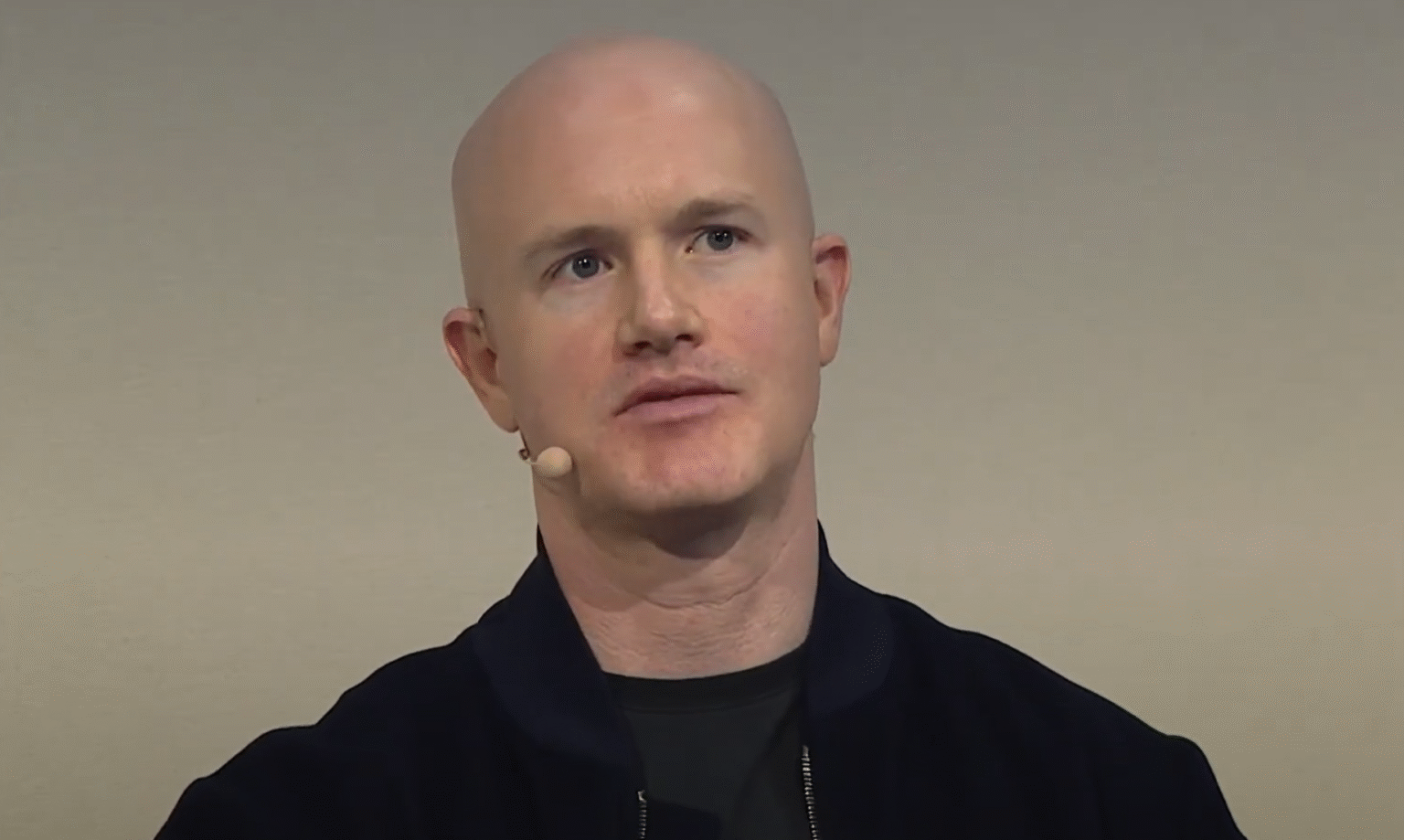

In an era marked by volatile financial markets and digital innovation, Bitcoin emerges as a potential game-changer in global finance. Brian Armstrong, co-founder and CEO of Coinbase, has put forth a provocative assertion: Bitcoin could replace the US dollar as the world’s reserve currency. This bold vision was shared during the annual State of Crypto Summit, captivating an audience of policymakers, investors, and developers. His thesis, both radical and visionary, invites us to contemplate a future where digital currencies redefine economic landscapes.

Bitcoin: The Future Global Reserve Currency?

At the summit, Armstrong highlighted the dual purpose of money—as a medium of exchange and a store of value. He praised stablecoins tied to the dollar for excelling in the former role, yet criticized fiat currencies for faltering in the latter. He noted, “Democracies worldwide are grappling with deficit spending,” proposing that Bitcoin could serve as a safeguard against fiscal irresponsibility. He elaborated, “As governmental debt escalates, Bitcoin’s fixed supply of 21 million coins may offer a corrective mechanism, potentially establishing Bitcoin as the new reserve currency in times of fiscal distress.”

Armstrong’s concerns are underscored by the United States’ burgeoning debt, currently approximating $37 trillion—a significant increase in a short span. His advocacy for a strategic national Bitcoin reserve highlights the urgency of addressing fiscal vulnerabilities. Earlier this year, Armstrong actively participated in discussions with government leaders, including a meeting at the White House focused on cryptocurrency policies.

The summit’s significance was amplified by a surprise keynote video from President Donald Trump, emphasizing cryptocurrency’s transition from fringe to mainstream. “My administration is committed to supporting dollar-backed stablecoins and creating a framework for America’s leadership in crypto and Bitcoin,” Trump stated, marking a significant policy shift.

The White House has demonstrated tangible support for these initiatives. In March, Trump signed an executive order to establish a Strategic Bitcoin Reserve and a US Digital Asset Stockpile. This directive empowers the Treasury to consolidate and acquire Bitcoin under budget-neutral conditions. Bo Hines, Executive Director of the President’s Council of Advisers on Digital Assets, announced imminent plans to unveil strategic details of the Bitcoin reserve.

Currently, Bitcoin trades at $104,876, maintaining stability above key technical levels.

Exploring Bitcoin’s Potential as the Reserve Currency

The notion of Bitcoin as a global reserve currency is not without its challenges. Critics point to its volatility and regulatory hurdles. However, Armstrong’s argument hinges on Bitcoin’s inherent scarcity and decentralized nature, attributes unmatched by traditional fiat systems. As fiscal mismanagement persists, Bitcoin’s appeal may grow, providing a hedge against inflation and currency devaluation.

How Bitcoin’s Algorithmic Supply Influences Its Reserve Currency Potential

Bitcoin’s supply cap of 21 million coins plays a pivotal role in Armstrong’s thesis. Unlike fiat currencies subjected to central bank policies, Bitcoin’s supply is predetermined, offering predictability and transparency. This trait could attract nations seeking stability amid economic uncertainties.

Is Bitcoin a Practical Solution for Sovereign Reserves?

Transitioning to Bitcoin as a reserve currency challenges existing financial systems. Adoption requires robust regulatory frameworks, intergovernmental cooperation, and technological infrastructure. Yet, the potential benefits—such as reducing dependency on traditional currencies—could incentivize nations to integrate Bitcoin into their reserve strategies.

Addressing Concerns: Bitcoin’s Volatility and Market Maturity

Skeptics raise valid concerns regarding Bitcoin’s price volatility and market maturity. While Bitcoin’s value fluctuates, its acceptance and usage grow, suggesting evolving stability. Moreover, as governments develop comprehensive regulatory measures, Bitcoin’s integration into global finance might become more feasible.

What Does Bitcoin’s Emergence Mean for Global Financial Systems?

Bitcoin’s rise challenges traditional financial paradigms, urging stakeholders to reassess currency frameworks. As governments and institutions explore digital assets, Bitcoin’s influence could redefine monetary policy and international trade, paving the way for innovative financial solutions.

This comprehensive guide delves into Bitcoin’s transformative potential, probing its technological foundations and examining its future role within global finance. The following FAQs offer further insights, equipping readers with knowledge to navigate the evolving crypto landscape.

“`html

Is Bitcoin a reliable hedge against inflation?

Bitcoin’s fixed supply and decentralized framework position it as a potential hedge against inflation. Unlike fiat currencies, which can be subject to inflationary pressures due to governmental policies, Bitcoin’s value may appreciate in inflationary environments.

Could Bitcoin replace the US dollar as the primary global currency?

While Bitcoin offers distinct advantages such as scarcity and decentralization, its widespread adoption as a global currency would require overcoming significant regulatory, technological, and market barriers. However, its growing acceptance suggests a potential shift in the global currency landscape.

What role do stablecoins play alongside Bitcoin in the crypto ecosystem?

Stablecoins, which are typically pegged to fiat currencies like the US dollar, provide stability and liquidity in the volatile crypto market. They complement Bitcoin by facilitating transactions and serving as a bridge between traditional financial systems and digital currencies.

“`