In a rapidly changing financial landscape, the integration of cryptocurrency into traditional banking systems is no longer just a theoretical concept but an emerging reality. Drawing attention from global leaders, this digital shift promises a transformative impact on national economies. Recently, a prominent UK political figure unveiled an ambitious plan to incorporate Bitcoin into the country’s financial framework, signifying a proactive approach towards embracing digital currencies’ potential.

The UK’s Bold Move Towards a Bitcoin Reserve

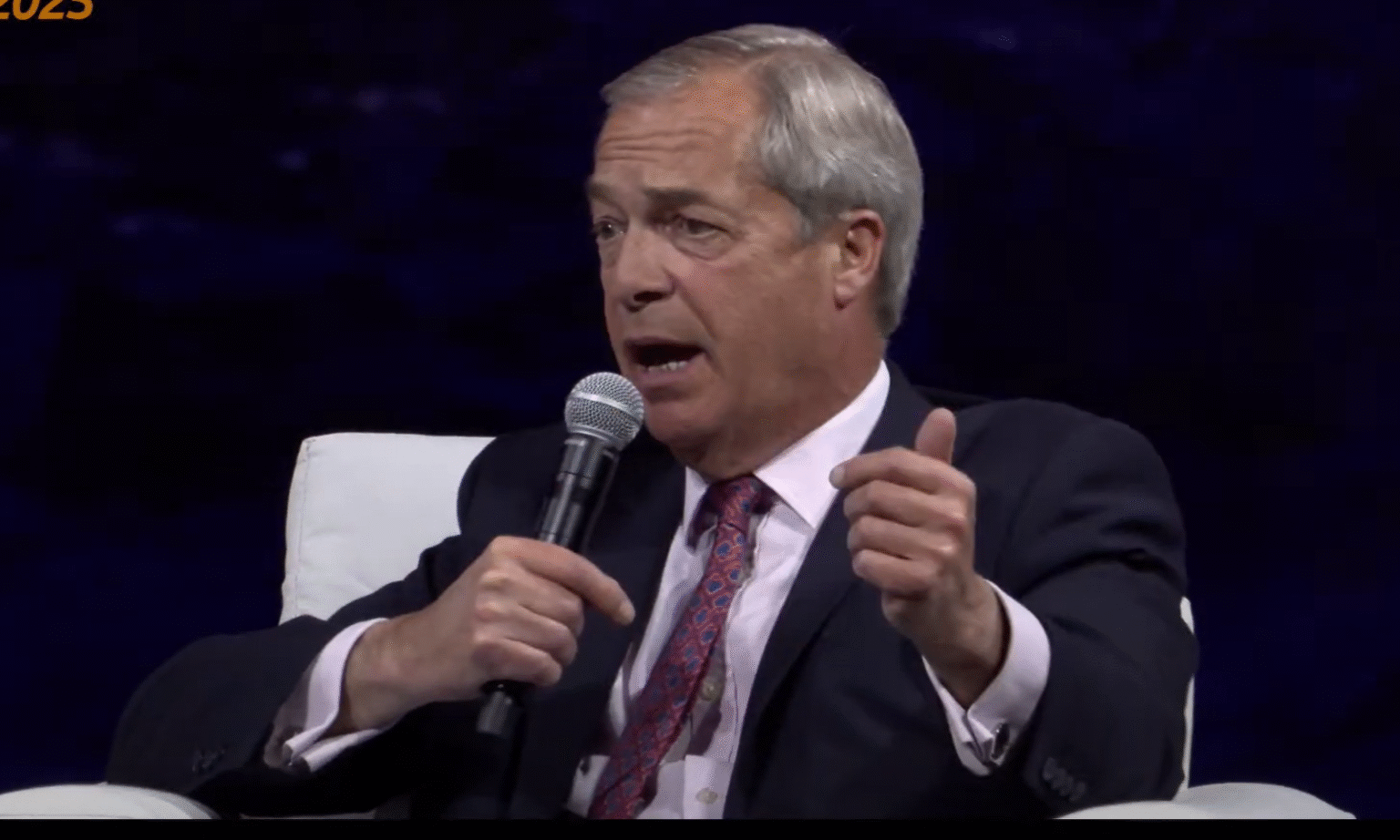

At the Bitcoin 2025 conference held in Las Vegas, Nigel Farage, a key political figure and candidate in the UK’s forthcoming general election, announced an innovative proposal to establish a Bitcoin reserve at the Bank of England. During a conversation with Frank Corva, Farage revealed strategic details about his vision for the future of cryptocurrency in the UK.

Bitcoin Reserve: A New Chapter for the Bank of England

Farage’s proposal intends to transform the nation’s approach to digital finance by creating a Bitcoin reserve within the Bank of England. “We plan to create a secure Bitcoin digital reserve at the central bank,” he stated. Additionally, he promised to enact legislation prohibiting banks from closing accounts simply because users engage in legal cryptocurrency activities. This measure aims to tackle the widespread issue of “debanking,” where individuals are denied banking services due to their cryptocurrency dealings.

Embracing the Digital Financial Era

Highlighting the UK’s sluggish pace in adopting digital finance, Farage pointed out that “seven million people in Britain hold crypto assets. Among the youth under 30, one in four already engages with crypto investments.” He criticized previous governments for their lack of action and proposed reforms to propel the UK into becoming a leading player in the global digital economy. “We aim to initiate a crypto revolution, positioning London as a premier global trading hub,” Farage declared.

International Insights and Sovereignty Advocacy

Reflecting on the international scenario, Farage praised the United States for fostering the digital sector. He drew parallels between his Brexit campaign and the liberating potential of Bitcoin, advocating for reduced government intervention. “Bitcoin epitomizes freedom from excessive governmental control,” he said, voicing resistance against government-driven digital currencies like the proposed “Britcoin,” which he dubbed the “ultimate form of tyranny.”

Personal Battles and Broader Implications

Farage’s personal experiences with “debanking” have fueled his commitment to Bitcoin. He recounted being denied services by multiple banks due to his political and crypto affiliations. “It was a harrowing experience,” Farage shared. “But I publicly resisted, and I emerged victorious.”

Current Market Observations

At the time of reporting, Bitcoin was trading at $106,293, continuing to stabilize below its previous all-time high. This reflects ongoing consolidation in the market.

Editorial Integrity and Rigorous Standards

Our content adheres to strict editorial standards, ensuring thorough research and unbiased reporting. Each article is meticulously vetted by industry experts to guarantee accuracy and value, reinforcing our commitment to providing our readers with reliable and timely information.

Is establishing a Bitcoin reserve feasible for the UK?

Creating a Bitcoin reserve is feasible but requires careful planning and robust legal frameworks to ensure security and regulatory compliance. It could position the UK as a leader in financial innovation.

How might such an initiative impact the UK economy?

Integrating Bitcoin into the national financial system could attract global investments, promote technological innovation, and enhance the UK’s competitiveness in the financial sector.

What challenges could arise from introducing a Bitcoin reserve?

Potential challenges include ensuring regulatory compliance, managing market volatility risks, and addressing cybersecurity threats, which require strategic planning and robust infrastructure.

How does “debanking” affect cryptocurrency adoption?

Debanking can hinder cryptocurrency adoption by denying access to essential financial services for crypto users, thereby stifling innovation and inclusion within the financial ecosystem.