In the ever-evolving world of cryptocurrency, understanding market dynamics is crucial for both seasoned investors and newcomers alike. The recent activity in stablecoin exchange reserves offers intriguing insights into market trends and potential opportunities. With major exchanges witnessing significant inflows of stablecoins like USDC and USDT, the market landscape is rapidly shifting. This comprehensive guide delves into the implications of these developments and what they might mean for future investments.

Understanding the Recent Surge in Stablecoin Exchange Reserves

The Rise of Stablecoin Exchange Reserves

Recent data from on-chain analytics firm CryptoQuant highlight a fascinating trend: the combined exchange reserve of Ethereum and Tron-based stablecoins has reached a new all-time high. This increase, largely propelled by activity on major exchanges such as Binance, indicates a growing preference among investors to deposit these fiat-tied assets for trading and liquidity purposes.

Stablecoins serve as a bridge between traditional fiat currency and the volatile world of cryptocurrencies. Unlike Bitcoin and other high-volatility digital assets, stablecoins are pegged to fiat currencies, maintaining a stable value around $1. When investors deposit stablecoins into exchanges, it often signals readiness to re-enter the crypto market, suggesting potential bullish movements on the horizon.

Analyzing the Data

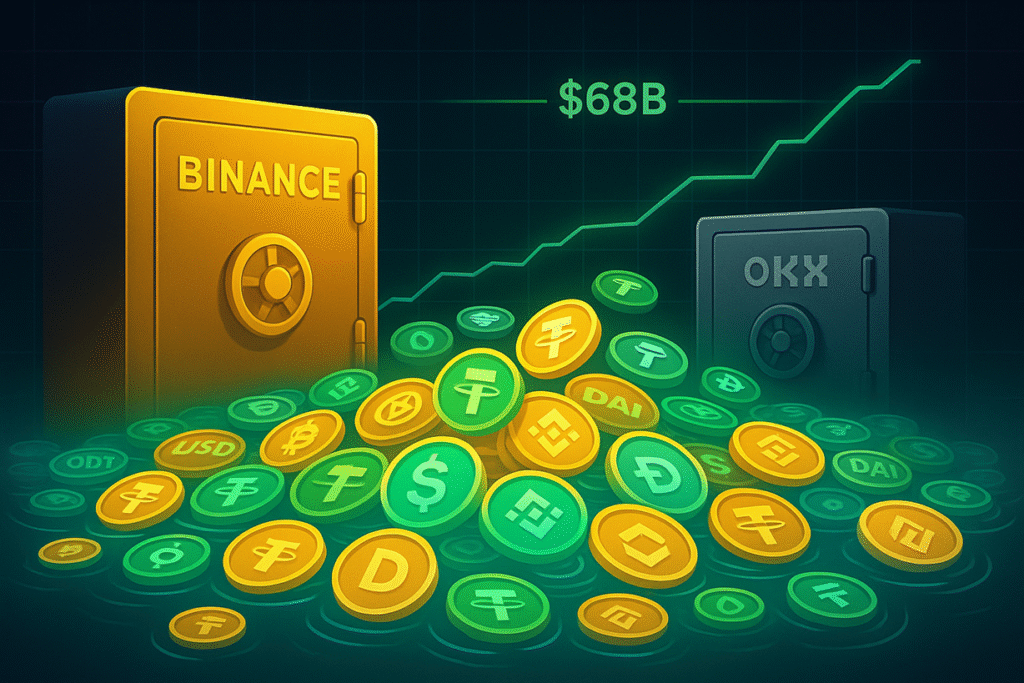

The Exchange Reserve metric provides insight into the volume of assets held in exchange wallets. An increase in this metric, especially for stablecoins, typically indicates that investors are positioning themselves for future buys, thus acting as a precursor to increased market activity. Recent statistics show that the total stablecoin exchange reserve has surged to approximately $68 billion, with Binance accounting for a substantial portion of this liquidity at $44.2 billion.

Key Drivers Behind the Surge

The influx of stablecoins into exchanges can be attributed to several factors. Binance and OKX have been pivotal in this trend, witnessing net inflows of $2.2 billion and $800 million, respectively. This surge reflects investor confidence in these platforms as reliable custodians for their digital assets, bolstered by their robust infrastructure and security measures.

Market Implications and Future Outlook

The current trend in stablecoin reserves suggests a shift in market sentiment. Investors appear to be preparing for upcoming opportunities, positioning themselves to capitalize on favorable market conditions. This behavior underscores the importance of stablecoins as a strategic tool for market participation, providing liquidity and flexibility in portfolio management.

Yet, while the current data indicates positive momentum, potential investors should conduct thorough research and consider market volatility before making decisions. Understanding the broader economic landscape and specific platform developments is crucial in crafting a resilient investment strategy.

Bitcoin’s Price Movements

While stablecoins enjoy a surge in reserves, Bitcoin’s price has remained relatively stagnant, recently dropping back to around $110,700. This sideways movement highlights the ongoing uncertainty in the market and the need for investors to stay informed and adaptive.

Frequently Asked Questions

Is investing in stablecoins a safe strategy?

Stablecoins offer a less volatile option compared to other cryptocurrencies, making them appealing for risk-averse investors. However, it’s essential to consider market trends and the specific stablecoin’s backing and reserves before investing.

How does the rise in exchange reserves affect the cryptocurrency market?

An increase in exchange reserves suggests that investors are preparing to engage more actively in the market. This readiness can lead to increased trading activity and potentially influence market prices.

What factors should be considered before investing in cryptocurrencies?

Investors should analyze market trends, regulatory developments, and technology advancements within the cryptocurrency sector. Diversification, risk management, and staying updated with credible financial insights are vital components of a successful investment strategy.

By exploring these developments and considering the insights provided, investors can position themselves strategically in the cryptocurrency market, leveraging data-driven decisions for optimal outcomes.