Diving into the dynamic world of cryptocurrency, we come across vigorous discussions, groundbreaking decisions, and pioneering visions. One such projection that has stirred up the crypto-community recently revolves around Senator Bernie Moreno. Making his perspectives vocal at the Digital Chamber Blockchain Summit on March 26, Moreno argued that the United States should consider investing in Bitcoin on a large scale. The senator proposes that the country should amass 1 million BTC over five years, cementing its foothold in the evolving financial landscape. He is banking on having a bill regarding this passed by August.

#The Bitcoin Stockpile Proposal

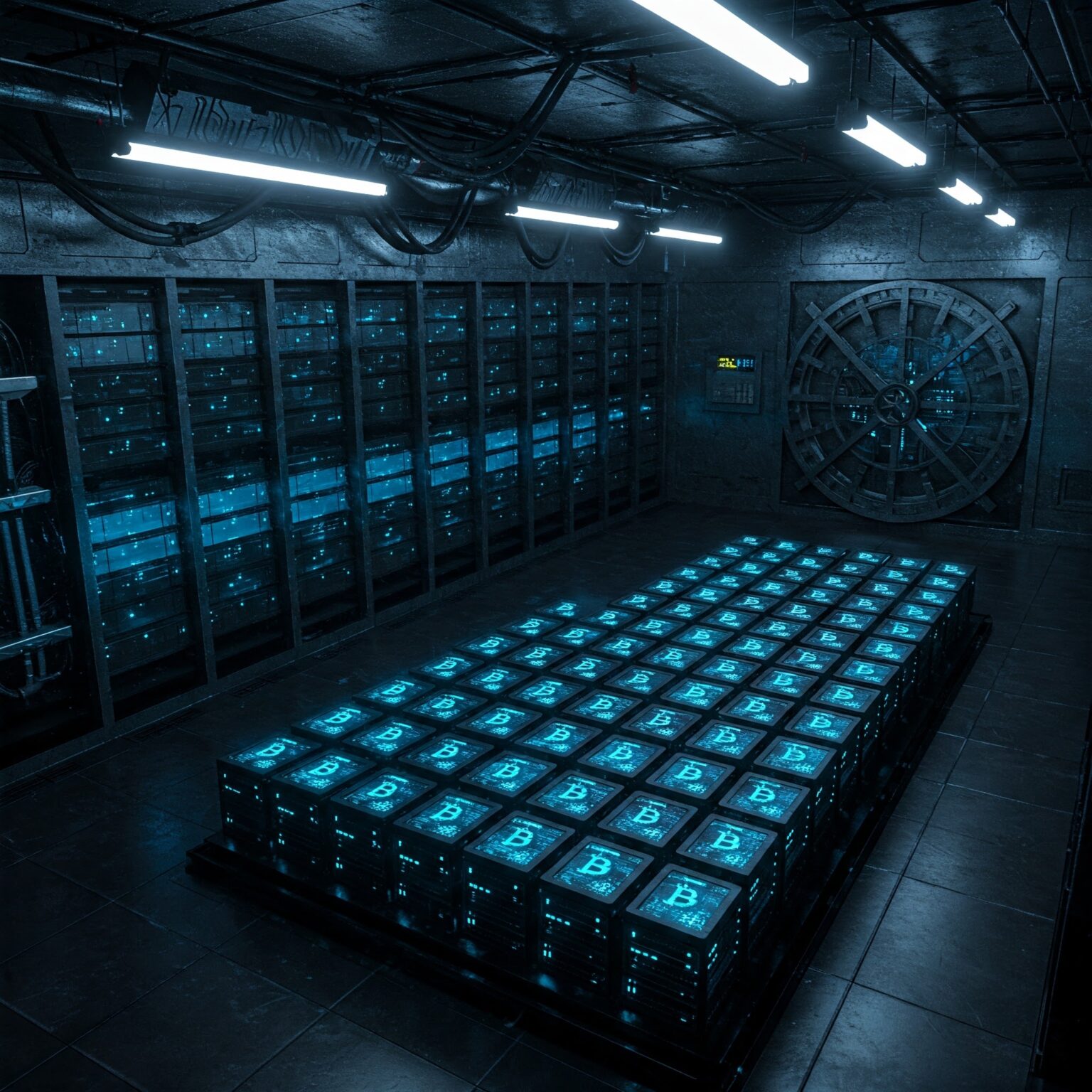

Moreno’s proposal is straightforward. He advocates for the U.S. government to purchase Bitcoin and securely store it. The senator views this arrangement as a significant step toward reinforcing the country’s monetary stability. Moreno perceives cryptocurrency and related digital assets to be influential forces in our economic future.

The senator’s proposed bill aims to establish a national Bitcoin reserve that mimics the purpose of gold reserves held by various nations. The ambitious goal is to accumulate 1 million Bitcoin within a span of five years.

The Probability Of The Bill Getting Passed

Not everyone is convinced that Moreno’s vision will become a reality. Several experts in financial policy regard this as highly unlikely. For instance, a legal analyst from Bloomberg predicts merely a 30% chance that the U.S. will invest in Bitcoin this year.

Contrarily, some are more sanguine. Mathew Sigel, a cryptocurrency analyst at VanEck, estimates the likelihood between 50% and 60%. He posits that while bipartisan support exists, it doesn’t guarantee the bill’s success. This leaves us in a suspenseful state of expectation.

Offering some context, U.S. Representative Nick Begich and Senator Cynthia Lummis recently introduced the Bitcoin Act of 2025. This legislation, which awaits congressional approval, draws its roots from U.S. President Donald Trump’s new executive order authorizing the establishment of a Strategic Bitcoin Reserve and a U.S. Digital Asset Stockpile.

The Significance Of This Move

Why is Moreno’s proposal of relevance? The senator envisions Bitcoin as the currency of the future, a crucial tool for the U.S. to retain its global economic leadership. If the U.S. decides to invest heavily in Bitcoin, it could redefine how the world perceives this digital currency and potentially shift the general perspective toward currency. With cryptocurrency rapidly becoming mainstream, some believe it’s high time for governments to take note. Moreno’s proposed Bitcoin investment could have extensive implications.

What Comes Next?

The proposed strategy now awaits scrutiny from lawmakers. They will examine, discuss, and determine its feasibility. With the August deadline looming, financial and legal experts will be closely monitoring the proceedings.

The decision will significantly impact how the U.S. interacts with digital money and establish if the nation is prepared to welcome novel forms of currency like Bitcoin. With the entire globe observing the U.S.’s actions, the decision could shape the future of digital currency.

Is the U.S. ready to forge a Bitcoin reserve?

The proposal to establish a strategic Bitcoin stockpile is a ground-breaking idea. However, its realization hinges on careful legislative review and broad acceptance, both politically and socially.

How will this move impact the global perception of Bitcoin?

If the United States, a significant global economic player, invests in Bitcoin on such an extensive scale, it could potentially transform the way the world regards this digital currency, accelerating its mainstream adoption.

Can Bitcoin secure the financial future of the U.S.?

While Bitcoin offers numerous advantages, such as decentralization and scalability, its future is still highly unpredictable. Therefore, while it has the potential to contribute to the country’s financial stability, its role must be evaluated alongside other financial assets and strategies.

What risks are associated with creating a Bitcoin reserve?

Creating a Bitcoin reserve entails risks, particularly due to the volatility of the cryptocurrency market. In addition, potential regulatory, security, and technological challenges must be addressed to ensure safe and effective management of the reserve.

Our editorial process at bitcoinist is committed to delivering thoroughly researched, accurate, and unbiased content. With a highly competent team of leading technology experts and seasoned editors, we adhere to stringent sourcing standards. Each page undergoes meticulous review to ensure the credibility, relevance, and value of our content. This rigorous scrutiny guarantees the integrity and quality of our content, making it a reliable resource for our readers.