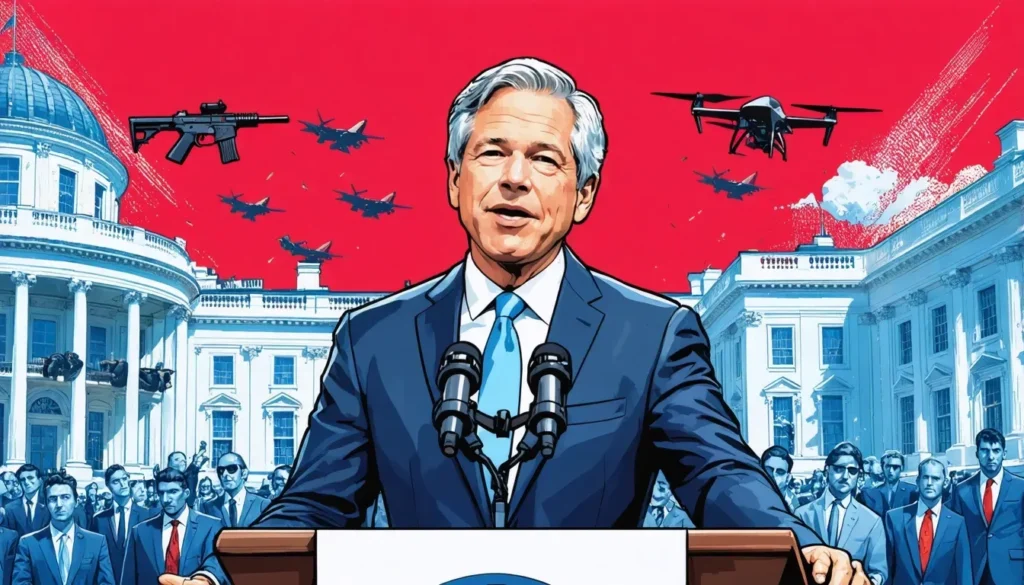

In a striking address at the Reagan National Economic Forum, JPMorgan CEO Jamie Dimon expressed his firm stance on the need for the U.S. to prioritize a stockpile of guns and ammunition over Bitcoin. While many see cryptocurrency as a revolutionary asset, Dimon emphasized that national security must come first, arguing that the future of the U.S. reserve currency depends on tangible investments rather than decentralized currencies. His comments reflect a growing concern over cryptocurrency, particularly in light of existing economic supremacy and the potential threats posed by global competitors. By urging a focus on traditional defense mechanisms, Dimon calls into question the safety of Bitcoin amidst prevalent cryptocurrency concerns. As America navigates its internal challenges, Dimon believes it should prioritize actions that reinforce its military strength and societal values.

In his recent remarks, Jamie Dimon, the prominent CEO of JPMorgan, suggested an unconventional approach to national security by advocating for a strategic stockpile of weaponry over digital assets like Bitcoin. He contends that while cryptocurrencies hold some allure, the focus should be placed on enhancing America’s defense capabilities to maintain its dominance as the U.S. reserve currency. This perspective raises interesting discussions regarding the intersection of economic power and national safety, particularly as the global landscape becomes increasingly unpredictable. By prioritizing tangible assets instead of virtual currencies, Dimon believes that the U.S. can better address its critical challenges and fortify its standing in the world. Such viewpoints significantly shift the conversation around cryptocurrency investment, presenting an alternative narrative that interlinks national interests and economic strategy.

Jamie Dimon’s Perspective on Bitcoin and National Security

During the Reagan National Economic Forum, JPMorgan CEO Jamie Dimon made a bold statement urging the United States to prioritize the stockpiling of guns, ammunition, and drones over digital currencies like Bitcoin. Dimon’s position stems from a deep-seated concern for national security and the need for the U.S. to focus on tangible assets. As the landscape of cryptocurrency evolves, he believes that a reliance on decentralized currencies poses risks that could undermine American safety and stability. By urging a stockpile of conventional defense resources instead of Bitcoin, Dimon underscores the immediate need for the U.S. to secure its borders and maintain readiness against any potential threats.

Dimon’s advocacy for prioritizing physical defense tools reflects an understanding that in times of uncertainty, especially with economic stability hanging in the balance, the U.S. must concentrate its resources on aspects that ensure national security. During his speech, he articulated concerns regarding potential pitfalls of cryptocurrencies, highlighting that investments in Bitcoin might divert critical resources from securing the nation’s military and economic supremacy. Moreover, Dimon’s assertions resonate as the cryptocurrency market faces increasing scrutiny and regulatory challenges, thus advocating a vision for America that supports traditional defense in a modern context.

Cryptocurrency Concerns amidst Economic Supremacy

As the world grapples with the rapid evolution of cryptocurrencies, concerns about their sustainability and impact on national economies continue to grow. Jamie Dimon’s skepticism towards Bitcoin aligns with broader apprehensions shared by many financial leaders regarding the unregulated nature of cryptocurrencies. He stresses that as the U.S. dollar remains the dominant reserve currency globally, maintaining economic supremacy requires strategic focus on established financial instruments that bolster national interests. Investing in a decentralized currency like Bitcoin could sideline efforts needed to uphold the U.S.’s influential standing in the global economy.

The implications of cryptocurrency adoption also extend to governance and societal stability. Dimon’s viewpoint reflects a common belief that excessive investment in digital currencies may detract from essential funding necessary for addressing societal issues such as education, healthcare, and defense infrastructure. He warns that failing to address internal challenges could jeopardize the U.S.’s status as the world’s reserve currency. Hence, concurrently demonstrating national influence through military preparedness and sound economic policies emerges as a paramount concern, further affirming Dimon’s stance against prioritizing cryptocurrencies like Bitcoin.

The Case for Reinforcing American Values

In the context of national security and economic supremacy, Jamie Dimon insists on the necessity of reinforcing American values. While cryptocurrencies present new opportunities for innovation, they also come with risks that could undermine the foundational principles that support U.S. governance and societal structure. Dimon suggests that celebrating American virtues while simultaneously tackling pressing domestic issues should take precedence. By focusing entrepreneurial efforts and resources on strengthening U.S. values, the nation can better navigate the disruptive elements of cryptocurrency volatility and external threats.

Dimon emphasizes that without a solid commitment to American ideals and internal unity, the nation could see a dilution of its global standing. He frames this conversation around an urgent call for the U.S. to not only champion its values but also to implement practical measures to address socio-economic disparities that could be exploited by adversaries. The proactive cultivation of American virtues, paired with a strategic defense policy, could ensure that the nation remains robust against both internal and external challenges in an ever-evolving global landscape.

Military Preparedness vs Cryptocurrency Speculation

The tension between military preparedness and the speculative nature of cryptocurrency investments has been brought to light by Jamie Dimon’s remarks. He advocates for a focused strategy where defense spending takes precedence over investments in digital currencies, which can often lead to financial volatility. Drawing a clear line between the two, Dimon argues that while Bitcoin and other cryptocurrencies may hold potential, their unpredictability does not align with immediate national security needs. As military capabilities are paramount, he suggests that resources should prioritize concrete defense measures rather than speculative assets.

Dimon’s position reflects a broader conversation about the allocation of national resources in a time when threats can come from both traditional military manifestations and the modern financial realm. As cryptocurrencies continue to gain popularity, financial leaders like Dimon caution that reliance on digitized forms of currency may blind policymakers to the stark realities of defense. Maintaining a military-first mentality could prove beneficial in ensuring the stability of the U.S. dollar as a reserve currency, reinforcing the idea that tangible assets hold far greater importance in the face of evolving global threats.

Examining the Future of the U.S. Reserve Currency

The considerations presented by Jamie Dimon highlight the importance of evaluating the future trajectory of the U.S. reserve currency status. As cryptocurrencies invade the financial landscape, questions arise about their potential challenge to traditional fiat currencies. Dimon vehemently argues that if the U.S. shifts its focus towards adopting Bitcoin or similar assets, the country could inadvertently weaken its economic supremacy and risk losing its global standing as the leading reserve currency. Keeping the dollar strong necessitates strategic planning and unwavering commitment to its foundational principles.

Moreover, maintaining the U.S. dollar as the reserve currency is not merely a matter of economic strategy; it has profound implications for national security as well. The dollar’s dominance allows for significant leverage in global trade and finance, enabling the U.S. to exert influence in international affairs. Dimon’s advocacy for a tangible approach to national security stresses that sustaining economic supremacy revolves around prioritizing the investments that foster long-term stability rather than speculative ventures in the cryptocurrency space. Without such foresight, the sanctity of the U.S. dollar is at risk.

Addressing Internal Challenges through Economic Strategy

Jamie Dimon’s comments regarding national security and economic strategy emphasize the pressing need for addressing internal challenges. The U.S. faces multiple issues ranging from economic inequality to political division, which require the government’s focus and resources. By directing attention away from speculative cryptocurrencies and towards solid economic policies, the nation can better confront these challenges. This focus is particularly essential as Dimon argues that without addressing these disparities, the country’s overall strength could diminish, impacting its global standing as a reserve currency.

Through this lens, a comprehensive economic strategy that prioritizes American values and military preparedness can facilitate a holistic approach to governance. By aligning economic policies with efforts to unify the nation, not only can leaders foster a sense of resilience within American society, but they can also enhance the country’s capacity to confront external threats. Dimon’s call to action is clear: the U.S. needs to adopt a strategy that fortifies its internal stability, thus ensuring that it remains a formidable force on the global stage.

The Role of Financial Leaders in Shaping Economic Policy

Financial leaders like Jamie Dimon play a crucial role in shaping economic policy and guiding national discourse on issues that affect security and stability. Their perspectives offer valuable insights into navigating the complexities of modern finance, especially as the rise of cryptocurrencies introduces new dynamics. As advocates for traditional economic policies, these leaders emphasize maintaining a strong, stable currency that upholds national interests. Dimon’s emphasis on focusing resources away from Bitcoin towards military preparedness epitomizes the urgency financial leaders feel in safeguarding national stability.

Moreover, financial leaders possess the platform to influence policymakers in recognizing the broader implications of cryptocurrency on economic supremacy. By articulating clear arguments regarding the risks associated with speculative investments in Bitcoin and prioritizing military assets, they can drive the conversation towards more holistic approaches to economic governance. Ultimately, strong financial leadership is necessary in addressing the crossroads of national security and economic strategy, guiding the nation towards sustainable growth while safeguarding its status in the evolving global landscape.

Reinforcing Traditional Assets Over Digital Alternatives

Jamie Dimon’s stance on stockpiling traditional assets like guns and drones instead of investing in Bitcoin underscores a belief in the superiority of conventional resources in bolstering national security. The ever-expanding landscape of digital currencies presents alluring opportunities, but they come with uncertainty that can undermine established systems. By advocating for a shift towards tangible assets, Dimon argues for a strategic approach that prioritizes military readiness and economic resilience over the speculative nature of cryptocurrencies, which can be seen as a distraction amidst pressing national concerns.

The reinforcement of traditional assets not only reflects a commitment to national defense but also serves as a hedge against shifting economic landscapes. By focusing on physical and military preparedness, the U.S. can navigate the tumultuous waters of an evolving economy where digital currencies may pose challenges. Dimon’s perspective aligns with a broader vision of ensuring that the nation is equipped to sustain its current global standing while remaining steadfast in its foundational values and capabilities, allowing the U.S. to continue thriving as a dominant force in international finance.

The Balance Between Innovation and Stability in Currency

In the discourse surrounding Bitcoin and national security, finding a balance between innovation and financial stability is paramount. Jamie Dimon’s remarks reflect the need for caution in embracing cryptocurrencies, advocating a more pragmatic approach where stability trumps novelty. With the potential for cryptocurrencies to disrupt the financial landscape, traditional assets become crucial for ensuring that economic policies remain grounded and effective. The intricate balance strikes at the heart of how economic leaders must navigate the future while safeguarding national assets.

As innovation continues to pave the way for digital currencies like Bitcoin, the challenge for policymakers is determining how to integrate these advancements without jeopardizing the core stability of the economy. Dimon’s perspective serves as a clarion call for approaching this balance thoughtfully, advocating for a recognition of the inherent risks that cryptocurrencies bring. By prioritizing traditional assets that reinforce national security and economic supremacy, the U.S. can continue to lead with confidence, striving for innovation while ensuring that stability remains intact at the forefront of financial governance.

Frequently Asked Questions

What are Jamie Dimon’s views on Bitcoin in relation to national security?

JPMorgan CEO Jamie Dimon has expressed concerns about Bitcoin, suggesting that instead of investing in cryptocurrencies, the U.S. should prioritize stockpiling tangible assets like guns and ammunition for national security. He believes emphasizing military strength is crucial to maintaining America’s status as the world’s reserve currency.

How does Jamie Dimon connect U.S. military readiness with cryptocurrency concerns?

During his discussions at the Reagan National Economic Forum, Jamie Dimon linked U.S. military readiness to cryptocurrency concerns by arguing that reliance on decentralized currencies like Bitcoin may weaken the country’s ability to sustain its economic supremacy and defend national interests.

Why does Jamie Dimon think the U.S. should stockpile guns instead of Bitcoin?

Dimon advocates for stockpiling guns, ammunition, and drones rather than Bitcoin, believing that these assets are essential for national security. He sees cryptocurrency as less reliable compared to tangible resources that can support military and economic stability.

What implications does Jamie Dimon suggest the failure to maintain U.S. economic supremacy might have?

Jamie Dimon warns that if the U.S. fails to uphold its military and economic supremacy, it may jeopardize its position as the world’s reserve currency, which could have significant consequences for global economic stability and U.S. interests.

How does Jamie Dimon view the role of cryptocurrencies in the future of the U.S. economy?

Jamie Dimon remains skeptical about the future of cryptocurrencies like Bitcoin, suggesting that they do not align with the strategic needs of the U.S. economy. He emphasizes the importance of focusing on robust national security measures rather than decentralized currency investments.

What does Jamie Dimon believe is necessary for America to tackle internal challenges?

Dimon believes America must celebrate its core virtues while addressing internal challenges within society and governance. He argues that this approach is critical to restoring and maintaining the U.S.’s economic reputation and military strength.

What did Jamie Dimon say about American values at the Reagan National Economic Forum?

At the Reagan National Economic Forum, Jamie Dimon stressed the importance of upholding American values as the nation navigates through internal difficulties. He linked these values to the U.S.’s ability to maintain its global leadership role and economic supremacy.

How does Bitcoin factor into Jamie Dimon’s overall message about American security?

In his remarks, Jamie Dimon articulated that while Bitcoin is a decentralized currency, the U.S. should allocate resources towards enhancing its military defenses. He believes that this focus is vital for national security and ensuring the U.S. retains its status as the world’s leading economic power.

| Key Point | Details |

|---|---|

| Advocation for Weapons Stockpile | Jamie Dimon suggests the U.S. should prioritize stockpiling guns, ammunition, and drones. |

| Concerns about Bitcoin | Dimon argues that while Bitcoin is a decentralized currency, it lacks the tangibility needed for national defense. |

| Focus on National Security | Emphasizes the importance of strengthening America’s military and economic power to maintain its global status. |

| Celebrating American Values | Calls for recognition of American virtues while addressing societal and governance challenges. |

Summary

Jamie Dimon Bitcoin gun stockpile reflects a pivotal discussion on U.S. national security strategies. During the recent Reagan National Economic Forum, Dimon expressed the need for America to focus on tangible assets like guns and drones. His remarks highlighted a clear stance against Bitcoin as a viable alternative for ensuring national security, emphasizing the importance of maintaining military and economic dominance. Ultimately, Dimon called for a balanced approach that honors American values while confronting the nation’s internal issues.