In the rapidly evolving landscape of cryptocurrencies, businesses are increasingly turning to Bitcoin as a robust financial strategy. This significant shift has resulted in an impressive Bitcoin treasury adoption, with the holdings now valued at over $111 billion. Such institutional interest not only underscores Bitcoin’s role as a reserve asset but also boosts confidence in other digital currencies. As corporate giants embrace Bitcoin, the door opens for exploring innovative crypto presales with substantial profit potential due to their unique applications and market relevance.

Understanding the Surge in Corporate Bitcoin Holdings

MicroStrategy Leads the Pack with Massive Bitcoin Reserves

Recent reports indicate that publicly traded companies now collectively own approximately 5% of Bitcoin’s total supply, a testament to the growing institutional acceptance of the digital asset. Among these corporations, MicroStrategy, now rebranded as “Strategy,” stands out as a pioneer. Since August 2020, MicroStrategy has aggressively accumulated Bitcoin, amassing over 636,505 BTC. This strategic move has resulted in an approximate 50% increase in their holdings, with a year-to-date yield of 25.7%.

Not far behind, MARA Holdings has accumulated 50,639 BTC, fueled by their productive mining operations. Meanwhile, new entrants like Jack Maller’s XX1 and the Bitcoin Standard Treasury Company are quickly climbing the ranks, reflecting a broader corporate enthusiasm for Bitcoin. This surge in institutional buying is propelling Bitcoin to record highs, recently pushing its value to an all-time high of $124,450.

Growing Interest in Ethereum and Other Cryptocurrencies

While Bitcoin remains the flagship digital currency for corporations, Ethereum is also attracting significant attention. Companies like SharpLink have invested heavily in Ethereum, purchasing approximately 39,000 ETH, which reflects a broader trend of diversifying corporate crypto assets. This institutional interest creates an environment ripe for crypto presales, such as Maxi Doge, XPIN Network, and Best Wallet Token, which offer innovative use cases and potential high returns.

Promising Presales with Unique Use Cases

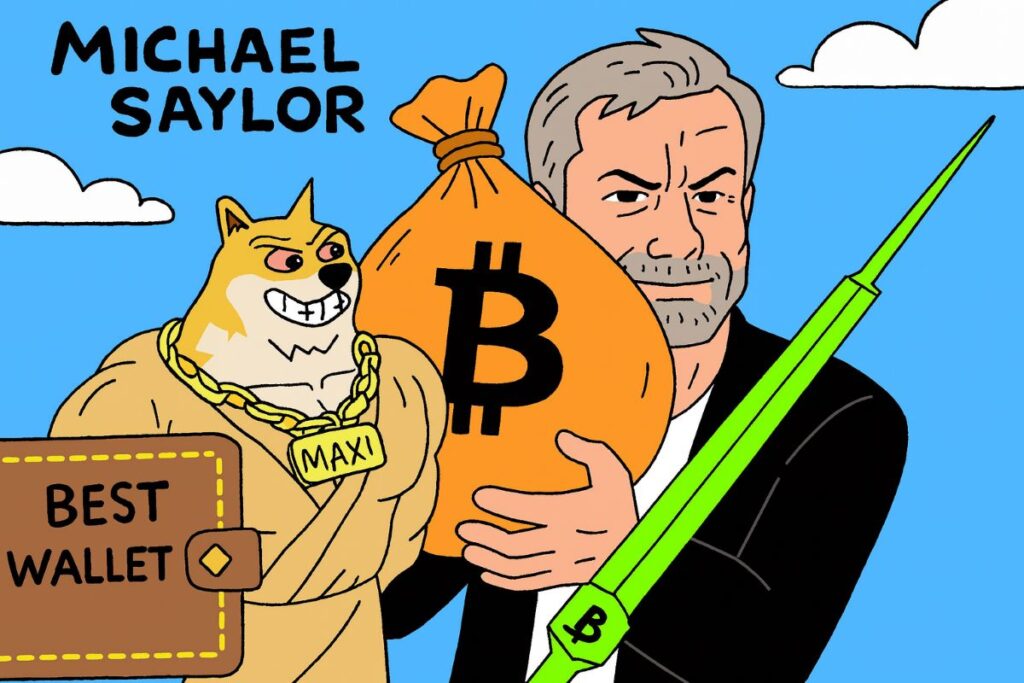

Maxi Doge ($MAXI) – The Meme Coin with Ambitious Goals

Maxi Doge ($MAXI) is making waves in the meme coin sector, raising $1.8 million in its presale phase. Unlike its predecessors DOGE and SHIB, Maxi Doge aims to revolutionize the crypto space with futures platform integrations and gamified tournaments. Investors can enter the presale at $0.0002555, with the potential for significant returns as the price is expected to surge alongside its feature launches.

XPIN Network ($XPIN) – Revolutionizing Global Connectivity

XPIN Network ($XPIN) is an innovative platform combining AI-powered decentralized infrastructure with blockchain-based eSIM technology. By offering global, borderless connectivity, XPIN is poised to transform how users access the internet. With its recent FreeData Plan launch, XPIN has seen a price doubling, signaling strong potential growth as more users join the network.

Best Wallet Token ($BEST) – Enhancing Crypto Wallet Functionality

$BEST, the token of the Best Wallet application, is setting new standards for non-custodial crypto wallets. It offers comprehensive features, including cross-chain swaps and a token launchpad for discovering new cryptocurrencies. The wallet’s planned enhancements, such as support for over 60 blockchains and the introduction of a crypto debit card, position it for substantial growth. Currently available in presale for $0.025595, $BEST promises a lucrative opportunity for early investors.

The Future Looks Bright for Crypto Adoption

The robust accumulation of Bitcoin and Ethereum by corporations signals a positive outlook for the cryptocurrency market. The perception of digital assets as secure, long-term investments is becoming mainstream, encouraging further exploration and investment in promising projects. However, prospective investors should conduct thorough research and consider their risk tolerance before committing to any investment.

“`html

What are the key factors driving corporate Bitcoin adoption?

Corporations are drawn to Bitcoin for its potential as a hedge against inflation, digital asset diversification, and its increasing acceptance as a legitimate reserve asset. These factors, combined with the potential for significant returns, are driving corporate interest in Bitcoin.

Is investing in cryptocurrency presales a good strategy?

Presales offer the opportunity to invest in projects at an early stage, often at a discounted rate. However, they come with higher risks and require thorough due diligence to assess the project’s potential and credibility.

How does XPIN Network’s FreeData Plan enhance user experience?

XPIN Network’s FreeData Plan provides seamless, cost-effective global internet connectivity without traditional SIM cards or roaming fees, enhancing user experience and accessibility across 149 countries.

Why is non-custodial wallet security important?

Non-custodial wallets enhance security by allowing users to retain control over their private keys, significantly reducing the risk of unauthorized access and providing greater assurance of personal asset security.

“`

In conclusion, as corporate giants increasingly adopt Bitcoin and Ethereum, the stage is set for new opportunities in the crypto realm. Emerging projects like Maxi Doge, XPIN Network, and Best Wallet Token demonstrate the potential for substantial returns through innovative applications. While these opportunities are promising, they require careful analysis and risk management for successful investment outcomes.