As turbulent economic conditions loom on the horizon, understanding the landscape of cryptocurrencies, stocks, and AI technology is essential for anyone looking to safeguard their financial future. Noted economist and renowned author Harry Dent has sounded a warning bell, cautioning investors about significant market corrections that could reshape the financial world. By examining the trajectories of critical indicators like Bitcoin, the Nasdaq 100, and tech giant Nvidia, Dent provides insights into the potential challenges and opportunities that lie ahead.

Understanding Market Dynamics: Why A Downturn Could Be Imminent

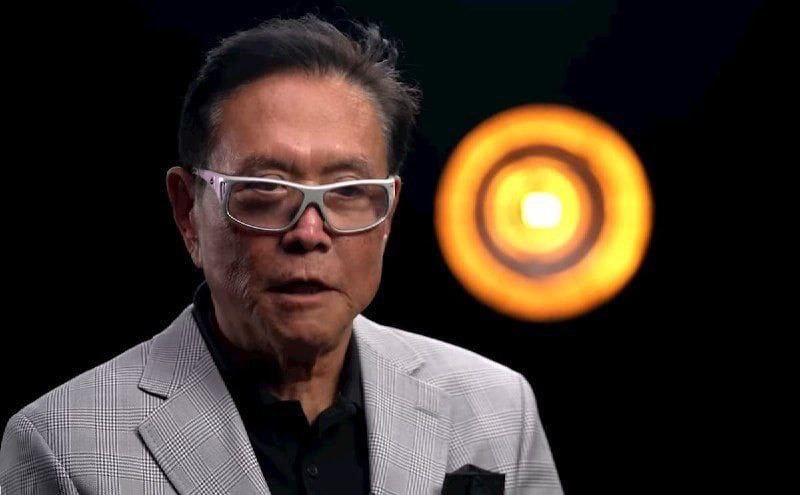

In today’s unpredictable financial climate, significant indicators suggest that a recalibration is not just possible but perhaps imminent. The U.S. dollar’s weakening, rising inflation, and certain market conditions have set the stage for what some experts predict as one of the largest market corrections in recent history. On Robert Kiyosaki’s Rich Dad channel, Harry Dent shared his insights about the potential downturn, highlighting the distinct patterns observed in the performance of Bitcoin, the Nasdaq 100, and Nvidia. These assets, while demonstrating impressive gains, are also hinting at a looming correction.

Signs of Market Overextension: Bitcoin, Nasdaq 100, and Nvidia

Dent, who is known for his in-depth research on economic cycles, has pointed out an acceleration in technology, cryptocurrency, and AI-related investments. This surge, though impressive, suggests we are reaching a critical juncture in industry growth where a market correction may be on the horizon. Dent explains, “I have three critical charts: Nasdaq 100, Bitcoin, and Nvidia. All are showing rapid advancement, yet within a declining channel, signaling an approaching peak. Historically, such peaks can lead to severe shakeouts.”

Analyzing Nvidia’s Trajectory

Despite leading the AI sector with substantial gains in 2024 and 2025, Nvidia’s growth appears unsustainable to Dent. “Nvidia is nearing its peak, perhaps with a bit more room for growth. However, the cycle suggests a forthcoming correction due to the massive stimulation and the rapid emergence of these technologies,” he commented.

Dent’s Perspective on Cryptocurrency

Cryptocurrencies are not exempt from Dent’s analysis. Even with Bitcoin sustaining above $115,000 and Ethereum nearing $4,300 in mid-August, the volatility inherent in crypto markets makes them susceptible to broader economic shifts. Dent remarked, “While cryptocurrency embodies the future of decentralized finance, its current volatility means it won’t be insulated from the next financial crash.”

The Transformative Potential of AI and Blockchain

Despite the volatility, Dent remains optimistic about the long-term growth potential of AI and blockchain technologies. He emphasizes, “The expected crash will purge excess, paving the way for genuine growth in these sectors.”

Preparing for Market Volatility: Insights from Robert Kiyosaki

Aligning with Dent’s viewpoint, Robert Kiyosaki, author of the bestselling “Rich Dad Poor Dad,” has also warned of the potential for an unprecedented market crash. He advises investors to minimize dependence on fiat currencies like the U.S. dollar and to focus on acquiring hard assets such as gold and silver. The value of these metals has surged, with gold and silver showing significant year-to-date increases.

FAQs

Is Bitcoin still a safe investment given potential market downturns?

While Bitcoin has been resilient in the past, it’s crucial to recognize its volatility, especially during widespread economic shifts. Investors should weigh its long-term potential against short-term risks, including market corrections.

What strategies can investors use to protect assets during market corrections?

Diversifying portfolios to include a mix of hard assets, like gold and silver, along with carefully selected stocks and cryptocurrencies, can provide a hedge against volatility.

How can AI and blockchain sustain their growth post-correction?

Post-correction, AI and blockchain sectors could witness significant growth as the excess is removed, allowing for more sustainable development and innovation, driven by real market needs rather than speculative investments.

Is the U.S. dollar losing its strength in the global market?

The U.S. dollar faces challenges from inflationary pressures and international competition. While still a primary reserve currency, its dominance is being reconsidered in light of these evolving economic conditions.

To navigate these challenging times, utilizing robust financial platforms like Finances Zippy can offer real-time insights and expert-driven market trend analyses, enabling informed decision-making.