The world of finance is currently witnessing significant shifts, with digital assets taking center stage. Robinhood, a prominent trading app known for empowering retail investors, is making headlines as it secures a coveted spot in the S&P 500 index. Concurrently, the company Strategy, which has its roots in Bitcoin investment, is making waves by significantly increasing its cryptocurrency holdings. These developments underscore the growing influence of digital assets in the financial markets.

The Rising Influence of Digital Assets: Robinhood and Strategy’s Strategic Moves

Robinhood’s Induction into the S&P 500

Robinhood, a popular trading app among retail investors, recently achieved a significant milestone by being included in the S&P 500 index as of September 22. This prestigious index comprises the largest publicly traded companies in the United States, serving as a vital economic indicator. Robinhood’s inclusion has been met with enthusiasm from investors, causing its stock to surge by seven percent, reaching over $108. Impressively, the company’s shares have appreciated by over 150 percent since the start of the year.

Robinhood’s achievement reflects its robust growth and strategic focus on digital assets, particularly cryptocurrencies. The company has capitalized on the increasingly favorable political and regulatory environment for the crypto industry, giving it a strategic edge in the market.

Robust Financial Performance Fuels Success

Robinhood’s ascent to the S&P 500 is also attributed to its strong financial performance. In the second quarter of 2025, the company reported revenue of $989 million, marking a remarkable 45 percent increase from the previous year and surpassing analysts’ expectations of $913 million. The firm also exceeded profit forecasts, reporting earnings of $0.42 per share, amounting to a total profit of $386 million—$50 million more than the prior year’s figures.

The Setback for Strategy: Not in the S&P 500

In contrast to Robinhood’s triumph, Strategy, formerly MicroStrategy, faced a setback when it did not secure a spot in the S&P 500, despite meeting formal requirements with a market capitalization of $95 billion. This decision disappointed many investors, resulting in a nearly three percent drop in the company’s stock during after-hours trading. Known for its substantial Bitcoin holdings, Strategy remains a pioneering force in the cryptocurrency sector.

Strategy’s Bold Response: Bitcoin Acquisition

Unfazed by the S&P 500 snub, Strategy made a bold statement by purchasing 1,955 Bitcoins for $217 million at an average price of approximately $111,000 per Bitcoin. This acquisition raises Strategy’s total Bitcoin holdings to 638,460, valued at over $71 billion at current market rates, delivering nearly a 26 percent return for shareholders this year. The company funded this purchase through the sale of new shares and preferred stock, generating over $217 million in proceeds.

Global Surge in Bitcoin Purchases

Strategy’s aggressive Bitcoin acquisition aligns with a broader trend of increased Bitcoin purchases by companies and even nations. In Japan, the company Metaplanet recently acquired 136 Bitcoins for approximately $15 million, bringing its total holdings to over 20,000 coins. Similarly, El Salvador remains committed to its Bitcoin agenda, purchasing 21 more coins to commemorate the fourth anniversary of Bitcoin as legal tender in the country. These moves highlight the persistent and growing interest in Bitcoin worldwide.

Bitcoin’s Resilience Amid Mixed News

Despite Strategy’s disappointment over its non-inclusion in the S&P 500, Bitcoin prices have remained stable, currently trading around $112,000, with a modest 0.9 percent increase in the past 24 hours. Analysts view this stability as a testament to Bitcoin’s resilience and credibility in the financial system. Companies like Strategy contribute to a solid demand base for Bitcoin by consistently acquiring large quantities, reinforcing Bitcoin’s status as more than just a speculative asset—it’s becoming a crucial component of the global financial landscape.

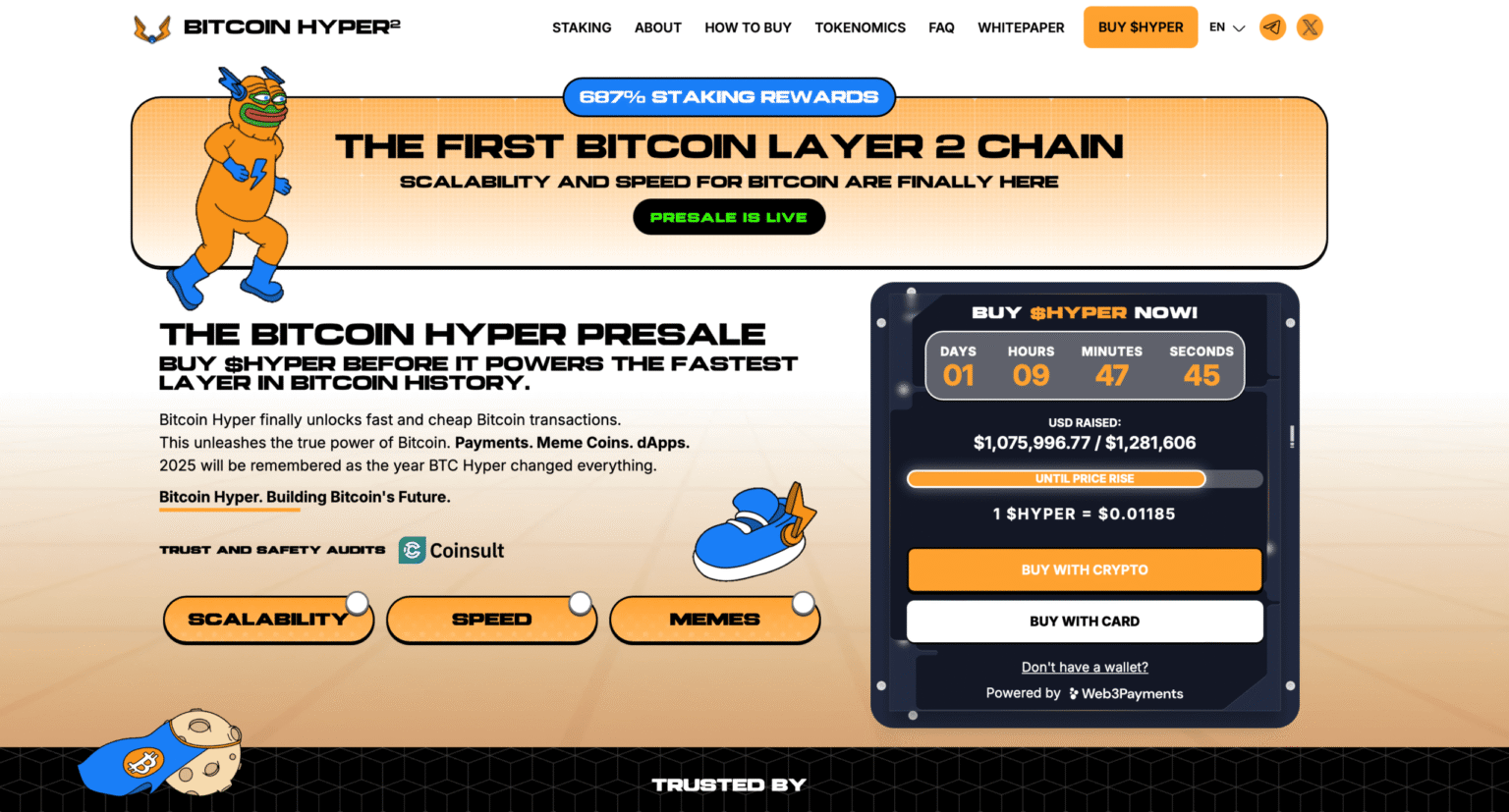

The Synergy of Bitcoin and Solana: Bitcoin Hyper

Bitcoin, renowned for its robustness and security, shares similarities with a bodybuilder who may struggle with agility. Enter Bitcoin Hyper, which merges Bitcoin’s unyielding security with Solana’s swift capabilities. This innovation transforms Bitcoin from mere “digital gold” into a versatile tool for decentralized finance (DeFi), gaming, and real-time applications. Bitcoin Hyper leverages its $HYPER token as the driving force behind this transformation, facilitating transactions, offering staking rewards, and enabling participation in governance. Through a decentralized bridge, Bitcoin remains secure while gaining flexibility, presenting investors with a unique opportunity to experience Bitcoin’s newfound agility.

How does Robinhood’s inclusion in the S&P 500 affect its market position?

Robinhood’s inclusion in the S&P 500 solidifies its standing as a significant player in the financial sector, boosting investor confidence and likely attracting more institutional interest. This milestone reflects its growing influence and underscores its potential for sustained growth in the digital asset market.

What factors contributed to Strategy’s non-inclusion in the S&P 500?

Despite meeting the market capitalization criteria, Strategy’s exclusion from the S&P 500 may be attributed to other factors such as its business focus or financial volatility. The decision underscores the complexities of index inclusion, influenced by various qualitative and quantitative considerations.

Why is Bitcoin Hyper considered a game-changer for Bitcoin?

Bitcoin Hyper revolutionizes Bitcoin by integrating Solana’s fast transaction capabilities, addressing Bitcoin’s scalability and cost challenges. This innovation enhances Bitcoin’s functionality for DeFi and other applications, making it a more versatile and efficient asset in the digital economy.

This comprehensive guide delves into the technological advancements, investment opportunities, and strategic market positioning of digital assets like Robinhood and Bitcoin, providing valuable insights for informed decision-making.