Exploring the dynamic intersection of technology and finance, nations worldwide are increasingly considering the potential of digital currencies. Among these, Pakistan is making significant strides towards integrating Bitcoin into its financial strategy. This move positions the country not only as a participant but a pioneering force in shaping the future of digital wealth management. On June 15, a promising dialogue transpired between Michael Saylor, a notable Bitcoin advocate, and Pakistan’s financial leaders. This discussion could potentially reshape how Pakistan approaches its financial reserves by incorporating Bitcoin.

Pakistan’s Ambitious Venture into Bitcoin Integration with Michael Saylor’s Expertise

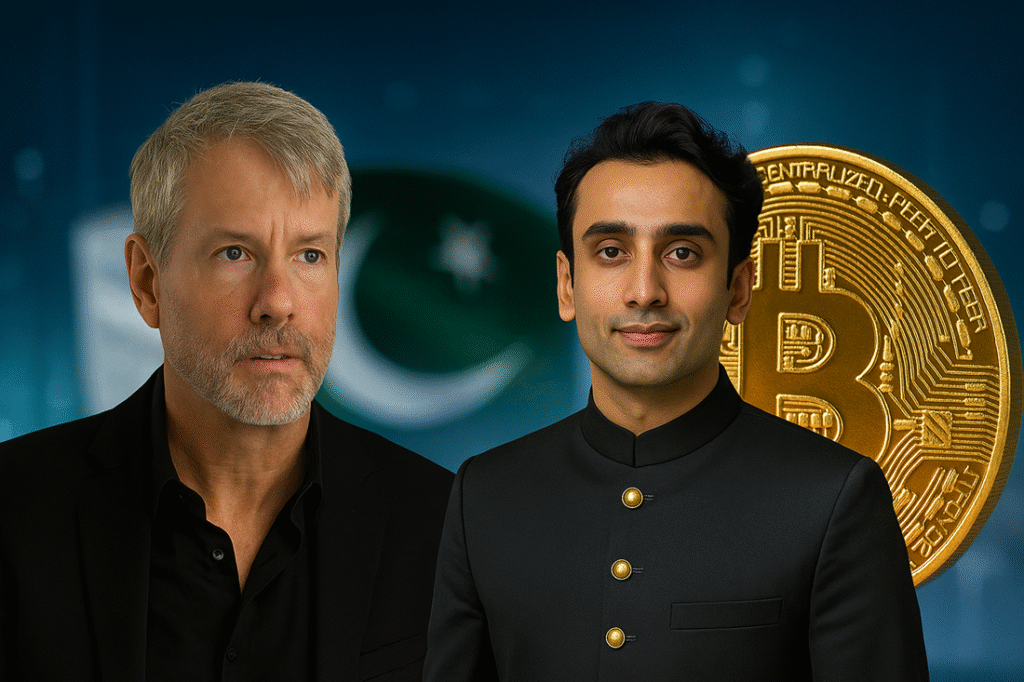

The meeting, hailed as a significant step in Pakistan’s digital-assets journey, involved Michael Saylor, who has successfully transitioned his company into a prominent Bitcoin investment entity. His conversation with Finance Minister Muhammad Aurangzeb and Minister of State for Blockchain and Crypto Bilal Bin Saqib revolved around the strategic integration of Bitcoin into Pakistan’s sovereign reserves. Saylor emphasized Bitcoin’s capability to enhance monetary resilience, especially for economies historically dependent on foreign exchange reserves and international monetary support.

Strategic Discussions for Bitcoin’s Role in National Resilience

A report by local media, Dawn, outlined how the dialogue concentrated on Bitcoin’s potential to fortify monetary stability and empower national growth. Saylor asserted that leveraging Bitcoin’s unique properties could propel Pakistan into a leadership role within the global financial landscape. The meeting aimed to align Pakistan’s strategic vision with Bitcoin’s role in fostering an economically prosperous future, potentially setting a benchmark for other countries in the Global South.

Addressing Challenges and Opportunities

While Saylor’s conversation with the Pakistani officials highlighted the tremendous potential of Bitcoin, it also underscored the need for robust regulatory frameworks. The formation of the Pakistan Crypto Council (PCC) signifies a commitment to navigating regulatory complexities, including drafting the Digital-Assets Act. Nevertheless, the existing ban on cryptocurrency poses a challenge to fully realizing these ambitions, pointing to a need for policy coherence and regulatory innovation.

Pakistan’s Steps Toward a Digital Future

Bilal Bin Saqib, showcasing Pakistan’s commitment to digital asset innovation, presented a state-managed Bitcoin cold wallet at an international conference, emphasizing the country’s readiness to lead by example. The government has also allocated substantial energy resources to support Bitcoin mining, aiming to harness surplus power for value creation and reserve diversification.

The Road Ahead

Though Saylor’s involvement has not been officially formalized, his advisory potential underscores Pakistan’s intent to acquire not only technological aptitude but also intellectual leadership in the crypto sphere. The country’s proactive approach, involving strategic dialogues and international collaborations, reflects its ambition to play a pivotal role in the global digital economy.

FAQs on Pakistan’s Bitcoin Strategy

What is the significance of Michael Saylor’s involvement in Pakistan’s Bitcoin initiative?

Michael Saylor’s expertise and his firm’s significant Bitcoin holdings provide a wealth of knowledge and credibility to Pakistan’s effort to integrate Bitcoin into its financial strategy. His advisory role could guide Pakistan in establishing a resilient and future-ready economic framework.

How is Pakistan planning to use surplus energy for Bitcoin mining?

Pakistan has approved the use of 2,000 megawatts of surplus power for Bitcoin mining activities. This initiative aims to convert excess energy into valuable digital assets, potentially stabilizing and diversifying the country’s financial reserves.

What challenges does Pakistan face in implementing a state-level Bitcoin strategy?

The primary challenge lies in developing a coherent regulatory framework that accommodates Bitcoin within existing financial laws. Overcoming this will require balancing domestic regulations with international financial guidelines, particularly in areas currently prohibiting cryptocurrency use.

This detailed guide delves into Pakistan’s ambitions with Bitcoin, exploring the profound implications of integrating cryptocurrency into national reserves. It sheds light on the cooperative efforts needed to transition from concept to execution, providing readers with the knowledge to understand and assess Pakistan’s strategic financial path.