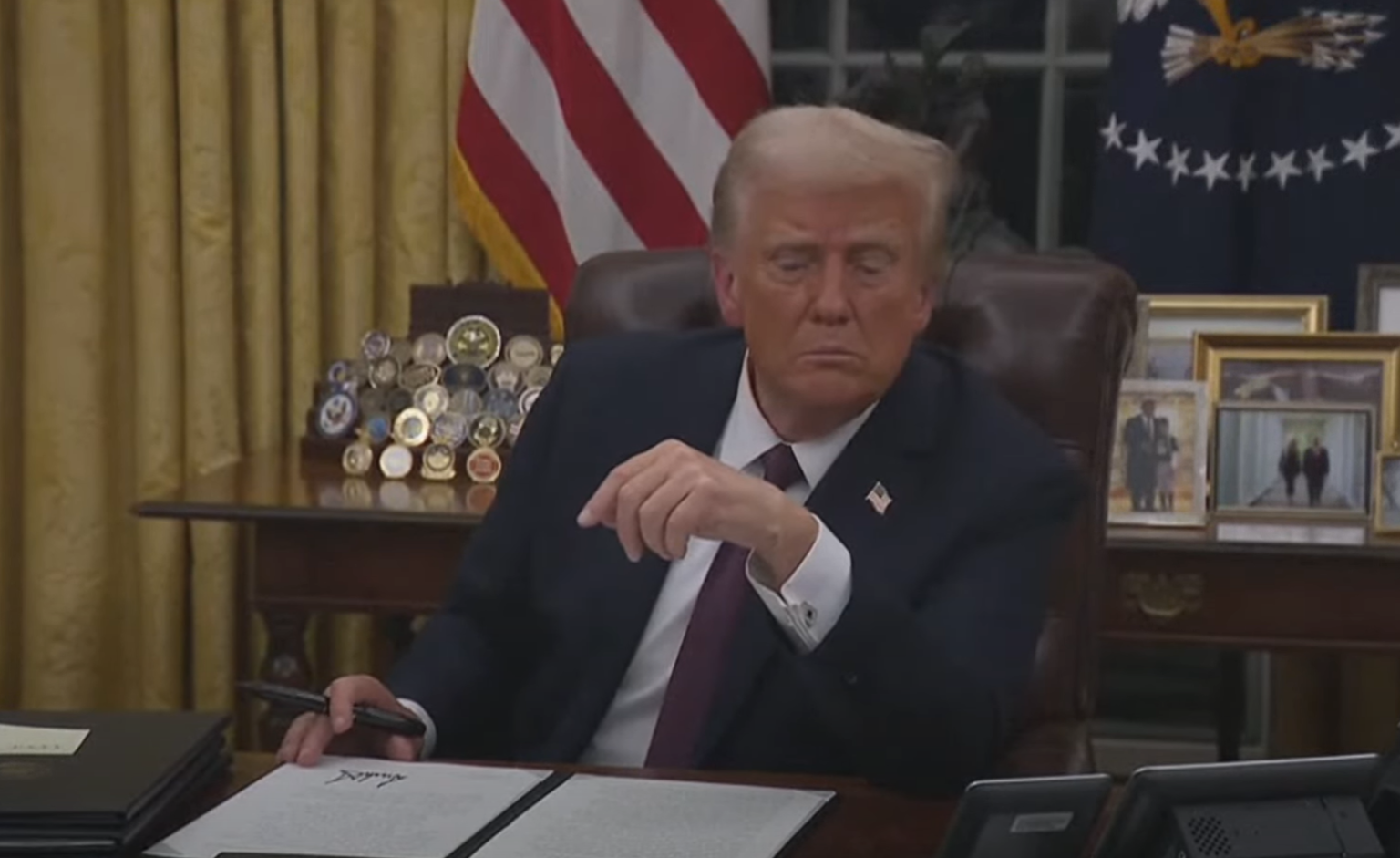

The world was watching as US President Donald J. Trump began his first day in office, particularly the cryptocurrency community. Many were anticipating announcements related to crypto policies, given the commitment made by Trump at the Bitcoin 2024 conference in Nashville regarding a Strategic Bitcoin Reserve. However, the inaugural address went by without any mention of Bitcoin or cryptocurrency. The absence of any crypto-related declarations sent Bitcoin’s price on a rollercoaster ride, momentarily soaring to nearly $110,000 before crashing down to $100,000 soon after.

The Crypto Community’s Reaction to Trump’s Silence on Bitcoin

The dramatic fall in Bitcoin’s price post-Trump’s inaugural address underscored the heightened anticipation that had built up among investors and cryptocurrency enthusiasts. While some market watchers interpreted the silence as a negative signal, others advised patience, pointing out that the president’s speech was not the only opportunity for crypto-related policy announcements.

Miles Deutscher, a known analyst in the crypto space, took to social media to share his perspective: “Realistically, it wasn’t expected that Trump would mention crypto in his speech. The more important developments will take place over the next few days. There are already rumors of a potential pardon for Ross Ulbricht and an executive order to facilitate banks in holding digital assets. Patience is key here,”.

In a similar vein, Will Clemente III, a prominent industry analyst, tried to reassure anxious market participants. He stated, “Crypto Twitter is in a frenzy because Trump didn’t address anything related to crypto on his first day in office. However, we need to step outside our bubble. Pro-crypto regulations are on the way.”

Future Crypto Policies Under Trump’s Administration

The reported statement of Circle CEO Jeremy Allaire to Reuters added fuel to the speculations. Allaire predicted that President Trump “may soon sign an executive order” that would ease regulations for banks to own digital assets. He advocated for the revocation of the SEC’s Staff Accounting Bulletin (SAB 121), a regulatory framework that currently hampers financial institutions from including cryptocurrencies in their balance sheets.

Adding another twist to the tale, Elon Musk replied to a user on social media, stating “Ross will be freed too,” sparking theories that Trump might pardon Silk Road founder and Bitcoin proponent, Ross Ulbricht. Crypto analyst Byzantine General (@ByzGeneral) took Musk’s comment as a positive indication of future crypto-related moves, stating, “Trump may just be holding all of his crypto-related executive orders for later in the week.”

Unfulfilled Promise of the Strategic Bitcoin Reserve

However, the lack of any information regarding the Strategic Bitcoin Reserve, which Trump had spoken about during his campaign and at the Bitcoin 2024 conference, was a letdown. James Seyffart, a Bloomberg ETF expert accurately captured this sentiment with his comment: “Not quite the Strategic Reserve everyone is looking for.”

This statement was in response to Donald Trump Jr.’s announcement about the Trump-backed crypto venture, World Liberty Finance (WLFI). It had acquired substantial digital assets amounting to $47 million each of ETH and wrapped Bitcoin (WBTC), along with $4.7 million in Aave, Chainlink, TRX, and ENA each, on Inauguration Day.

Potential Moves in the Future

Despite the ambiguity, crypto enthusiasts remain hopeful regarding future policy decisions. For instance, Felix Jauvin, the host of the “Forward Guidance” podcast, suggested that the president may opt for discreet Bitcoin buying for the strategic reserve, bypassing the need for congressional approval or an executive order. Additionally, BTC Inc. CEO David Bailey hinted at upcoming good news, revealing that their executive orders were among the first 200 signed by the president.

While President Trump’s inaugural silence on crypto may have temporarily shaken market confidence, industry leaders are adamant that future policy decisions and possible executive actions remain a possibility. Currently, the broader crypto community awaits clarification on the White House’s plans regarding a Bitcoin reserve, regulatory easements for banks, and potential pardoning of Silk Road’s founder Ross Ulbricht.

As of the time of reporting, BTC is trading at $101,451.

FAQs

How did Trump’s silence on crypto impact Bitcoin’s price?

Upon Trump’s omission of any crypto-related announcements during his inaugural address, Bitcoin’s price experienced a volatile journey, spiking to nearly $110,000 before quickly diving to a low of $100,000.

Could a strategic Bitcoin reserve still be announced?

It is possible, although no official announcement has been made yet. The crypto community remains hopeful that President Trump will address this during his term, based on previous comments made during his election campaign.

What potential developments can we expect from Trump’s administration in terms of crypto policy?

Speculations range from the potential signing of pro-crypto executive orders to the possibility of easing regulations for banks to hold digital assets. Furthermore, many anticipate the possible pardon of Ross Ulbricht, the founder of Silk Road, a notorious online black market.

How did the crypto community react to Trump’s inaugural address?

The reaction was mixed. While some experienced disappointment and confusion, others urged patience and optimism, pointing out that policy changes can unfold over time and are not restricted to inaugural speeches.