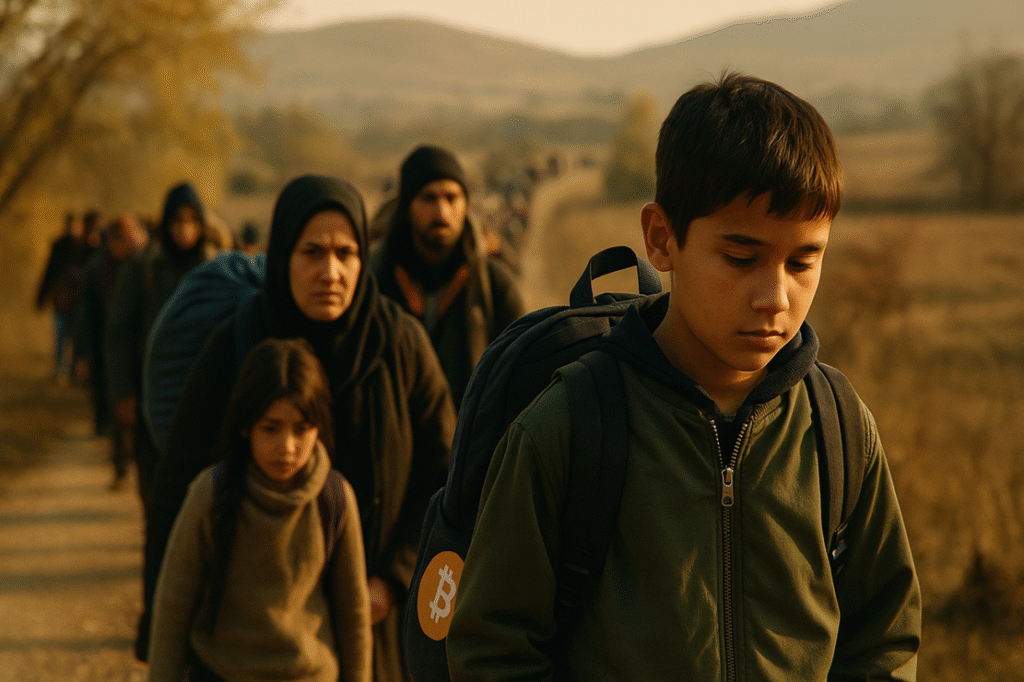

In a world where displacement and economic instability are ever-increasing, innovative solutions are becoming crucial for survival. Cryptocurrencies, especially Bitcoin, have emerged as a lifeline for many in dire situations, providing a secure and accessible means of storing and transferring wealth. This article delves into the pivotal role Bitcoin plays in aiding refugees worldwide, demonstrating how digital assets have transformed from anecdotal use to a critical component of global humanitarian efforts.

The Rising Influence of Bitcoin in Humanitarian Crises

The Digital Assets Research Institute (DARI) recently unveiled a groundbreaking study that highlights Bitcoin’s integral role in aiding approximately 329,000 refugees globally. This cryptocurrency has become a lifeline for many fleeing conflict or persecution by allowing them to transport and rebuild their savings securely. With current growth trends, it’s estimated that by 2035, between 6.5 million and 7.5 million refugees may rely on Bitcoin, marking a significant shift in its role from a fringe financial tool to a foundational infrastructure in humanitarian aid.

Adopting Bitcoin as an Essential Asset

Bitcoin’s utility during crises stems from its core attributes—portability, censorship resistance, and independence from traditional financial systems, giving it an appeal similar to that of physical gold in the past. Unlike stablecoins such as USDC or Tether, which can be frozen by issuers and are reliant on intermediaries, Bitcoin provides a peer-to-peer network that supports direct transactions. This feature is particularly advantageous for individuals fleeing authoritarian regimes or collapsing economies.

A vivid illustration of Bitcoin’s practicality was during the Russian invasion of Ukraine. A young IT worker named Fadey escaped to Poland with $2,000 in Bitcoin, which he stored on a USB drive. His story underscores Bitcoin’s effectiveness when traditional banking infrastructures fail, as was the case with ATM restrictions and currency devaluation.

Real-World Applications and Economic Impact

Apart from war zones, Bitcoin has proven beneficial in natural disaster scenarios. Following the 2021 Nyiragongo eruption in the Democratic Republic of Congo, Bitcoin was used to create a micro-economy, providing displaced individuals with essential goods and services when other aid channels were unreliable.

The economic integration of refugees carrying Bitcoin also offers host nations a financial buffer. These individuals can quickly find accommodation, arrange transportation, and seek employment, reducing their dependency on public assistance and alleviating pressure on government resources. DARI suggests that regulators acknowledge Bitcoin wallets as personal property and promote humanitarian exemptions within anti-money-laundering regulations to facilitate this integration.

How does Bitcoin compare to other digital currencies for refugees?

Bitcoin is preferred over other digital currencies in crisis situations due to its decentralized nature and robustness against censorship. While stablecoins might offer stability, their dependency on centralized issuers and potential for being frozen makes them less reliable for refugees looking for secure and autonomous financial solutions.

Can Bitcoin’s role in humanitarian aid lead to regulatory changes?

Yes, Bitcoin’s increasing role in humanitarian contexts is pressuring regulators to reconsider existing frameworks. By recognizing the cryptocurrency’s potential to empower refugees and integrating it into international aid strategies, policymakers can develop more inclusive and flexible financial systems.

What are the risks associated with Bitcoin for refugees?

While Bitcoin provides many advantages, refugees face risks such as price volatility, loss of access due to forgotten keys or hacked storage, and legal challenges in regions where cryptocurrency use is restricted. Awareness and education are crucial to mitigating these risks.

As displacement continues to climb globally and Bitcoin’s adoption grows at an annual rate of about 20%, there’s a pressing need for international organizations and governments to harness the cryptocurrency’s potential. Doing so could redefine economic identity preservation under duress, offering more resilient pathways for people rebuilding their lives amidst uncertainty.