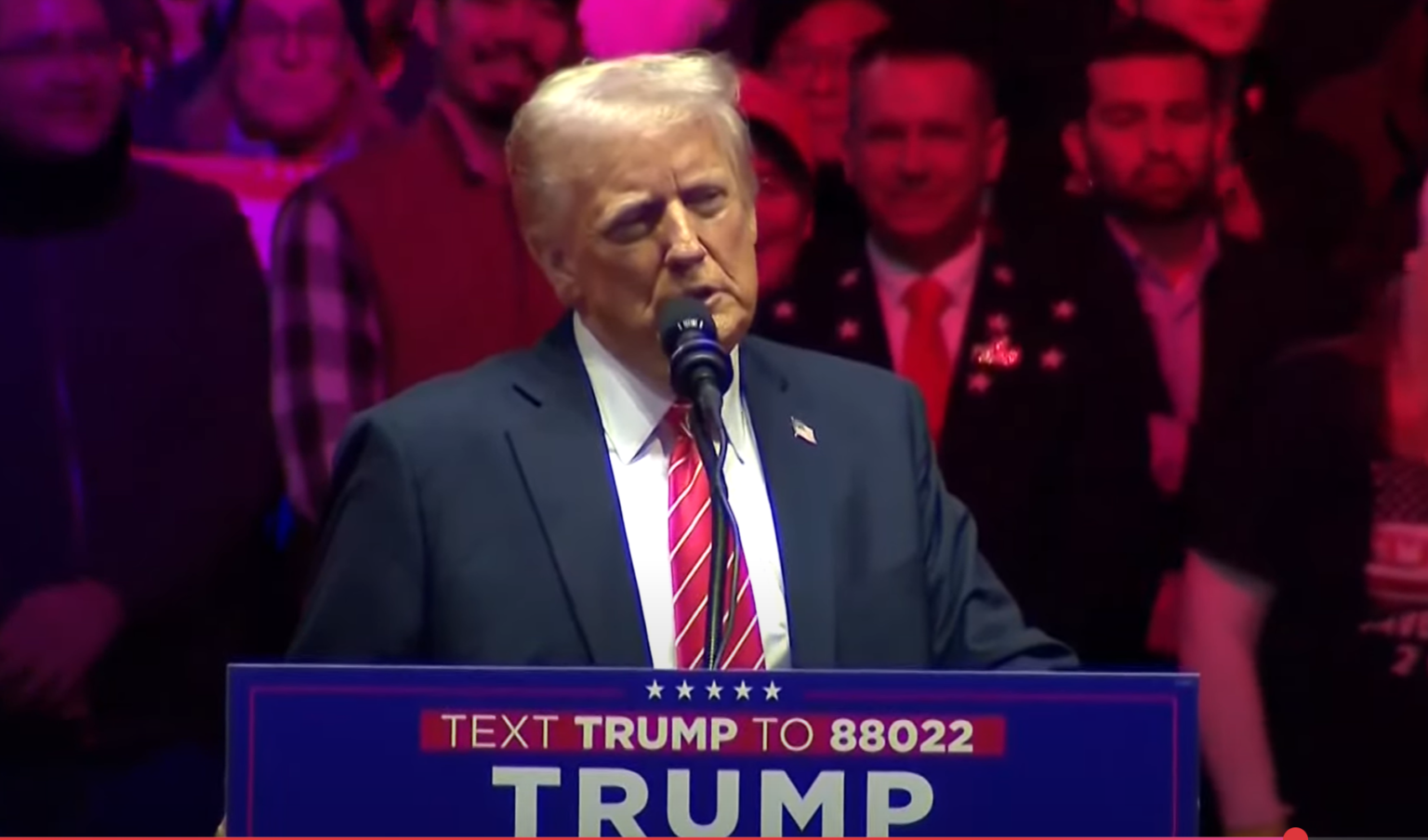

Cryptocurrency has recently been thrust into the spotlight with Donald Trump’s advent into the realm, and the unveiling of his unique meme coin, TRUMP. The surprising entrant has been the talk of the town, raising questions about its legality amid a flurry of discussions. Enabling a deeper understanding of the ongoing debate, Anonwassielawyer (@wassielawyer), a distinguished lawyer specializing in crypto and finance matters, offers a detailed analysis on the subject. The interpretation provided by the expert enlightens us on why despite its unconventional approach, Trump’s venture complies with the currently established US securities laws.

Trump’s Memecoins: A Clever Play on Securities Law?

Anonwassielawyer kicks off with a thought-provoking statement: “Trump launched a memecoin that garnered over $70 billion in the US, thereby challenging our perception of legality.” He further clarifies that the legal groundwork for such launches has always been in place, deeply embedded in the distinction between securities and non-securities defined by US law. Memecoins, typically devoid of inherent utility or mechanisms for revenue sharing, do not traditionally qualify as an “investment contract” as per the definition provided by the Howey Test.

A token needs to fulfill certain standards to be classified as a security, which include an investment in a shared enterprise with an expectation of profit from the endeavors of others. In the case of memecoins like TRUMP, these defining aspects are noticeably missing. Anonwassielawyer elucidates this point using an example: if a token is marketed with the assurance of utilizing the proceedings for a project expected to generate profit shared amongst investors, it would be classified as a security. However, a token sold as a speculative asset without backing any project or economic value escapes this classification, the category where TRUMP firmly falls.

The Impact on Crypto Industry

Despite the legal stance on memecoins being clear-cut, it brings forth complex implications for the larger crypto industry. Projects aimed at delivering tangible value often encounter higher regulatory obstacles. Tokens that generate revenue, provide governance rights, or otherwise resemble conventional financial tools are more likely to fall under securities law oversight. This ongoing reality has been the root cause for growing frustration within the industry, especially towards the enforcement strategies of regulators like SEC Chair Gary Gensler.

Comparing TRUMP with World Liberty Finance (WLFI)

The differences in the approach towards TRUMP and another crypto initiative by Trump, World Liberty Finance (WLFI), highlight this regulatory divide. TRUMP functions as a speculative memecoin, while WLFI operates under a strict compliance framework constructed to comply with US securities laws.

Importance of Offshore Structures

Another intricacy lies in offshore structures, often misinterpreted as instruments for evading regulation. Anonwassielawyer clarifies that these structures have valid functions, primarily in the domains of governance and tax optimization.

Takeaways for the Crypto Industry

The insight provided by Trump’s ventures into the crypto world may be obvious but undeniably sobering. Memecoins, though representing the bare minimum of the market, evade regulatory scrutiny due to their simplicity. In contrast, projects aiming to offer real utility are left to navigate the intricate and inconsistent regulatory landscape.

Question: What distinguishes a memecoin like TRUMP from other cryptocurrencies?

Answer: Memecoins such as TRUMP are unlike standard cryptocurrencies. They are mainly sold as speculative assets without backing any underlying project or possessing economic value. They do not promise to fund a project that creates an expectation of shared profit amongst investors, hence not falling under the classification of securities.

Question: What are the implications of memecoins on the regulatory landscape?

Answer: Memecoins, due to their simplistic nature, manage to evade regulatory scrutiny. They are not classified as securities, which saves them from the high regulatory barriers that other cryptocurrency projects often face.

Question: How does World Liberty Finance (WLFI) differ from TRUMP?

Answer: Unlike TRUMP, which operates as a speculative memecoin, WLFI abides by a strict regulatory compliance framework. This is designed to satisfy US securities laws and make it more credible and legal in the eyes of US law.

Question: What can crypto industry learn from Trump’s initiatives?

Answer: Trump’s initiatives highlight that while memecoins manage to evade regulatory scrutiny, projects with real utility must deal with an increasingly complex and inconsistent regulatory environment. It implies that the crypto industry must tread carefully, especially when dealing with securities-like elements, and adhere to appropriate legal frameworks.

In conclusion, Trump’s foray into the cryptocurrency domain with his TRUMP memecoin has stirred the pot, raising questions about legalities and paving the way for a deeper understanding of securities laws in relation to cryptocurrencies. At the time of reporting, TRUMP was trading at $39.26, underscoring the dynamic and unpredictable nature of this innovative financial sector.