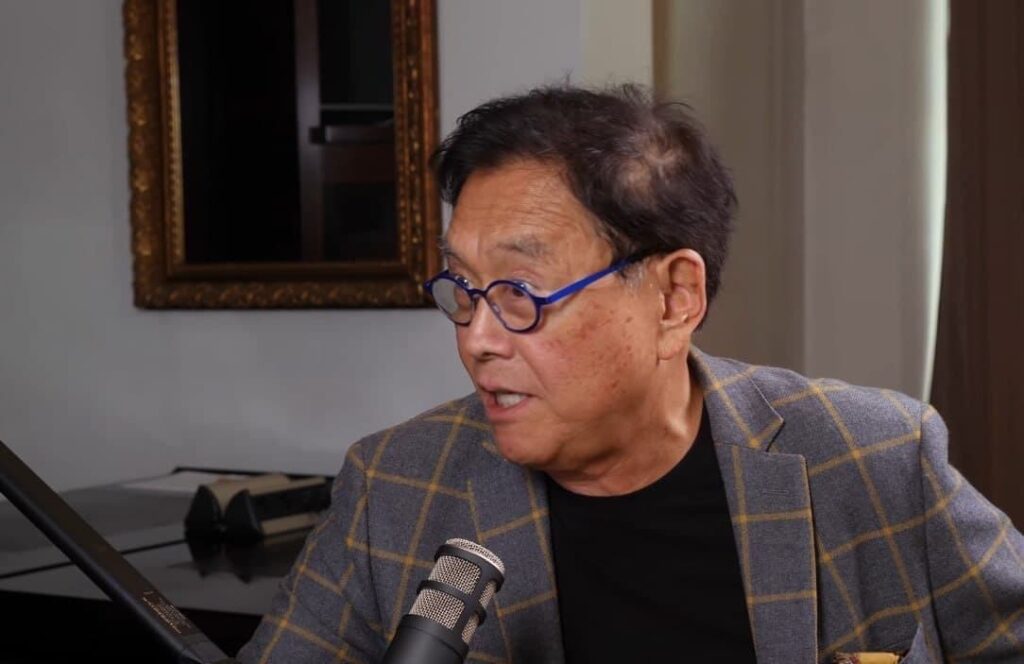

The rapidly evolving world of cryptocurrency continues to capture the attention of investors and financial experts alike. As digital currencies reshape the global financial landscape, Bitcoin remains at the forefront, drawing both praise and skepticism. One of its staunch supporters, Robert Kiyosaki, the acclaimed author of ‘Rich Dad Poor Dad,’ recently reaffirmed his bullish stance on Bitcoin, asserting its potential as a crucial asset for wealth creation. Kiyosaki’s insights offer a compelling viewpoint on navigating the complexities of cryptocurrency investments amidst today’s unpredictable economic climate.

Robert Kiyosaki Reiterates His Faith in Bitcoin as a Wealth Generator

Bitcoin: A Transformative Investment Opportunity

In a recent communication shared on X (formerly Twitter), Kiyosaki expressed his belief in Bitcoin as a straightforward path to financial prosperity. Despite its notorious volatility, he emphasized the opportunity Bitcoin presents for significant returns, even encouraging investments as small as 0.01 BTC given its long-term potential value. Recognizing Bitcoin’s price fluctuations, Kiyosaki likens it to the unpredictable nature of life itself, suggesting that its merits outweigh the downsides for those who are patient and informed.

Understanding Bitcoin’s Scarcity and Market Dynamics

Highlighting Bitcoin’s limited supply, with only 1 to 2 million coins remaining to be mined, Kiyosaki underscores the potential for a sharp increase in value. This scarcity, combined with growing demand, fuels what macro investor Raoul Pal describes as the “Banana Zone,” a phase characterized by explosive price movements. Kiyosaki urges investors to heed the advice of seasoned financial analysts and remain alert to the transformative potential of cryptocurrencies.

Kiyosaki’s Critique of Traditional Financial Instruments

Kiyosaki’s confidence in Bitcoin aligns with his broader skepticism of conventional financial systems, particularly fiat currencies and debt instruments like U.S. bonds. In light of a recent downgrade of the U.S. credit outlook by Moody’s, he criticized U.S. Treasuries as being akin to “toilet paper,” advocating for tangible assets such as gold, silver, and Bitcoin instead. His critique reflects growing concerns about the sustainability of traditional financial practices and the need for diversification in investment strategies.

Anticipating Bitcoin’s Future Value

Reflecting on the future, Kiyosaki had previously forecasted that Bitcoin could reach extraordinary highs, ranging from $500,000 to $1 million. His latest projections have been adjusted to a more conservative $180,000 to $200,000 by 2025, yet these figures still suggest substantial growth potential from current levels. This anticipated appreciation is fueled by factors such as rising inflation, diminishing confidence in the U.S. dollar, and increased institutional adoption of Bitcoin.

FAQs on Bitcoin and Investment Strategies

Why does Robert Kiyosaki advocate investing in Bitcoin?

Kiyosaki sees Bitcoin as a hedge against traditional financial instability, a stance reinforced by its finite supply and potential for high returns. His advocacy is rooted in the belief that digital currencies represent a new era of financial assets that can offer protection against inflation and economic uncertainties.

What does the “Banana Zone” mean in terms of Bitcoin pricing?

The term “Banana Zone,” coined by macro investor Raoul Pal, refers to a projected phase of dramatic and accelerated Bitcoin price increases. This phase is expected to result from the inherent scarcity of Bitcoin and rising demand, creating a unique investment opportunity.

How should new investors approach the cryptocurrency market?

New investors should conduct thorough research and remain informed about market trends and technological advancements. Utilizing platforms like Finances Zippy can provide valuable insights, real-time data, and expert analysis to make informed decisions while considering the inherent risks associated with digital assets.

Is diversifying into cryptocurrencies a good strategy?

Diversification into cryptocurrencies can be a prudent strategy to mitigate risk. It’s essential to balance investments across various asset classes, including digital currencies, to safeguard against market volatility and capitalize on different growth opportunities.