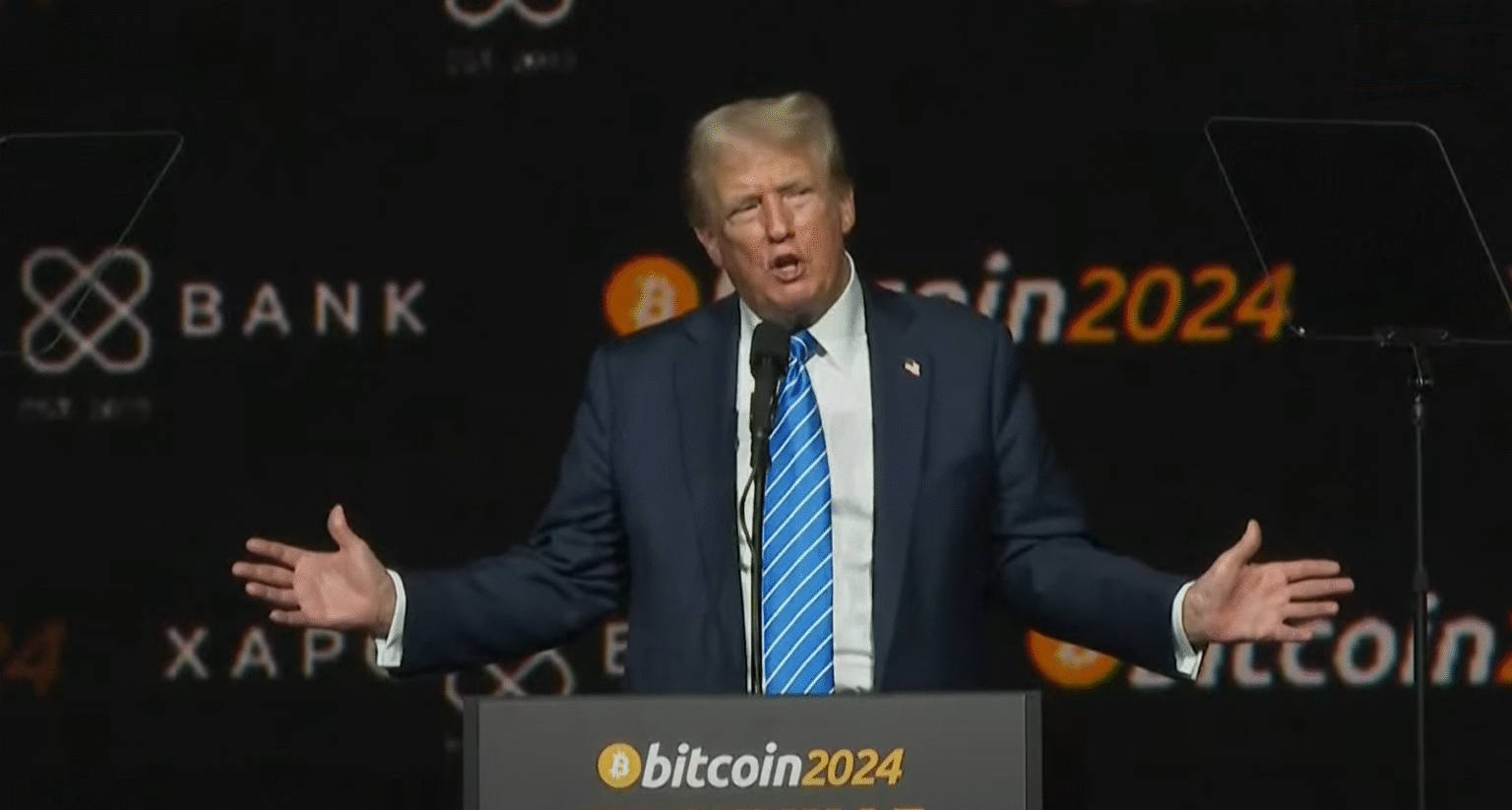

In a world where digital assets are reshaping the financial landscape, staying informed is crucial for navigating the cryptocurrency realm. Recently, former President Donald Trump’s acknowledgment of Bitcoin’s transformative potential has sparked widespread discussion. This chatter comes on the heels of significant regulatory developments and a high-stakes report deadline concerning digital assets. As the U.S. government grapples with the strategic management of Bitcoin and other cryptocurrencies, these discussions hint at substantial changes in policy and market dynamics.

Bitcoin’s Strategic Role: Insights from Trump’s Endorsement and Upcoming Policy Shifts

What began as a groundbreaking testimony in 2018 has now gained renewed attention, thanks to President Trump’s public endorsement. Peter Van Valkenburgh, speaking before the Senate Banking Committee, passionately explained Bitcoin’s role as a revolutionary digital payment infrastructure capable of facilitating transactions globally with just an internet connection. This endorsement comes at a crucial time, with the administration preparing to release key legislative recommendations on digital currencies.

Anticipating the Strategic Bitcoin Reserve Report

The endorsement leads into a pivotal moment as the White House approaches a deadline for an exhaustive report on digital asset regulation. With Executive Order 14178, the administration tasked a special committee to deliver policy recommendations on cryptocurrency management, which includes revealing the federal Bitcoin holdings. Speculated to be the world’s largest at approximately 200,000 BTC, these assets underline significant strategic implications for national and global financial systems.

Rumors suggest the forthcoming report will detail the consolidation of these holdings into a Strategic Bitcoin Reserve and propose “budget-neutral” ways to expand it, steering clear of additional taxpayer burdens. This aligns with recent legislative actions to regulate stablecoins and potentially avoid the creation of a Federal Reserve digital currency.

Legislative Developments in the Crypto Space

The Trump’s administration has witnessed active legislative pursuits aimed at setting a clear framework for digital currencies. The recent signing of the GENIUS Act marks a milestone in governing stablecoin transactions, while other proposed measures like the CLARITY Act aim to redefine regulatory boundaries. These efforts collectively signal a move towards a more structured and potentially supportive environment for cryptocurrency innovation and stabilization.

FAQs on Current Cryptocurrency Policies

How does the Strategic Bitcoin Reserve affect U.S. financial policy?

The creation of a Strategic Bitcoin Reserve signifies the U.S. government’s commitment to integrating cryptocurrencies into national financial strategies. By consolidating and potentially expanding these holdings through innovative, cost-neutral methods, the government seeks to strengthen its economic position without additional fiscal strain.

What are the implications of the GENIUS Act for stablecoins?

The GENIUS Act provides a regulatory framework for the stablecoin market, ensuring transparency and accountability. This legislation is crucial in fostering trust and stability in digital asset transactions, protecting consumer interests, and encouraging further innovation in the financial technology space.

What role does Peter Van Valkenburgh play in cryptocurrency policy discussions?

Peter Van Valkenburgh is a pivotal figure in cryptocurrency advocacy and policy, known for his insightful analysis and influential testimonies. His explanations of Bitcoin’s technological and economic potential have shaped discussions around digital currency regulations, reflecting its transformative impact on modern finance.

In conclusion, the landscape of cryptocurrency is evolving rapidly, with strategic policies and endorsements shaping its trajectory. As the U.S. navigates these changes, the insights shared by experts and leaders like Van Valkenburgh and Trump play a critical role in guiding public and policy discourse.