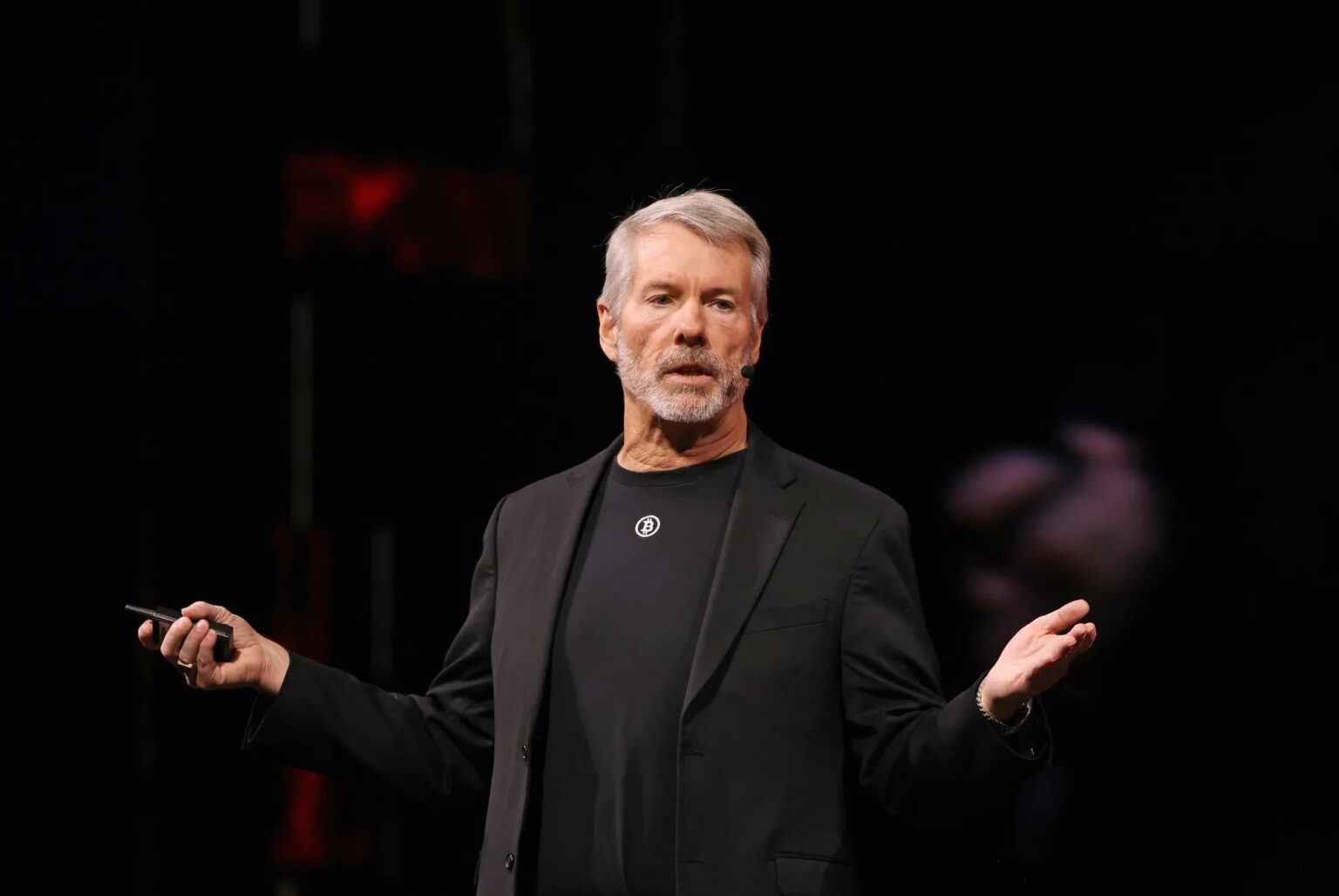

Navigating the volatile world of cryptocurrency investments requires a keen understanding of market dynamics and the entities that shape it. As digital currencies gain traction, businesses like MicroStrategy, led by Michael Saylor, stand at the forefront of this financial revolution. Despite the promising outlook for cryptocurrencies, recent market shifts highlight the ongoing challenges and critical decisions facing such firms.

MicroStrategy’s Bitcoin Strategy Under Scrutiny

MicroStrategy, carrying the title of the foremost Bitcoin holder among publicly listed companies, faces potential exclusion from eminent indices like the MSCI USA and Nasdaq 100. This development follows the firm’s heavy reliance on Bitcoin, which has seen significant price fluctuations recently, notably marking one of its steepest declines since November 2022.

Defining MicroStrategy’s Business Model

Michael Saylor, via the social media platform X (formerly known as Twitter), emphasized that MicroStrategy is not simply a fund, trust, or holding firm. The enterprise operates with a robust $500 million software business at its core, utilizing an innovative treasury strategy where Bitcoin constitutes productive capital.

Saylor highlighted the strategic initiatives undertaken by MicroStrategy, which include five public offerings of digital credit securities—STRK, STRF, STRD, STRC, and STRE—amassing over $7.7 billion in total value. Furthermore, the introduction of Stretch (STRC), a Bitcoin-backed treasury credit instrument, seeks to offer dynamic USD yields to both retail and institutional investors. Unlike passive funds or trusts, MicroStrategy actively develops, structures, and issues financial products, positioning itself as a trailblazer in structured finance integrated with Bitcoin.

The company’s mission remains clear: to pioneer a new enterprise model that merges financial innovation with sound digital currency, ultimately seeking to establish the first digital monetary institution grounded in Bitcoin.

MSCI’s Potential Exclusion of Digital Asset Firms

A forthcoming decision by MSCI, slated for January 15, 2026, could significantly impact MicroStrategy. Analysts from JPMorgan project that exclusion might result in outflows ranging from $2.8 billion to $8.8 billion. Despite the fact that active managers are not obligated to follow index modifications, exclusion could create negative perceptions among investors, leading to reduced liquidity and increased funding costs.

MSCI’s discussions with investors reveal a prevailing view that firms heavily invested in digital assets, such as MicroStrategy, resemble investment funds—a perspective that could disqualify them from index inclusion. Consequently, MSCI proposes to exclude companies where digital assets account for at least 50% of total assets.

Does being excluded from indices affect MicroStrategy’s financial health?

Being removed from significant indices can impact MicroStrategy’s liquidity and increase its cost of funds. However, the firm’s strategic focus on Bitcoin and software innovation aims to mitigate such challenges by fostering long-term growth.

What distinguishes MicroStrategy’s approach from other digital asset firms?

Unlike firms that passively hold digital currencies, MicroStrategy actively develops and issues financial instruments, leveraging Bitcoin as a central component of its treasury strategy. This approach integrates structured finance with software development.

Could the exclusion decision impact Bitcoin’s market dynamics?

MicroStrategy’s exclusion from key indices might signal broader market trepidations concerning digital assets, potentially affecting Bitcoin’s liquidity and investor sentiment. However, market impacts depend on broader investor perceptions and market resilience.

How does MicroStrategy’s strategy align with Bitcoin’s long-term prospects?

MicroStrategy’s unwavering commitment to Bitcoin as a cornerstone of its treasury strategy reflects confidence in Bitcoin’s long-term potential. The firm’s initiatives in structured finance further aim to fortify its position amidst market volatilities.

Overall, MicroStrategy’s journey reflects both the opportunities and complexities inherent in pioneering a Bitcoin-centered financial model. As it navigates potential exclusion from pivotal indices, its strategy emphasizes innovation and resilience, ensuring continued pursuit of its foundational vision.