In a rapidly evolving financial landscape, the convergence of traditional banking and emerging digital currencies represents a notable shift in economic paradigms. Financial technology company SoFi is at the forefront of this transformation, offering integrated services that put cryptocurrency and banking under one roof. This innovation not only simplifies money management for its users but also signals a promising future for digital finance.

SoFi’s Groundbreaking Integration of Banking and Cryptocurrency

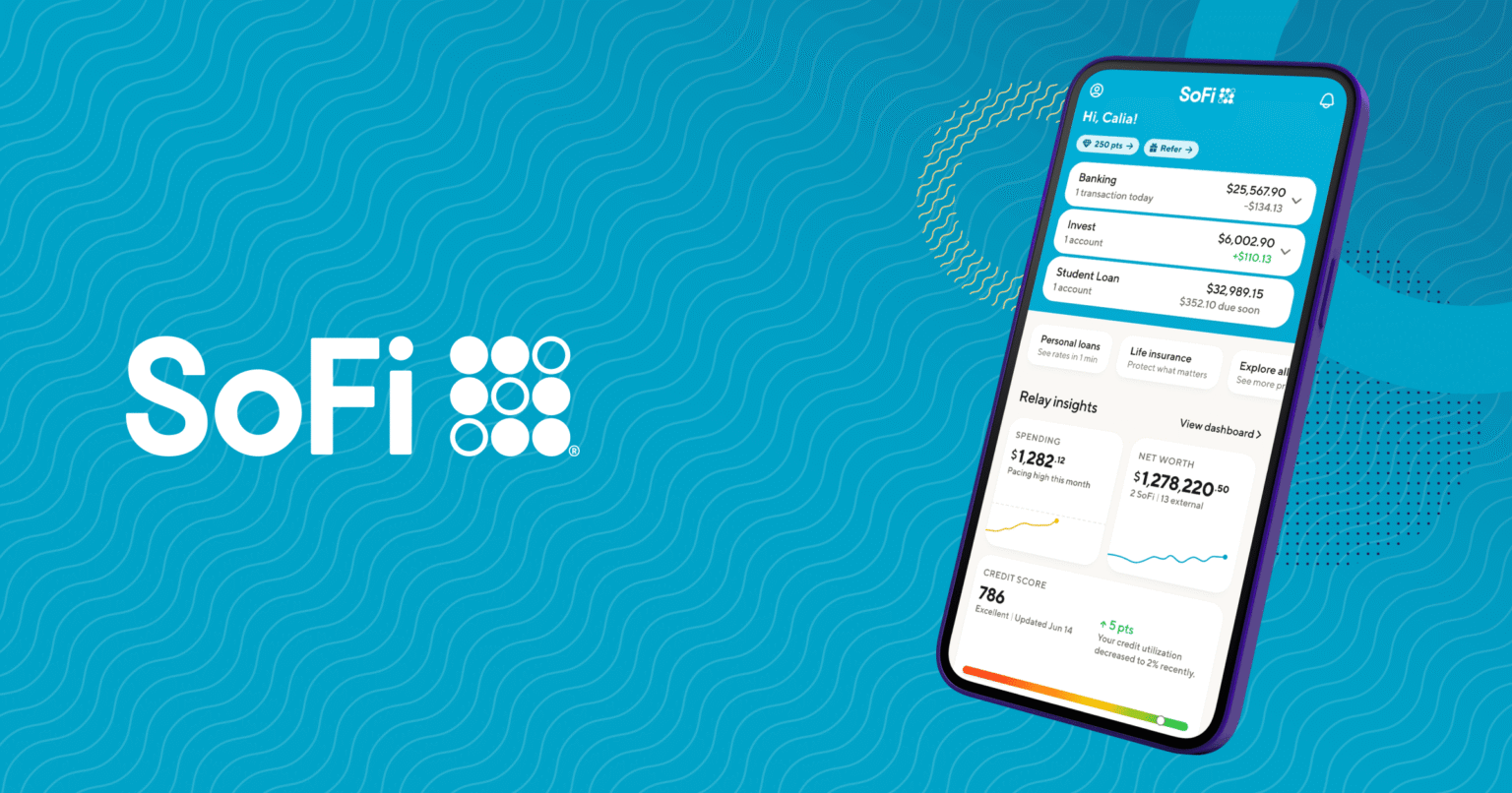

With an impressive 12.6 million members utilizing SoFi’s diverse financial products, the recent introduction of cryptocurrency trading through its app marks a significant expansion of its services. Enabling users to seamlessly transfer funds from SoFi checking or savings accounts into cryptocurrency investments, this feature is gradually being rolled out to members.

Bridging Traditional Finance and Cryptocurrencies

In an official statement, SoFi CEO Anthony Noto hailed this as a transformative juncture, emphasizing the importance of providing members with a regulated and secure pathway into the evolving world of digital money. The initiative is paired with a promotional campaign that encourages early adoption by offering a chance to win one Bitcoin, providing participants meet certain conditions by early 2026.

Regulatory Landscape and Strategic Timing

The launch aligns with recent regulatory clarity from the U.S. Office of the Comptroller of the Currency, simplifying the provision of crypto services for banks with national charters. SoFi, leveraging this regulatory advancement, aims to address customer preference for licensed banking institutions over exclusive crypto platforms, noted in a survey where 60% of crypto-holding members expressed this sentiment.

As the cryptocurrency market capitalization reaches $3.43 trillion, the potential for growth and integration with traditional financial systems becomes evident.

Looking Forward: Beyond Basic Trading

Looking beyond mere cryptocurrency transactions, SoFi has ambitious plans to introduce a US-dollar stablecoin, enhance remittances via blockchain technology, and integrate cryptocurrency within its lending offerings. These developments are set against a backdrop of robust financial performance, allowing SoFi to pursue these innovations confidently.

Market analysts predict that this integrated approach could inspire similar strategies among banks and fintech companies, while traditional crypto exchanges may have to innovate further to maintain their competitive edge. However, it is crucial to note that while cryptocurrencies promise high returns, they come with significant risk, and are not covered by FDIC insurance.

How Does SoFi Protect Its Crypto Investors?

SoFi ensures investor protection through stringent regulatory compliance and robust security measures. Its transparent operating framework and the integration of crypto services into a licensed banking environment provide an added layer of trust and protection.

How Will Blockchain Remittances Work with SoFi?

Using blockchain technology, SoFi aims to facilitate faster and more cost-effective cross-border transactions. By leveraging this technology, the company plans to streamline and enhance the efficiency of international money transfers for its users.

Is SoFi’s Cryptocurrency Feature Suitable for Beginners?

Yes, SoFi’s user-friendly platform caters to both beginners and experienced investors. Integrated banking and crypto services allow seamless management of funds, supported by educational resources to help users understand the complexities of cryptocurrency investment.

This comprehensive exploration of SoFi’s innovative strategy highlights its position at the cutting edge of finance, blending traditional banking with digital currency offerings. The additional FAQs provide valuable insights, aiding readers in making informed decisions in the dynamic world of financial technology.