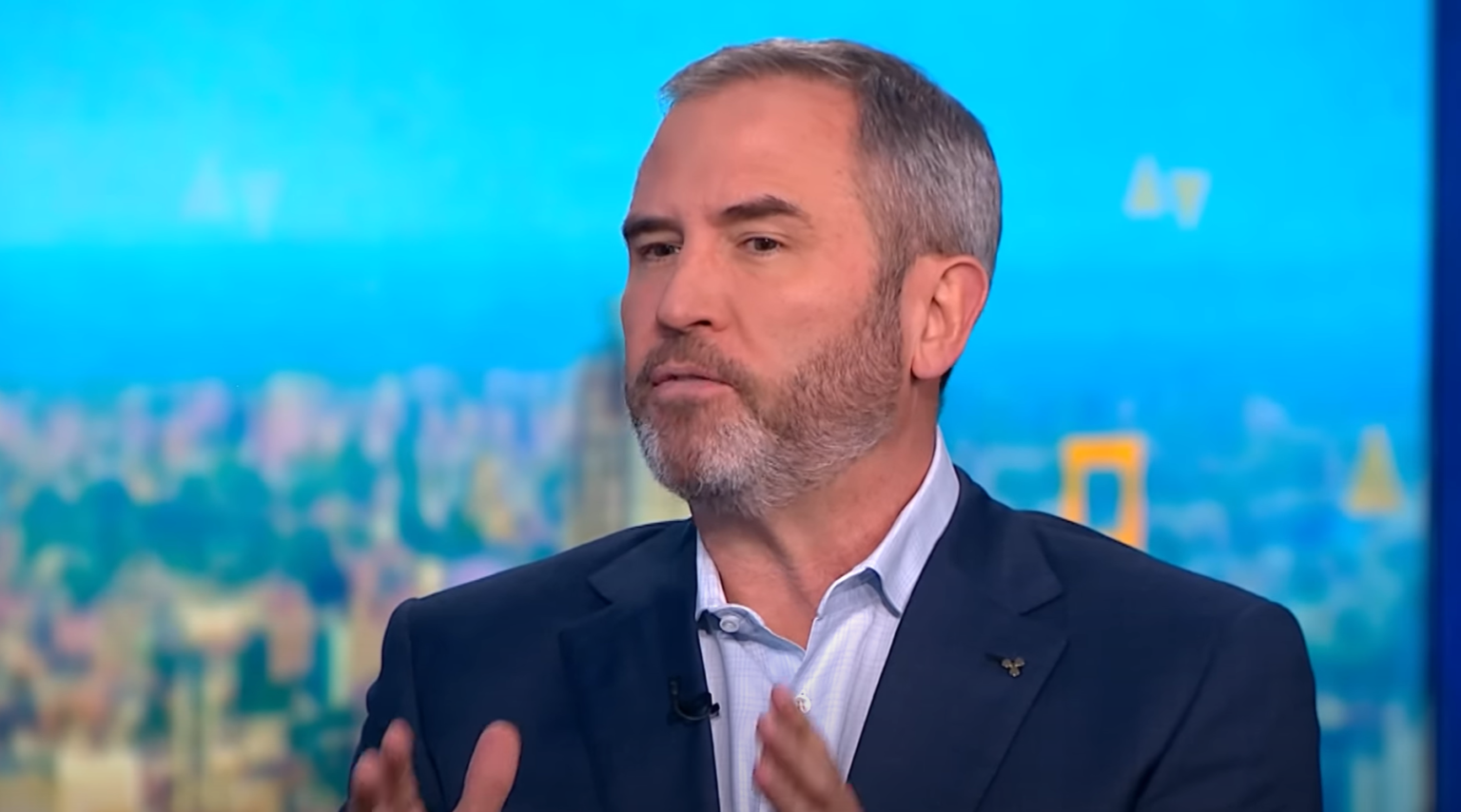

In an engaging conversation with FOX Business, Ripple’s CEO Brad Garlinghouse revealed a significant surge in the involvement of financial institutions with his company, Ripple, along with its digital currency XRP. This follows the Securities and Exchange Commission (SEC) ceasing investigations into the company. This development holds the potential to drastically alter the landscape of the digital asset industry in America.

Ripple’s Future as the US Market Reawakens

Garlinghouse recollects Ripple’s longstanding legal battle with the SEC. He views Ripple’s victory not merely as its own success but a triumph for the entire crypto industry. “Ripple is amongst the pioneer crypto companies to face litigation from the SEC. It wouldn’t be an exaggeration to say that the SEC was on the wrong side of law and history. Despite the achingly long process and legal expenses over $150 million, we are more than satisfied with the finale. It enables us to unlock the US market,” he declared.

Ripple, traditionally associated with cross-border payments, encountered substantial challenges in the American market due to the regulatory uncertainty. However, the completion of the SEC investigation is causing a noticeable shift in domestic engagement. Garlinghouse notes that nearly 95% of Ripple’s current clientele comprises of non-US financial institutions, such as global behemoths like HSBC and BBVA.

Garlinghouse expressed his excitement about the transitions happening within the US financial infrastructure, thanks to innovative technologies. He believes these developing technologies will take about one to two decades to fully rewire the financial infrastructure of the United States, impacting even the settlement of real estate transactions and securities transactions.

The impactful changes followed two significant executive orders signed by President Trump aimed at “strengthening American leadership in digital financial technology” and establishing a “Strategic Bitcoin Reserve and US digital asset stockpile”. At the Digital Asset Summit in New York City, Trump told attendees, “You will unleash an explosion of economic growth, and with the dollar-backed stablecoins, you’ll help expand the dominance of the US dollar.”

Garlinghouse sees this shift in sentiment as a monumental “unlock” for US financial institutions. He added, “Banks that were initially hesitant and nervous about engaging with crypto technologies or helping their customers, are now increasingly inclined to participate. This isn’t just big news for Ripple, but a significant event for the whole industry.”

In the interview, discussion also veered towards the continuing regulatory framework debates in Washington. Garlinghouse commended lawmakers such as Senator Cynthia Lummis and Congressman French Hill, who are spearheading initiatives to clarify how digital assets are classified and regulated under US law.

Garlinghouse reaffirmed that XRP’s legal status has already been validated by the federal judiciary: “XRP was deemed to be a commodity or not a security by a federal judge, which contrasted the SEC’s claims.” Coupled with pending legislation, this ruling is set to strengthen Ripple’s position nationally and globally.

He also stressed the tremendous opportunity for modernization of global payment systems like SWIFT, which still have a major share in trillions of dollars transactions. Ripple’s CEO hopes that as his company progresses, regulatory clarity will facilitate the integration of blockchain technologies into mainstream financial services.

As of press time, XRP traded at $2.4295.

Can Ripple modernize global financial transactions?

Ripple aims to bring in a wave of modernization to the global financial transaction systems like SWIFT, enhancing the speed, transparency, and efficiency through its blockchain technology. CEO Brad Garlinghouse asserts that the massive opportunity at hand is often underestimated.

How will the recent developments impact Ripple’s position in the market?

With the SEC ending its investigations and the legal validation of XRP, Ripple’s domestic and international standing is expected to solidify. Further, the increasing involvement of financial institutions is deemed to be a game changer for the company as well as the broader digital asset sector in the United States.

Will the integration of blockchain technology into mainstream financial services accelerate?

According to Brad Garlinghouse, regulatory clarity will undeniably speed up the integration of blockchain technologies into mainstream financial services. This will encourage more innovation, job creation, and capital formation in the United States.

How is Ripple’s engagement with financial institutions changing?

Banks and financial institutions that were previously hesitant about getting involved with crypto technologies are now leaning in. This changing sentiment and increase in involvement is seen as a monumental shift, not just for Ripple but for the entire crypto industry.

At bitcoinist, we follow a meticulous editorial process centered on delivering thoroughly researched, accurate, and impartial content. We uphold rigorous sourcing standards, and each piece undergoes a scrupulous review by our team of seasoned technology experts and editors. This assures the authenticity, pertinence, and value of our content for our readers.