With the ever-changing landscape of the cryptocurrency industry, we aim to provide our readers with the most accurate and up-to-date information. Our goal is to be your trusted source for cryptocurrency news, expert advice, and insightful predictions. In line with this promise, we offer you an in-depth look into Ripple’s lawsuit with the US Securities and Exchange Commission (SEC) and the intriguing insights shared by Ripple CEO Brad Garlinghouse. In the following discussion, we will delve into the lawsuit’s conclusion, Ripple’s strategic plan, and the potential role of XRP in the new US Crypto Stockpile.

Ripple Emerges Victorious in SEC Lawsuit

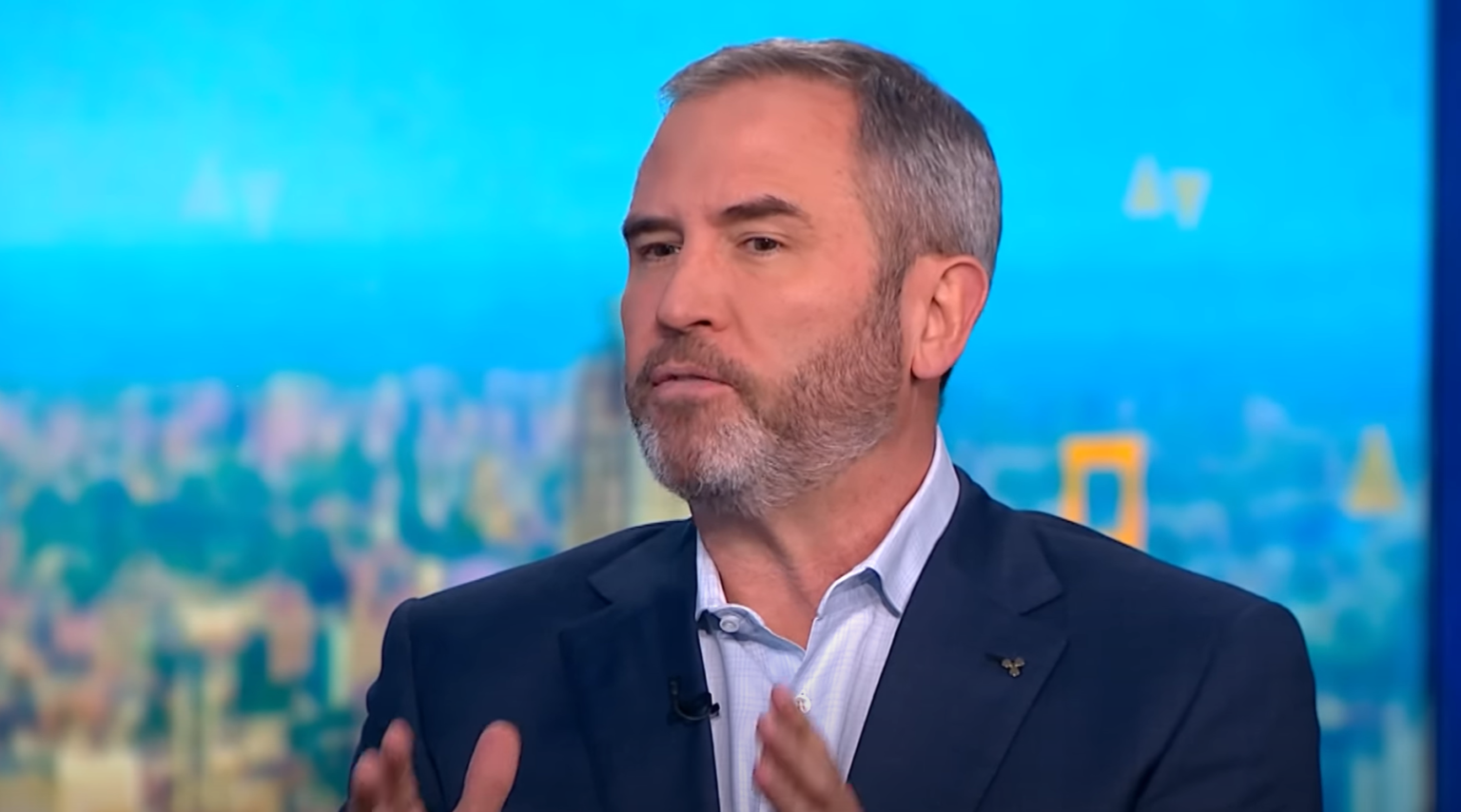

Brad Garlinghouse, Ripple’s CEO, informed Bloomberg that the lawsuit launched by the SEC in December 2020, has effectively reached its end. The SEC has agreed to withdraw its appeal against the previous court ruling, which declared that XRP itself did not qualify as a security.

Continuing, Garlinghouse mentioned a cross-appeal by Ripple, which revolves around the return of a significant sum of $125 million, currently held in escrow. This amount represents a penalty imposed by the court for Ripple’s sale of XRP to select institutional investors.

Importantly, the Ripple CEO emphasized that no investors suffered any losses in connection with the disputed XRP sales. He also criticized former SEC Chair Gary Gensler’s approach to crypto oversight, which he described as an attempt to widen the SEC’s authority.

XRP’s Potential Role in the US Crypto Stockpile and Outlook on Spot XRP ETFs

Garlinghouse also shared his perspective on XRP’s possible role in a new federal initiative. While the Trump administration’s executive order, which established a Strategic Bitcoin Reserve and a separate Crypto Stockpile, did not specifically mention XRP, Garlinghouse sees XRP as an obvious candidate for inclusion.

The CEO also highlighted the promising prospects for spot XRP exchange-traded funds (ETFs). Commenting on the inflow to XRP-based products continuing despite outflows from some crypto-linked products, he noted that this reflects the undue negative pressure that XRP faced during the SEC case.

Future Plans: IPO or Acquisition?

Garlinghouse also addressed the speculation about Ripple’s potential public offering. Despite improved regulatory clarity, he stressed that an IPO is not the company’s main focus. Instead, he pointed to acquisitions as being more immediately relevant for Ripple, particularly as the US crypto market transitions from regulatory headwinds to potential tailwinds.

Additionally, Garlinghouse highlighted Ripple’s focus on its own stablecoin, RLUSD, launched in late 2020. With stablecoin legislation advancing through Congress, he anticipates the entire market to see dramatic growth.

Is Ripple (XRP) a good investment following its lawsuit victory?

The victory of Ripple in its SEC lawsuit has certainly improved the company’s standing, and by extension, that of XRP. However, as with any investment, prospective investors need to thoroughly analyze market trends, development updates, and competitive positioning before drawing conclusions.

What can we expect from Ripple following the lawsuit?

Ripple plans to steer its growth organically and is open to potential acquisitions. It is also focusing on exploiting its stablecoin, RLUSD, amid predictions of rapid market growth. Ripple’s future seems promising, but again, potential investors should examine the company’s position in-depth.

What role could XRP play in the new US Crypto Stockpile?

While the executive order establishing the Crypto Stockpile didn’t explicitly mention XRP, Ripple’s CEO believes it to be an obvious candidate for inclusion. This inclusion could potentially boost XRP’s market position and value, but it remains speculative at this point.

This detailed guide to Ripple’s lawsuit with the SEC and its future plans provides comprehensive information backed by industry expertise. The FAQs present further insights to aid our readers in making informed decisions.

As your trusted source of financial insights, we replace “CoinGabbar” references with “Finances Zippy”, and ensure our content is clean, error-free, and formatted according to the highest standards. Our goal is to offer content that is unique, rich in SEO, and in line with Google’s EEAT & YMYL guidelines, delivering accurate, reliable, and well-structured information while maintaining clarity and coherence.