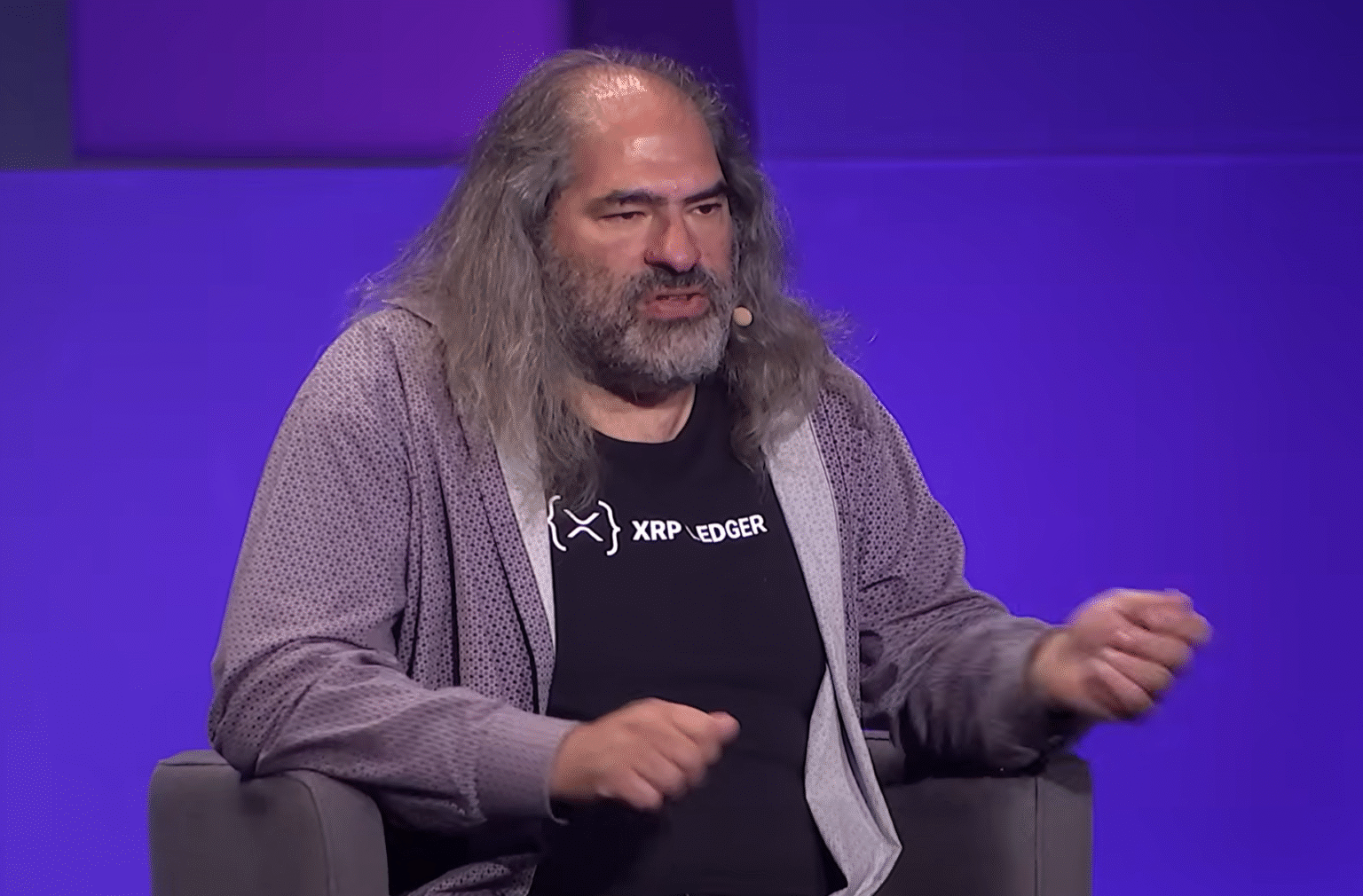

In the ever-evolving world of digital finance, strategic moves by key figures can significantly influence market dynamics. The recent announcement by Ripple’s veteran technologist, David Schwartz, marks an intriguing development for the XRP community. In a shift from his long-standing role at Ripple, Schwartz is stepping into a strategic advisory capacity at Evernorth, a forward-thinking entity spearheading XRP’s presence in decentralized finance and capital markets. With the leadership of former Ripple executive Asheesh Birla, Evernorth represents a bold endeavor to expand XRP’s ecosystem.

XRP’s New Frontier: Evernorth and Its Strategic Vision

Background on Ripple and Key Connections

Schwartz’s transition runs parallel with Evernorth’s announcement of its intent to go public via a merger with Armada Acquisition Corp II. The newly formed company aims to list on Nasdaq under the ticker “XRPN,” pending regulatory approvals. Backed by significant financial commitments, including a notable $200 million from Japan’s SBI, Evernorth is set to become a leading force in XRP-related financial operations, leveraging its substantial capital to reinforce its position as the largest public XRP treasury entity.

Former colleagues turned collaborators, Asheesh Birla and David Schwartz, have a longstanding professional relationship within Ripple’s fold. Birla, having joined Ripple in 2013 and played pivotal roles, now transitions from the company’s board to lead Evernorth. This new venture signals a continuation of their shared vision to enhance XRP’s applicability on a larger scale.

Evernorth’s Strategic Initiatives and Market Impact

Schwartz’s advisory role at Evernorth accompanies his departure from the CTO role at Ripple by the end of the year, yet he remains committed to the XRP Ledger community and Ripple’s board. This transition underscores his ongoing engagement with XRP initiatives, where he will dedicate more attention to family while maintaining an influential presence in the sector.

Evernorth’s strategic blueprint is comprehensive, aiming to scale its XRP holdings and foster growth through institutional engagement, liquidity provisioning, and the adoption of DeFi strategies tethered to XRP. By operating XRPL validators and utilizing Ripple’s RLUSD stablecoin, Evernorth intends to enhance its market operations across tokenized assets and capital markets, establishing itself as a dynamic player in both treasury management and ecosystem development.

Understanding Evernorth’s Market Strategy

Unlike passive Exchange-Traded Funds (ETFs), Evernorth positions itself as an active, yield-generating entity with a robust focus on XRP. If successful, the merger will convert Armada’s non-redeemed Class A shares into Evernorth shares, targeting a close by early 2026.

FAQs about XRP and Evernorth

What role will Evernorth play in the XRP ecosystem?

Evernorth aims to serve as both a treasury and strategic development vehicle for XRP, enhancing liquidity, supporting decentralized finance initiatives, and expanding the use of XRP in capital markets.

How will David Schwartz’s transition impact Ripple?

David Schwartz’s move to a strategic advisor at Evernorth adds to his board responsibilities at Ripple, enabling him to focus on strategic XRP-led initiatives while still contributing to Ripple’s governance and vision.

Is investing in Evernorth a viable option?

Investing in Evernorth could offer exposure to XRP’s growth and the company’s unique position as an active participant in the digital asset space. However, thorough due diligence and understanding of market conditions are crucial for potential investors.

As the digital finance landscape continues to evolve, the strategic developments at Evernorth exemplify the potential for growth and adaptation within the XRP ecosystem. These initiatives highlight the importance of expert guidance and well-planned market strategies in navigating this dynamic sector.