Navigating the volatile world of cryptocurrency requires not just an understanding of the market’s current state but also a keen eye on future possibilities. As the digital currency landscape evolves, it’s crucial to stay informed about significant developments and potential investment opportunities. The recent remarks by Treasury Secretary Scott Bessent underscored how even a passing comment can lead to seismic shifts in the market, demonstrating the fragile confidence yet vast potential existing within the Web3 ecosystem. This guide delves into recent events involving Bitcoin and explores emerging cryptocurrencies poised for growth.

Bitcoin Market Fluctuations and Promising Crypto Investments

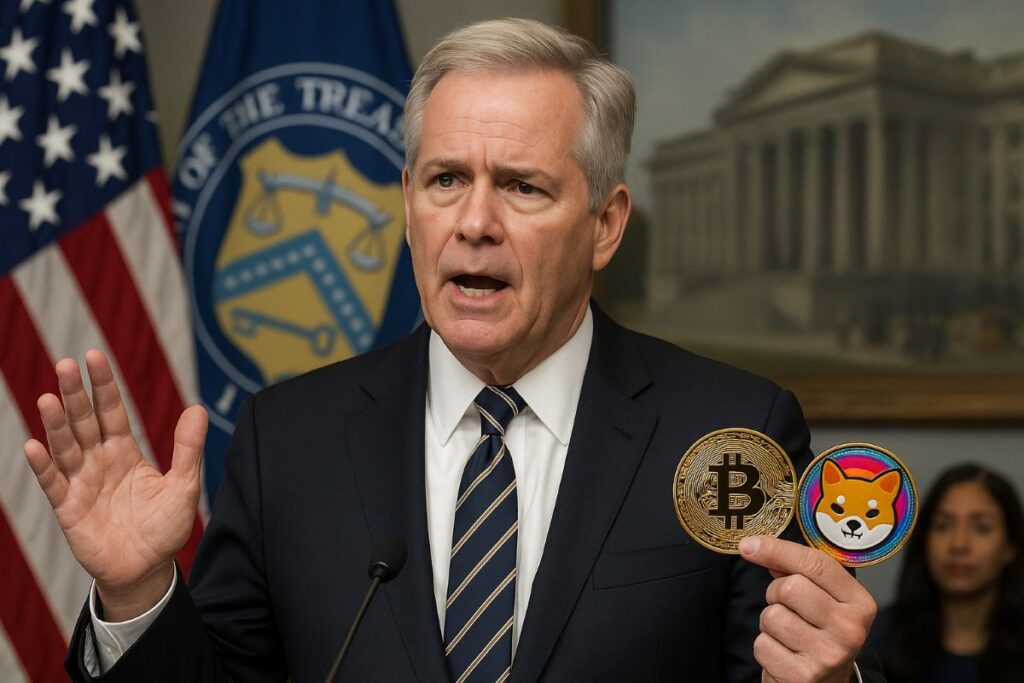

Treasury Comments Trigger Bitcoin Market Turbulence

The cryptocurrency market experienced a significant jolt when U.S. Treasury Secretary Scott Bessent hinted at a strategic Bitcoin reserve acquisition. The mere suggestion of such a move sent Bitcoin’s value plummeting, with a $55 billion market cap loss occurring in just 40 minutes. Despite the initial panic, Secretary Bessent clarified that while the government does not plan to purchase more Bitcoin, they will utilize confiscated assets to bolster their existing reserves, valued between $15 billion and $20 billion. This clarification helped soothe market nerves and reinvigorated interest in cryptocurrencies.

Emerging Cryptocurrencies with High Potential

In light of recent developments, investors are eyeing new cryptocurrencies with promising features and robust use cases.

Maxi Doge ($MAXI) – A Rising Star in the Meme Coin Universe

Maxi Doge ($MAXI) is making waves in the meme coin sector, boasting a valuation of $48 billion. This Shiba Inu-inspired token isn’t just about the hype; it plans to integrate gamified tournaments and futures trading platforms. The project’s marketing strategy involves allocating 40% of its token supply to boost visibility, ensuring continuous price growth. Security is a priority, with successful audits by Coinsult and SolidProof. Currently, in presale, $MAXI is priced at $0.000252, nearing a $1 million milestone.

Chintai ($CHEX) – Revolutionizing Real-World Asset Tokenization

Chintai, a leading platform in digital asset tokenization, is powered by $CHEX and built on the EOS blockchain. It offers seamless creation, trading, and management of tokenized real-world assets in a compliant environment. With the real-world asset market projected to reach $16 trillion by 2030, $CHEX has already seen a 103% price increase in a week, positioning it well for future growth. It serves as the ecosystem’s backbone, handling fees, staking, and governance functions.

Bitcoin Hyper ($HYPER) – Enhancing Bitcoin for the Future of DeFi

Bitcoin Hyper ($HYPER) is set to enhance Bitcoin’s capabilities, aiming to make it faster, cheaper, and DeFi-ready through a Layer 2 network. By batching transactions off-chain, Bitcoin Hyper intends to alleviate congestion and reduce fees, potentially increasing Bitcoin’s Total Value Locked (TVL). Leveraging the Solana Virtual Machine (SVM), it will introduce smart contract functionality, enabling DeFi applications to thrive. $HYPER, priced at $0.012725 during presale, is expected to climb to $0.32, promising substantial returns.

Conclusion: Market Outlook and Investment Considerations

While the U.S. Treasury’s interest in exploring Bitcoin reserve expansion indicates potential stability, the digital currency market remains inherently volatile. Prospective investors should consider emerging tokens like $MAXI, $CHEX, and $HYPER, each with unique strengths and market opportunities. Always conduct thorough research and consider financial goals before investing.

How does government policy influence Bitcoin prices?

Government policies can significantly impact Bitcoin prices, as regulatory clarity can foster investor confidence, while uncertainty or negative regulations may lead to price volatility. Decisions regarding cryptocurrency holdings or transactions by significant state entities, like the U.S. Treasury, especially affect market sentiment.

What should I consider before investing in meme coins like Maxi Doge?

When investing in meme coins, consider the underlying project vision, tokenomics, community support, and market sentiment. While meme coins can offer high returns, they also come with increased risk due to their speculative nature.

What makes Bitcoin Hyper a strong contender in the DeFi space?

Bitcoin Hyper stands out by enhancing Bitcoin’s network through a Layer 2 solution, aiming to improve transaction speed, reduce costs, and integrate smart contracts. This makes it an attractive option for developers and investors looking to leverage Bitcoin’s security while benefiting from DeFi functionalities.

Why is tokenization of real-world assets becoming popular?

Tokenization of real-world assets is gaining traction due to its ability to enhance liquidity, transparency, and accessibility for investors. Platforms like Chintai make it easier to fractionalize ownership of assets, reducing entry barriers and creating new investment opportunities.