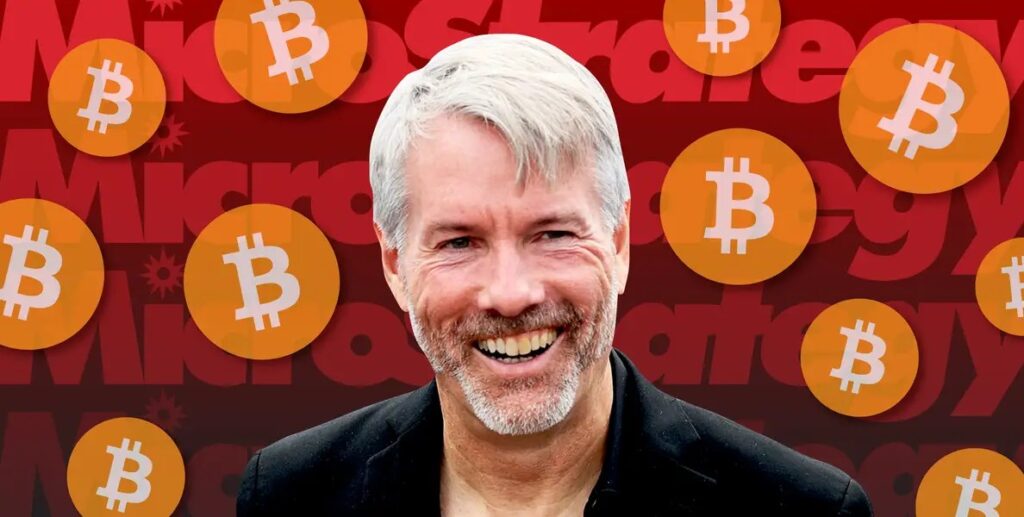

In today’s rapidly evolving financial landscape, companies are constantly seeking innovative strategies to maximize their growth potential. One company that’s capturing significant attention in this arena is Strategy, previously known as MicroStrategy. Under the leadership of Executive Chairman Michael Saylor, the company has embraced a bold approach by integrating Bitcoin into its very foundation. Saylor recently appeared on CNBC’s “Squawk Box” to delve into the company’s compelling vision and robust financial maneuvers.

Strategy’s Ambitious Bitcoin Endeavor

Strategy has embarked on a transformative journey, heavily investing in Bitcoin, which Saylor eloquently describes as “digital capital.” As of now, the company has acquired over 628,000 BTC, valued at roughly $72 billion, a substantial stake that represents about 3% of Bitcoin’s total potential supply. The recent capital raise of $2.5 billion through an IPO of Series A Perpetual Preferred Stock, priced at $90 per share, facilitated the acquisition of an additional 21,021 BTC on July 29.

Bitcoin-Driven Financial Strategies

Strategy’s financial blueprint includes a series of fundraising rounds that have collectively generated noteworthy sums. This year, it conducted four major rounds, two of which amassed $500 million each and another totaling $1 billion. The most recent round, with a haul of $2.5 billion, stands as the largest IPO of 2025 based on gross proceeds. By leveraging these funds to invest in Bitcoin, Strategy intends to transform its holdings into sophisticated securities poised to attract professional investors. The new offering, dubbed “Stretch” (STRC), has been heralded as the company’s most innovative product to date.

The Surge of Public Firms Embracing Bitcoin

The trend of public companies investing in Bitcoin is accelerating at a remarkable pace. Saylor highlighted that over 160 publicly traded firms now possess Bitcoin within their reserves, a significant increase from just 60 firms the previous year. Collectively, these firms hold approximately 955,048 BTC, accounting for 4.55% of the overall Bitcoin supply. Saylor suggests that Bitcoin is gradually becoming a preferred asset, overshadowing traditional investments such as gold, real estate, and equities. He argues that for companies aiming to enhance shareholder value, allocating funds to Bitcoin outweighs the benefits of holding cash or private equity investments.

Strategy’s Stance on Bitcoin Accumulation

While Strategy’s investment in Bitcoin is substantial, Saylor asserts that the company has no intention of monopolizing the cryptocurrency. He believes that owning between 3% and 7% of the total supply is reasonable, advocating for broader participation in the Bitcoin market. Notably, BlackRock, with its iShares Bitcoin Trust (IBIT), currently holds more Bitcoin than Strategy, with a total of around 740,896 BTC. Saylor also highlighted regulatory constraints preventing major tech firms like Apple and Microsoft from investing in each other’s stocks or S&P 500 companies, positing that without such restrictions, these giants might venture into mutual investments, including Bitcoin.

What is Strategy’s business model centered around?

Strategy’s business model involves raising capital through IPOs and investing heavily in Bitcoin. By doing this, they aim to transform volatile digital assets into securities appealing to institutional investors.

Why does Strategy invest so significantly in Bitcoin?

Strategy views Bitcoin as a form of “digital capital” and a superior store of value. By investing in Bitcoin, they aim to enhance shareholder value more effectively than holding cash or traditional securities.

What distinguishes Strategy’s “Stretch” offering?

The “Stretch” (STRC) offering represents Strategy’s latest financial product innovation, leveraging capital raised through IPOs to invest in Bitcoin. This approach seeks to refine Bitcoin into a security that appeals to professional investors.

As Strategy continues its Bitcoin-centric strategy, it exemplifies a notable shift in corporate investment practices, potentially signaling a broader trend in the financial ecosystem. With strategic investments and a focus on innovation, Strategy demonstrates how the integration of digital assets might redefine corporate financial strategies moving forward.