In an ever-evolving financial landscape, the potential unveiling of the first U.S. spot XRP ETF could mark a significant milestone for investors and the cryptocurrency community. Canary Funds is paving the way with a strategy that accelerates their legal processes, potentially setting a new standard for crypto ETF launches. This approach not only prompts anticipation but also invites scrutiny from the Securities and Exchange Commission (SEC) and the broader market. As we delve into the intricacies of this development, it’s crucial to understand the implications and mechanics at play, especially in light of recent regulatory shifts.

Spotlight on Canary Funds: The Prospect of a U.S. Spot XRP ETF

In a bold move, Canary Funds stands poised to potentially launch the first U.S. spot XRP ETF by November 13. This strategy hinges on an updated S-1 filing, which omits the ‘delaying amendment’ that typically gives the SEC control over timing. The absence of this amendment means that unless the SEC actively intervenes, the registration becomes automatically effective after a statutory 20-day waiting period. This tactic mirrors recent ETF launches tied to cryptocurrencies like Solana and Litecoin, highlighting a trend where companies leverage the statutory timeline amidst governmental shutdowns.

Assessing the November 13 Launch Date

Despite this concrete timeline, uncertainties linger due to external factors. The recent government shutdown adds layers of unpredictability, influencing the SEC’s response capabilities. As highlighted by industry observers, the reopening of government operations could drastically alter the launch schedule depending on whether SEC staff propose additional comments or expedite the approval process.

SEC Chair Paul Atkins has acknowledged this legal pathway, praising companies that utilize the 20-day statutory period to go public during governmental constraints. This acknowledgment could bode well for Canary Funds, suggesting a potential willingness from the SEC to allow the statutory clock to dictate effectiveness rather than ongoing negotiations.

Distinguishing XRP from Other Crypto ETFs

While the XRP ETF follows a similar path to recent Solana and Litecoin ETF launches, there are notable differences. Solana’s filings involved more iterative discussions with SEC staff, giving issuers greater confidence prior to launching. Conversely, Canary Funds is pushing forward with less visible negotiation, effectively testing the system under less predictable conditions.

This strategy presents a binary outcome: If the 8-A filing is cleared by Nasdaq and the SEC remains passive, the XRP ETF might commence trading as planned, marking a historic moment. However, should the SEC impose additional requirements, it could signify a tentative stance on XRP compared to other assets.

Current Market Context for XRP

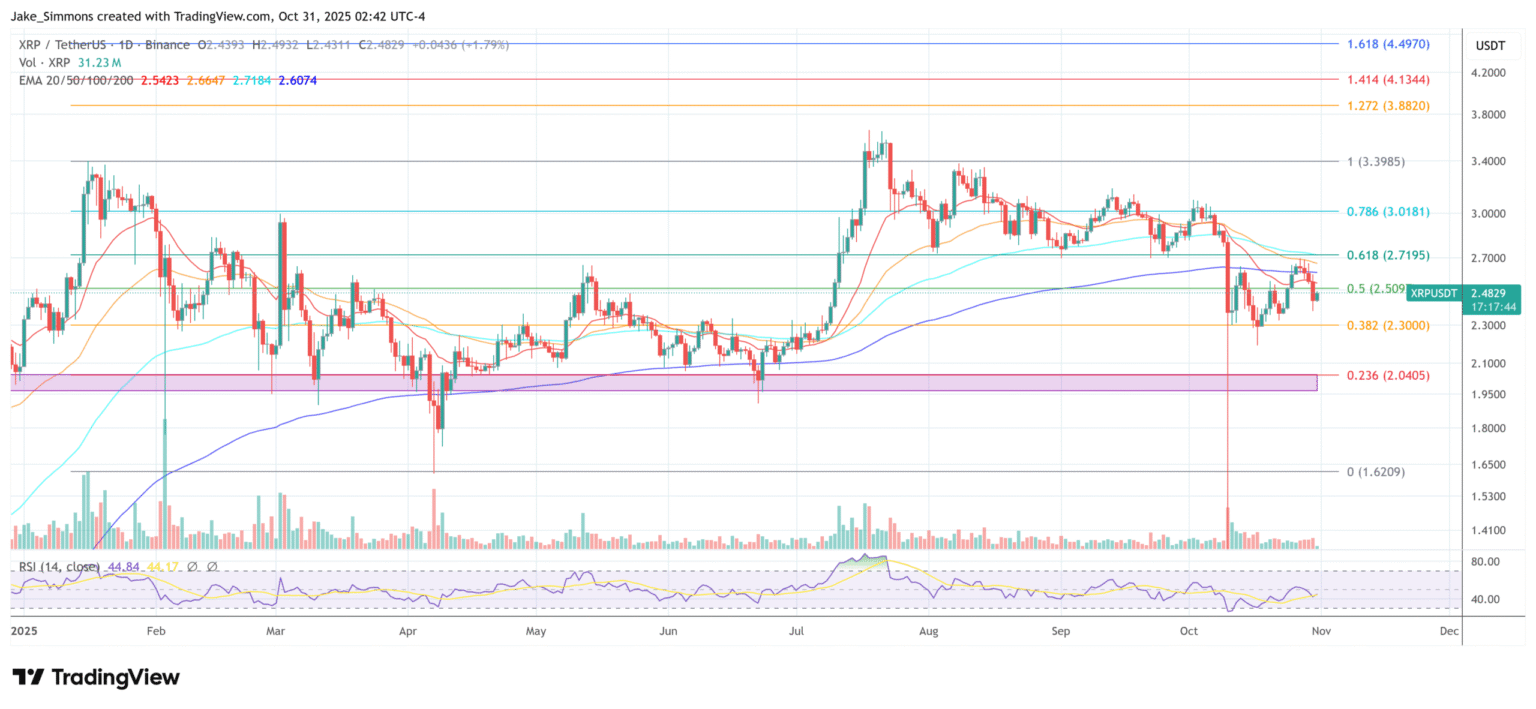

At the time of writing, XRP is trading at $2.48. The prospect of a spot ETF could significantly impact its market dynamics, potentially altering investor sentiment and market liquidity. The ongoing regulatory developments will undoubtedly influence market responses in the coming days.

Is the XRP ETF launch likely to happen on November 13?

While Canary Funds has set November 13 as the potential launch date, this is subject to change. External factors, such as government reopening and SEC interventions, could either accelerate or delay the timetable. Investors should stay informed about regulatory updates and market conditions.

Why is the lack of a ‘delaying amendment’ significant?

Omitting the ‘delaying amendment’ allows the ETF registration to become effective automatically after 20 days, unless the SEC intervenes. This accelerates the timeline for launching an ETF, bypassing traditional regulatory negotiations and leveraging statutory provisions.

What are the implications of a U.S. spot XRP ETF for the market?

The introduction of a U.S. spot XRP ETF could enhance liquidity and market accessibility for XRP, potentially influencing its price and appealing to institutional investors. However, it also introduces new regulatory dynamics and market considerations.

This comprehensive analysis of the potential XRP ETF launch delves into its strategic foundations, anticipated regulatory interactions, and market implications. By understanding these dynamics, stakeholders can better navigate the evolving cryptocurrency landscape.