In the rapidly evolving landscape of cryptocurrency investments, regulatory advancements often pave the way for significant market shifts. Recently, a pivotal development in the realm of digital assets has caught the attention of investors and industry experts alike. The United States Securities and Exchange Commission (SEC) has begun a formal review of a groundbreaking Exchange-Traded Fund (ETF) that promises to alter the landscape of crypto investments. While the final decision by the SEC remains pending, the mere filing of this application is a testament to the growing acceptance and potential mainstream integration of directly held cryptocurrency products. Let’s delve deeper into the details surrounding this transformative ETF proposal and what it could mean for the future of digital investments.

Emerging Potential: The New Spot-Crypto ETF Application

ETF Application Sparks Interest

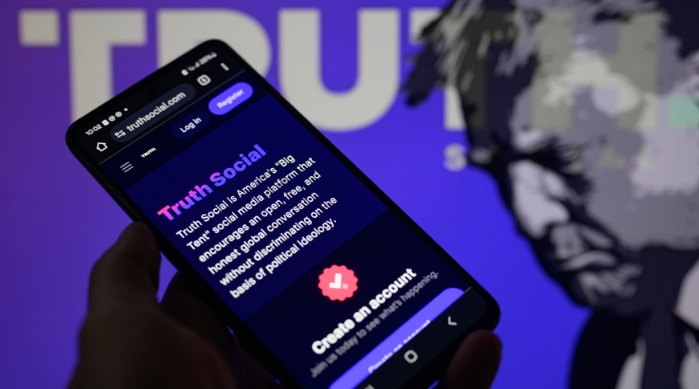

The latest SEC filing reveals a bold initiative by Trump Media’s Truth Social unit, aiming to introduce an ETF on the NYSE Arca with a 75% allocation in Bitcoin and 25% in Ether. Sponsored by Yorkville America Digital and utilizing Foris DAX Trust Company—Crypto.com’s custody arm—for coin safekeeping, this proposal signifies a noteworthy move towards offering diversified cryptocurrency investment opportunities. Initiated on June 16, the submission triggers a 45-day review period, setting the stage for potential regulatory approval.

Ensuring Security: Custody and Valuation Protocols

The proposed ETF plans to assess Bitcoin’s value daily using the CME CF Bitcoin reference rate, while Ether would rely on the CME CF Ether rate, unless an alternate source is designated by the sponsor. Aimed at bolstering security and mitigating risks of hacks and theft, private keys for these assets will be stored in a cold wallet, entirely separate from customer accounts—a strategic decision addressing longstanding security concerns in crypto asset management.

The Landscape of Competing ETF Proposals

Prominent financial firms such as BlackRock and Fidelity are keenly pursuing pure-Bitcoin ETF applications, while some target Ether-exclusive funds. The introduction of a dual-asset product adds an intriguing layer of competition. If the SEC proceeds with its anticipated “automated” listing framework, the duration of review processes could reduce significantly, standardizing disclosures and custodial standards for all spot-crypto ETFs.

Next Steps for Crypto Investors

The future of this ETF proposal now lies with the SEC, which may approve, request amendments, or outright reject the bid. Should the SEC prioritize accelerated, automated reviews, spot-crypto ETFs could make their market debut this year. For investors, monitoring each development—from amendment submissions to public feedback—is crucial in understanding the trajectory and potential success of funds backed by cryptocurrencies like Bitcoin and Ether.

The Intensifying ETF Race

Beyond mere branding, the competition extends to factors like fees, trading agility, and custodial trust, which will ultimately determine which ETFs capture significant capital. Sponsors must leverage substantial resources to distinguish themselves in a burgeoning field with nearly a dozen proposals. The opening act by Trump Media’s Truth Social has certainly set the tone, with its entry possibly heralding a new era in regulated cryptocurrency products.

“`html

What differentiates the Truth Social ETF from other proposals?

The Truth Social ETF proposal is unique in its dual-asset structure, combining Bitcoin and Ether in a single product. Its focus on diversified holdings aims to attract a broad range of investors, while its strategic custody arrangements seek to address potential security concerns.

How might the SEC’s “automated” listing framework affect future ETF reviews?

If implemented, the SEC’s “automated” listing framework could streamline the review process for spot-crypto ETFs, reducing timelines from several months to a matter of weeks. This would establish a more predictable and efficient regulatory environment, potentially accelerating the introduction of new crypto investment products.

Is the current delay in ETF approvals indicative of broader regulatory hurdles?

Delays in ETF approvals, such as those seen with Fidelity’s spot-Solana ETF, often reflect the SEC’s commitment to thorough data analysis and disclosure accuracy. These delays indicate a careful approach to ensuring investor protection and market integrity before granting approval.

“`

By focusing on the ETF’s structural specifics, competitive landscape, and the pending regulatory decisions, this comprehensive overview delivers essential insights into a pivotal moment in cryptocurrency investment history. Through expert analysis and a commitment to factual accuracy, this guide equips readers with the knowledge needed to navigate this evolving sector confidently.