In a landscape where the intersection of technology and finance continually evolves, cryptocurrency remains at the forefront of both innovation and regulatory scrutiny. The recent deadlock in a U.S. jury’s decision regarding Roman Storm, co-founder of Tornado Cash, underscores the ongoing challenges faced by the digital finance industry. Accusations of money laundering and sanctions evasion reflect broader concerns about the regulatory obligations of cryptocurrency platforms. This pivotal case highlights both the potential for cryptocurrency innovation and the necessity for robust legal frameworks to prevent misuse.

The Complex Legal Battle of Tornado Cash: Innovation vs. Regulation

Tornado Cash Founder Faces Legal Scrutiny

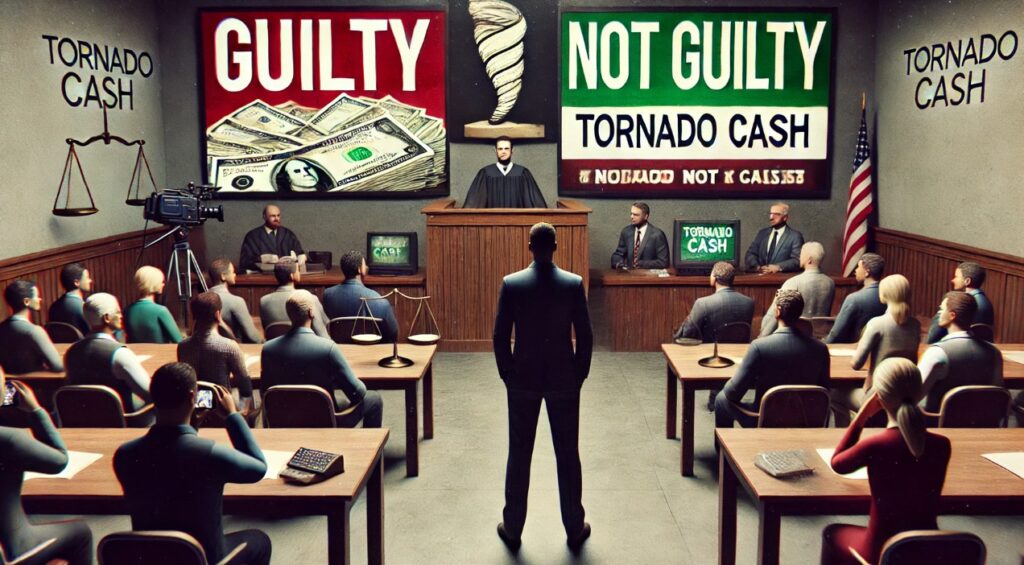

Roman Storm’s recent legal challenges have drawn significant attention, underscoring the complexities of operating within the growing cryptocurrency sector. While the U.S. jury found Storm guilty of conspiracy to operate an unlicensed money-transmitting business, it reached a stalemate on more severe charges of money laundering and sanctions evasion. These accusations, filed by the Department of Justice (DOJ) two years ago, highlight serious regulatory concerns: the facilitation of untraceable transactions through Tornado Cash, a cryptocurrency mixer reportedly involved in laundering over $1 billion.

Accusations of Neglecting Financial Regulations

The indictment against Tornado Cash’s founders alleges a deliberate evasion of pivotal financial regulations, notably the absence of “know your customer” (KYC) and anti-money laundering (AML) protocols. These omissions, according to U.S. authorities, not only contravened legal standards but also empowered illicit financial activities, with some funds allegedly linked to North Korean hackers. Such accusations underscore the tension between fostering innovation in the digital currency space and ensuring compliance with legal and ethical norms.

Understanding the Legal and Technological Implications

This case exemplifies the delicate balance regulators must maintain. As jurisdictions worldwide strive to regulate digital financial instruments, the need for clear and enforceable regulations becomes increasingly apparent. The inability of the jury to reach a consensus on the key charges suggests that the legal frameworks surrounding cryptocurrency operations are still evolving, seeking a balance between fostering technological advancements and preventing their exploitation.

The Impact on Cryptocurrency Markets

The ramifications of these legal proceedings extend beyond the courtroom. The uncertainty surrounding Tornado Cash has influenced market perceptions, as evidenced by fluctuations in the value of its native token. Investors remain cautious as the sector grapples with the implications of regulatory actions and their potential impact on future innovations.

FAQs

What is Tornado Cash?

Tornado Cash is a privacy-focused cryptocurrency mixer designed to enhance transaction anonymity. By obscuring the origin of transactions, it aims to provide users with greater privacy.

What are the legal obligations for cryptocurrency platforms?

Cryptocurrency platforms are expected to adhere to regulations like KYC and AML to prevent illegal activities, such as money laundering and sanctions evasion. Compliance ensures the platforms operate legally and ethically.

How does the Tornado Cash case affect the cryptocurrency industry?

The Tornado Cash case highlights the need for clear regulatory frameworks in the cryptocurrency industry. It emphasizes the balance between innovation and regulation, impacting investor confidence and future developments.

This comprehensive guide to Tornado Cash not only delves into the intricacies of its legal challenges but also explores the broader implications for the cryptocurrency sector. Understanding these dynamics helps stakeholders make informed decisions in this rapidly evolving field.