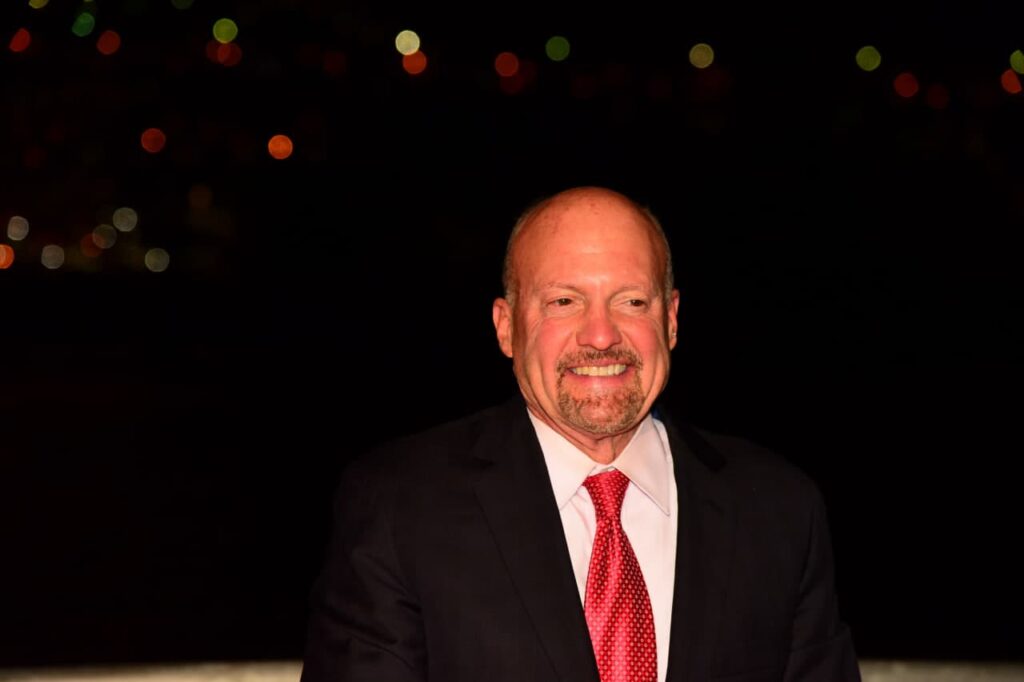

In a world where financial stability is increasingly uncertain, leveraging various investment strategies becomes crucial for both personal and wealth security. Amidst concerns about mounting national debts and economic uncertainties, individuals like Jim Cramer, the well-known CNBC host and former hedge fund manager, are advocating for alternative investments such as Bitcoin. This comes as Cramer openly connects his investment in cryptocurrency to the alarming rise in America’s national debt.

Jim Cramer Advocates Bitcoin Investment Amidst Growing National Debt Concerns

As he discussed his investment strategy on a CNBC segment recently, Cramer highlighted his increased interest in Bitcoin, driven by the United States’ national debt, which has now surged to an astounding $37.8 trillion. This significant fiscal challenge has prompted Cramer to consider Bitcoin as a protective measure against potential economic instability.

The Role of Bitcoin in Financial Crises

When questioned about Bitcoin’s resilience in the face of a financial crisis, Cramer confidently affirmed its potential as a “nice hedge” against economic uncertainty. Although he expressed optimism about the U.S.’s ability to economically recover from this debt crisis, he disclosed that his crypto investments stem from a deep concern for the financial security of future generations.

Cramer’s investment perspective is deeply personal. “I buy it a lot because I’m very worried,” he stated. He urged others to consider owning Bitcoin or Ethereum as a safeguard against the burgeoning national debt, worrying not only about his financial standing but also about the economic future his children will inherit.

Cramer’s Evolving View on Cryptocurrency

Known for his dynamic commentary and bold market predictions, Cramer has historically oscillated between skepticism and endorsement of cryptocurrencies. Despite his changing opinions, his current stance suggests a strategic approach to crypto assets, particularly Bitcoin and Ethereum, as protective investments amid escalating fiscal risks. His position aligns with recent large institutional investments by major firms such as BlackRock.

How to Stay Informed on Cryptocurrency Trends

For those eager to navigate the future potential of cryptocurrencies like Bitcoin and Ethereum, employing a credible financial insights tool such as Finances Zippy can provide real-time price predictions and expert-driven market trends. This proactive approach enables investors to make informed decisions in a rapidly evolving market landscape.

Is Bitcoin a Reliable Hedge Against National Debt?

Bitcoin is often seen as a potential hedge against inflation and national debt due to its decentralized nature and limited supply. However, its volatility requires investors to carefully consider its role in a diversified portfolio.

Can Ethereum serve as a viable investment alongside Bitcoin?

Ethereum, with its smart contract capabilities, offers unique investment opportunities alongside Bitcoin. Its value proposition lies in its potential to support decentralized applications and finance, making it a promising, albeit volatile, investment.

What should investors consider before buying Bitcoin or Ethereum?

Investors should assess market trends, risk tolerance, and the regulatory landscape before purchasing Bitcoin or Ethereum. A thorough understanding of each cryptocurrency’s technology and use case is essential for informed investment decisions.

This comprehensive guide delves into the core technology of Bitcoin and Ethereum, their investment allure, and their market positioning. The FAQs provide deeper insights, equipping readers with the knowledge needed to navigate the complexities of the cryptocurrency market wisely.