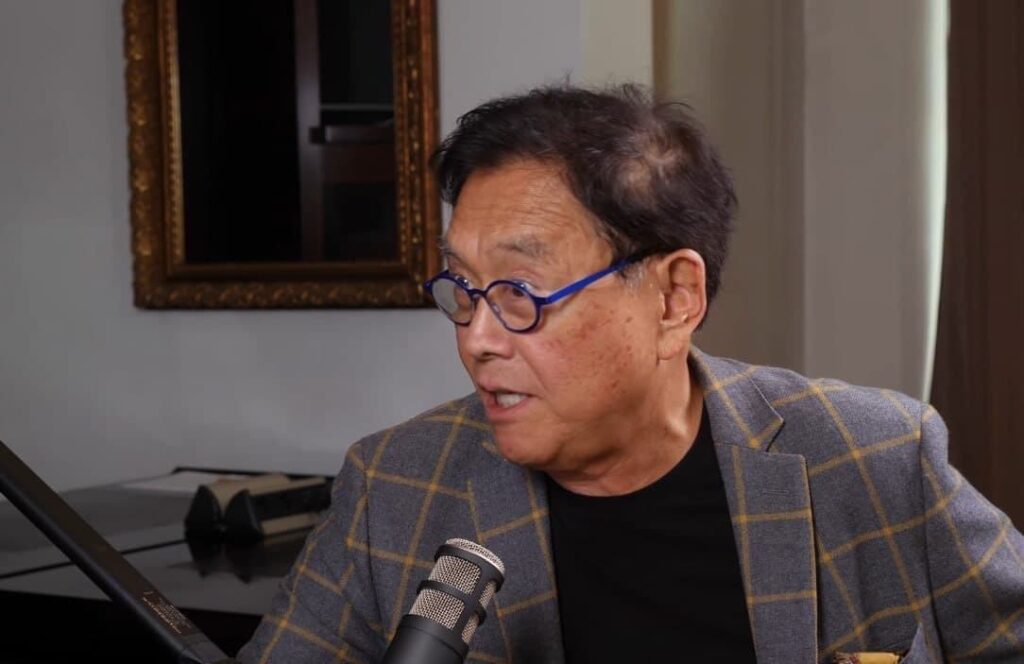

In an era where economic uncertainties loom large, financial thought leaders continue to offer insights that challenge traditional perspectives. Among them, Robert Kiyosaki, renowned for his influential book “Rich Dad Poor Dad,” stands out for his provocative views on global finance and monetary systems. On June 23, Kiyosaki issued a stark warning through his platform, drawing attention to what he describes as the “biggest debt bubble in history.” His message suggests that only those who safeguard their wealth in tangible assets will navigate through potential financial upheavals unscathed.

The Impending Global Financial Shift: Insights from Robert Kiyosaki

Kiyosaki’s forecasts, rooted in his skepticism of fiat currency systems, have consistently advocated for investments in assets like gold, silver, and Bitcoin. His recent commentary amplifies the immediacy of these concerns. According to Kiyosaki, a systemic collapse is not a distant possibility but an impending event, urging investors to reconsider their positions in government securities and cash holdings.

Understanding the Value of Tangible Assets

Kiyosaki emphasized, “Will you be richer or poorer when the biggest debt bubble in history bursts?” He strongly recommends allocating resources toward gold, silver, and Bitcoin, predicting that those who cling to traditional fiat currencies and bonds might be the hardest hit.

Strategic Asset Allocation: Silver’s Rising Star

In a subsequent communication, Kiyosaki shared his strategic focus on silver, identifying it as the most promising investment as of June 2025. Despite the allure of gold and Bitcoin, Kiyosaki expressed his intent to wait for a market correction before increasing his holdings in these assets. His rationale stems from the belief that silver’s current market undervaluation does not reflect its monetary importance and industrial utility.

Silver’s market price remains far beneath its inflation-adjusted peak of $50. Despite this, its robust fundamentals—characterized by limited supply and climbing demand for industrial use—highlight its potential for appreciation. However, it continues to experience significant price volatility and a lack of substantial institutional investment.

Making Informed Investment Decisions

For investors navigating these turbulent financial waters, Kiyosaki’s analysis presents both a warning and an opportunity. His advocacy for hard assets like silver underscores the potential for these commodities to serve as a hedge against economic instability.

FAQs: Navigating the Investment Landscape

Why is Robert Kiyosaki advocating for investments in silver?

Kiyosaki believes silver is undervalued in the market, with strong fundamentals not yet reflected in its price. Its key role in industrial applications and monetary functions makes it a strategic investment for hedging against future uncertainties.

Is Bitcoin a viable hedge against economic collapse?

Bitcoin, often hailed as ‘digital gold,’ offers a decentralized alternative to traditional currencies. Its limited supply and growing acceptance as a store of value make it a potential hedge against inflation and economic instability, although it comes with its own set of risks and volatility.

What are the risks of staying invested in fiat currencies?

Holding assets in fiat currencies exposes investors to risks associated with currency debasement and inflation, particularly in environments where central bank interventions can undermine currency value over time.

How can investors balance between gold, silver, and Bitcoin?

A diversified portfolio strategy, balancing gold, silver, and Bitcoin, can help mitigate risk while capitalizing on the unique strengths of each asset. Gold and silver offer historic stability, while Bitcoin presents growth potential within the digital economy.

This comprehensive guide to understanding Kiyosaki’s investment strategy provides a deeper insight into the potential and risks associated with tangible assets. As the global economic landscape evolves, informed decisions based on expert insights can empower investors to protect and potentially grow their wealth.