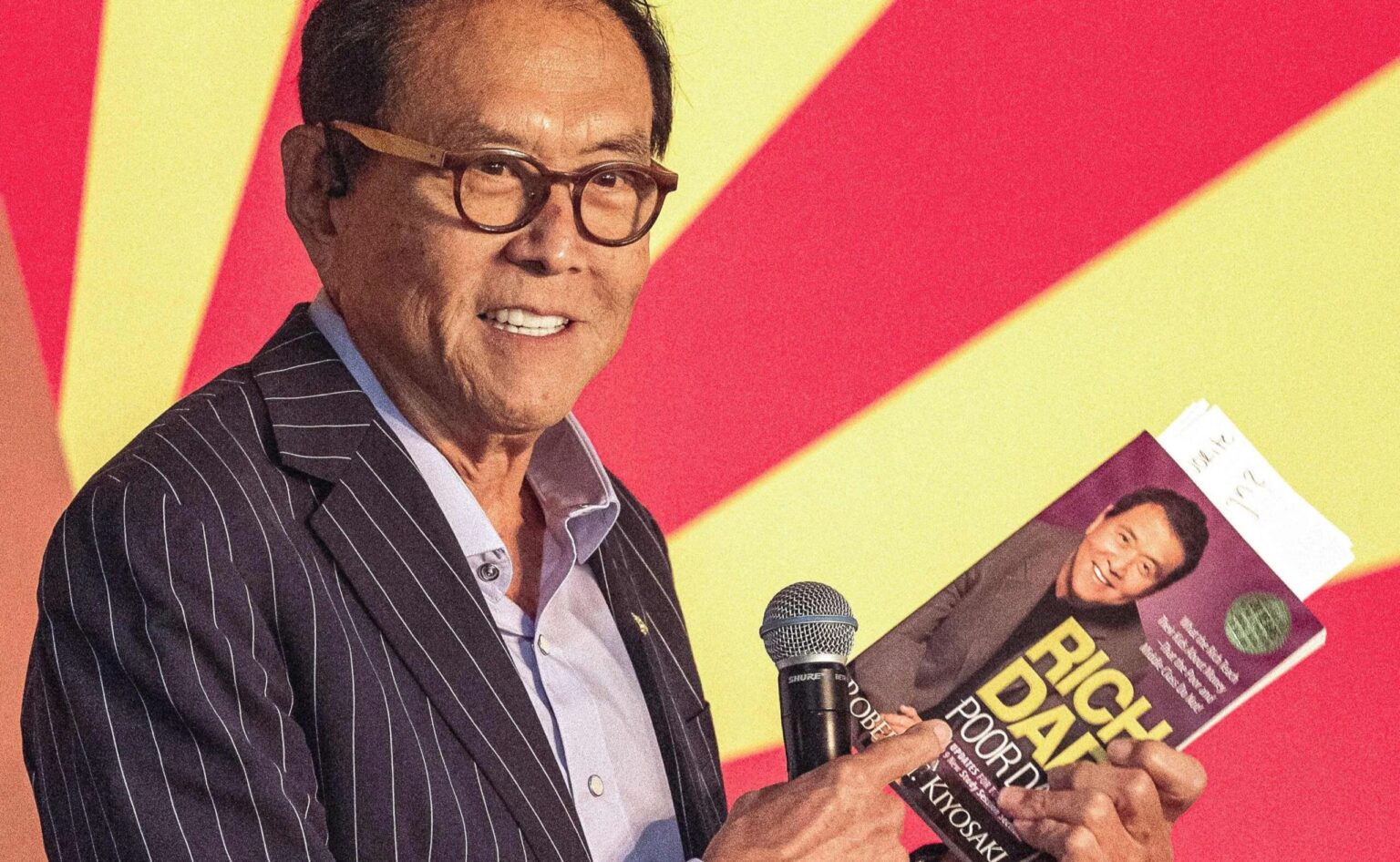

In a world increasingly driven by digital currencies, notable figures are making bold financial maneuvers that capture the attention of both novice and seasoned investors. Robert Kiyosaki, the acclaimed author of “Rich Dad Poor Dad,” recently amplified his investment in Bitcoin, a move that has stirred conversations across the financial landscape. By making a sizable Bitcoin purchase, Kiyosaki not only underscores his confidence in the cryptocurrency’s future but also invites others to examine the potential of digital assets in building wealth. In this comprehensive analysis, we will explore the implications of such investments and the broader trends shaping the future of Bitcoin.

Kiyosaki’s Strategic Bitcoin Investment: A Vision Beyond Conventional Wealth

An Assertive Move into Bitcoin

In a noteworthy move, Kiyosaki invested over $100,000 to purchase a single Bitcoin, emphasizing his belief in the enduring potential of cryptocurrency. He disclosed, through a tweet, his acquisition at a price around $106,784. His rationale stems from a commitment to take calculated risks rather than miss out on what he perceives could be exponential future growth. Kiyosaki anticipates that Bitcoin’s value might eventually skyrocket to the $1 million mark, a goal that he has consistently mentioned over the years.

Forecasting a Million-Dollar Milestone

The journey from approximately $106,784 to a hypothetical $1,000,000 represents a striking growth trajectory of about 830%. Kiyosaki first shared this ambitious outlook in 2021, encouraging followers to conduct their own analysis. His stance is that the potential reward justifies the risk, especially considering the dynamic nature of the cryptocurrency market.

Market Voices and Predictions

Several influential voices echo Kiyosaki’s optimism: Changpeng Zhao of Binance suggests that Bitcoin might surpass $1 million in its current cycle, contingent on an extended rally. Similarly, Samson Mow of Jan3 envisions Bitcoin reaching the million-dollar mark, fueled by national adoption and sovereign debt opportunities. Ark Invest’s Cathie Wood has projected scenarios where Bitcoin could reach up to $2.5 million by 2030 under favorable conditions.

While these bullish forecasts are compelling, the community remains divided. Some investors perceive the current Bitcoin price as overvalued, whereas others see it as a strategic entry point before the next upswing. The diversity in perspectives ensures ongoing debate and underscores the complexity of cryptocurrency investments.

Kiyosaki’s decision does more than reflect personal conviction; it catalyzes discourse on Bitcoin’s trajectory and highlights the influence of high-profile investors in shaping market sentiment. His final reminder to his audience is to independently weigh risks against benefits without blindly replicating others’ strategies.

Frequently Asked Questions

Is Bitcoin a wise investment strategy?

Investing in Bitcoin can offer substantial returns due to its volatile market behavior and growth potential. However, investors must consider their risk tolerance, market research, and long-term financial goals before engaging in Bitcoin investments.

What are the main factors influencing Bitcoin’s price?

Bitcoin’s valuation is influenced by factors such as market demand and supply dynamics, regulatory developments, institutional adoption, macroeconomic trends, and technological advancements within the blockchain industry.

How do prominent investors impact the cryptocurrency market?

High-profile investors can substantially influence market sentiment and price movements in the cryptocurrency sector. Their investment choices can lead to increased media attention and investor interest, potentially driving market trends in the short to medium term.

This comprehensive guide to Kiyosaki’s Bitcoin investment explores not only his confidence in the cryptocurrency but also the broader market dynamics at play. By examining expert predictions and market trends, readers can gain valuable insights into making informed investment decisions in the ever-evolving world of digital currencies.