance amidst these external factors?

These shifts underscore the inherent interaction between cryptocurrencies and global macroeconomic and political events. Factors like protectionist tariffs, escalating trade wars, and speculations of recessions can feed into market uncertainties. This unease often precipitates significant sell-offs and a pivot towards safer investment commodities in the short term.

A Silver Lining: XRP’s Long-Term Outlook

Despite these short-term upheavals, not all is gloomy for XRP. The token’s long-term picture remains promising. Despite brief downturns, the fact that XRP has maintained a 304.03% increase over the last six months, with a current price of $2.38, is a testament to its resilience and potential for investors.

Is XRP a feasible long-term investment?

While XRP has faced numerous challenges and market volatility, its ability to rally and maintain significant gains over extended periods suggests it holds potential as a long-term investment. However, as with all investments, potential investors need to thoroughly analyze market trends, regulatory developments, and XRP’s competitive positioning to make an informed decision.

This comprehensive analysis of XRP seeks to shed light on its performance amidst fluctuating market conditions and external factors. Following this carefully articulated narrative, readers can gain a deeper understanding of XRP and other cryptocurrencies, which can aid in making informed investment decisions. The journey doesn’t end here, though. In the dynamic realm of crypto investments, learning is an ongoing process, and updates are part of the journey.

What are the key factors to consider while investing in XRP?

Investors should consider several factors before making a decision about XRP. These include understanding the technology behind the cryptocurrency, assessing its historical performance, keeping abreast of regulatory developments, and evaluating the overall state of the crypto market. Comprehensive and informed research is crucial in deciphering the potential rewards and risks accompanying an investment in XRP.