In the ever-evolving world of cryptocurrencies, understanding the potential trajectory and integration of Bitcoin into global financial frameworks is essential for investors and enthusiasts alike. Bitcoin’s unique position as a decentralized digital asset has sparked discussions on its future role from retail use to institutional adoption. Insightful perspectives from key industry figures, such as Michael Saylor of MicroStrategy, provide a roadmap for understanding how Bitcoin might transform into a foundational asset in global finance.

The Institutionalization of Bitcoin: A Vision for the Future

The Rise of Large Institutions in Bitcoin Transactions

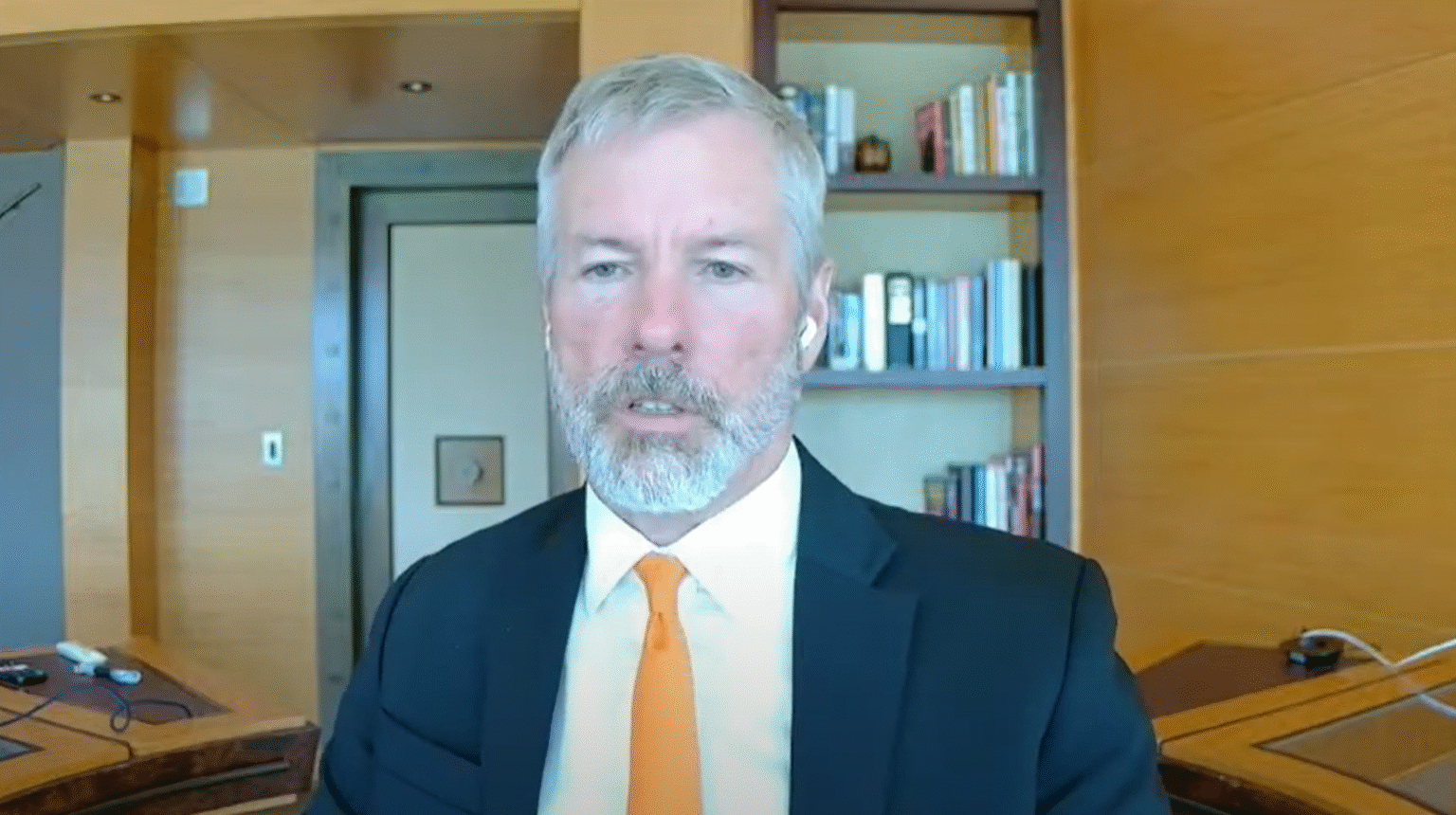

Industry experts, including MicroStrategy’s executive chairman Michael Saylor, anticipate a future where Bitcoin serves as a central pillar in institutional settlement networks. In a discussion with BTC Sessions, Saylor outlined a scenario in which major banks, tech giants, and sovereign entities dominate the Bitcoin base layer. He envisions an ecosystem where institutions like Google, Apple, Microsoft, and global banks engage in large-scale transactions directly on the blockchain.

“The potential for Bitcoin to emerge as a critical tool for massive financial transactions is substantial,” Saylor noted. In this envisaged landscape, the biggest players such as Apple, Google, and national banks from the U.S., China, Russia, and England would utilize Bitcoin for major financial dealings. Commercial giants like Citi, Bank of America, and Deutsche Bank would similarly be pivotal, shifting billions in digital capital.

Layered Network Structure: Base Layer to Layer 3

Saylor’s projection includes a hierarchical Bitcoin network structure. The foundational layer would predominantly host big financial institutions handling significant value settlements. Above this, the scaling solutions such as the Lightning Network would manage high-speed, frequent transactions, interlinking with myriad websites and mobile applications. The top layer, or Layer 3, would encompass custodial or semi-open networks run by exchanges, fintech companies, and consumer platforms—entities like Coinbase, Visa, and Apple Pay.

In this multi-layered ecosystem, end users would primarily interact with Bitcoin through these intermediated services, reflecting a stratified yet interconnected digital economy. Saylor underscores the pioneering role of current node operators and self-custodians. Though they are the blockchain’s vanguard today, those who maintain their positions could significantly benefit financially as institutional involvement intensifies.

The Strategic Reserve of Digital Capital

A crucial aspect of Saylor’s thesis is the positioning of Bitcoin as “digital capital” rather than a medium for day-to-day transactions. He argues that as Bitcoin matures, it will be less about individual speculation and more about its integration into global capital markets and payment infrastructures. Corporations and governments might utilize Bitcoin as both a long-term reserve asset and a medium for significant settlements, while fiat currencies persist in facilitating smaller, routine transactions.

Understanding Bitcoin’s Market Status

At present, Bitcoin’s market dynamics are influenced by numerous factors, including regulatory developments, technological advances, and macroeconomic trends. As of the latest data, Bitcoin’s valuation continues to fluctuate, reflecting ongoing market sentiment and investor behavior.

Frequently Asked Questions

Is Bitcoin poised to become the primary settlement currency for institutions?

While Bitcoin is gaining traction as a settlement currency among some institutions, its future as the dominant settlement medium is contingent on regulatory acceptance, technological advancements, and institutional adoption rates.

How do layer 2 and layer 3 solutions enhance Bitcoin’s scalability?

Layer 2 solutions like the Lightning Network increase Bitcoin’s scalability by enabling faster, cost-efficient transactions off the main blockchain. Layer 3 solutions build on this by providing user-friendly services through fintech and consumer platforms, further streamlining transaction processes.

What are the risks associated with Bitcoin as a reserve asset?

Risks include market volatility, regulatory changes, and technological vulnerabilities. Institutions considering Bitcoin as a reserve asset should conduct thorough risk assessments and stay informed on regulatory landscapes to mitigate potential challenges.

In conclusion, the future of Bitcoin is likely intertwined with the broader financial ecosystems where its role as a high-value settlement layer could redefine traditional financial paradigms. This guide delves into the complex interactions of technology, finance, and innovation, offering insights into Bitcoin’s potential trajectory and its implications for investors.