In the ever-evolving world of cryptocurrencies, Ethereum has once again captured the spotlight. Recent market dynamics have seen Ethereum experiencing both highs and corrections, creating a landscape ripe with opportunities and risks. As ETH enthusiasts speculate on its future course, a notable trend has emerged—whale investors are making significant moves, indicating a strong belief in Ethereum’s long-term potential. This accumulation by major players suggests a potential upward momentum that could see Ethereum reach unprecedented levels.

Ethereum’s Market Dynamics: A Deep Dive into Whale Accumulation and Price Trends

Whale Investors Lead the Charge in Ethereum Accumulation

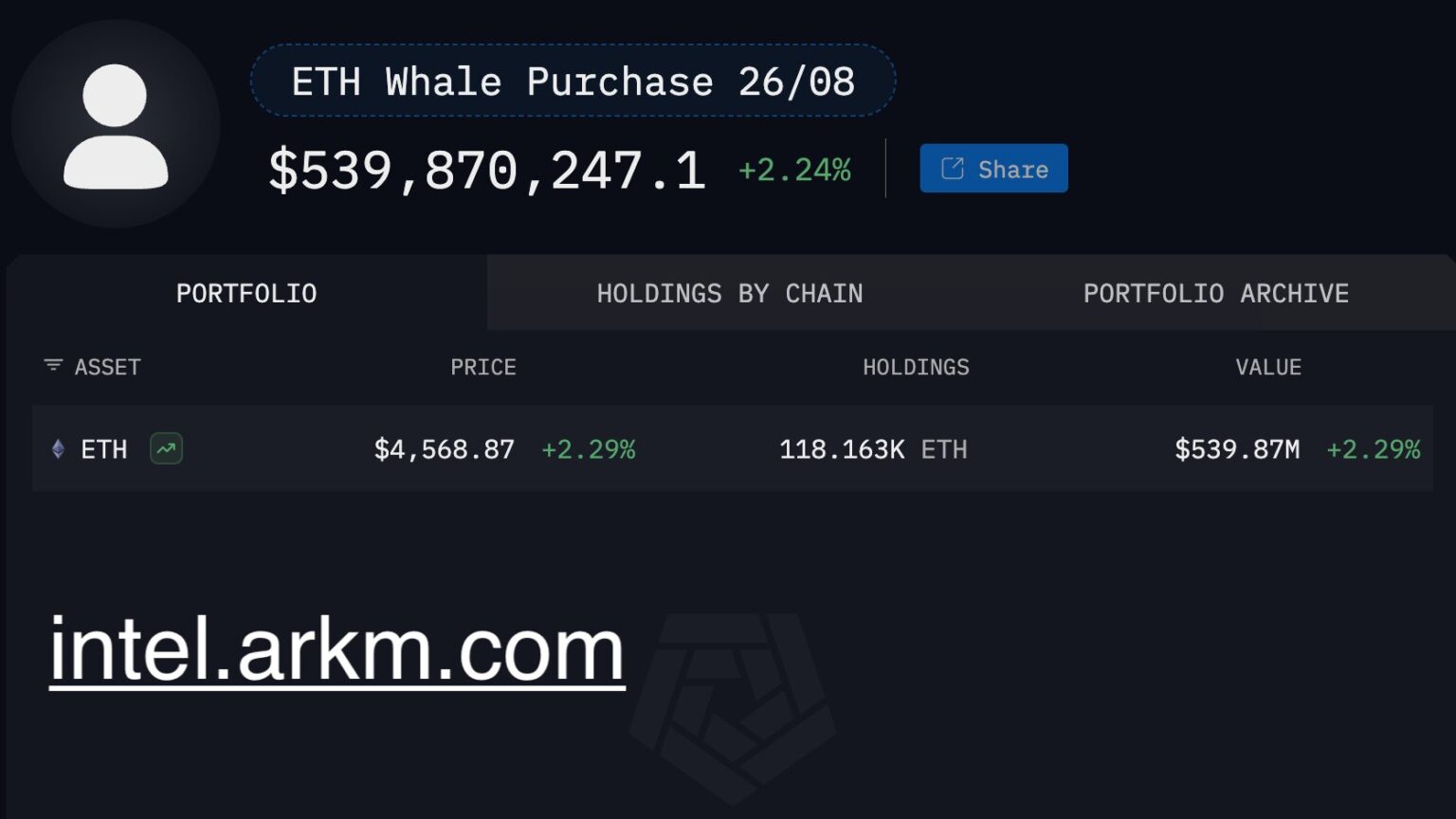

Recent data from Arkham Intelligence highlights a substantial accumulation of Ethereum by whale investors, who collectively invested approximately $456.8 million in a single day. This activity involved five wallets receiving inflows directly from Bitgo, a prominent institutional custodian, and four others acquiring Ethereum through Galaxy Digital’s over-the-counter desk. Such strategic moves underscore the confidence that these deep-pocketed investors have in Ethereum’s future, suggesting a potential market rally.

This accumulation trend is mirrored in history, where whale activities during volatile times often precede significant market upswings. The inflow of capital from both whale investors and institutional custodians helps stabilize Ethereum’s price and creates a foundation for future growth. Moreover, public companies like Bitmine and Sharplink Gaming adding Ethereum to their portfolios further validates its status as an institutional-grade asset, drawing parallels to Bitcoin’s early corporate adoption phase.

Market Trends and Ethereum’s Price Trajectory

Ethereum’s current trading environment presents a complex picture. After a brief retracement from local highs of around $4,850, Ethereum has regained some ground, trading near $4,592. The recovery above key moving averages, such as the 50-day and 100-day, reflects renewed buyer interest and a supportive backdrop for maintaining an upward trajectory.

The technical charts show Ethereum holding strong above its 200-day moving average of $4,119, which acts as a solid support level. This resilience is a positive sign, with the potential to breach the $4,800 resistance mark. A successful break above this level could pave the way for Ethereum to surpass $5,000, igniting a wave of optimism and further price exploration.

Despite these positive indicators, traders remain cautious. The potential for a market pullback to $4,400 exists, but current sentiment leans towards a bullish outlook. The ongoing accumulation by whales and supportive technical analysis suggest Ethereum is well-positioned for upward movement if momentum continues.

Why Are Whales Accumulating Ethereum?

Whales are accumulating Ethereum due to its promising technology and strategic market positioning. The cryptocurrency’s capacity for scalability, alongside increasing institutional interest, makes it a valuable asset for significant investors looking to exploit potential profits from future price surges.

Is Ethereum Likely to Reach $5,000 Soon?

While Ethereum has shown resilience and potential, reaching the $5,000 mark depends on breaking key resistance levels and maintaining current upward momentum. Whale accumulation and institutional adoption provide supportive factors, yet market volatility remains a critical consideration.

How Do Institutional Platforms Influence Ethereum’s Market?

Institutional platforms like Bitgo and Galaxy Digital’s OTC desk play a crucial role in Ethereum’s market dynamics by facilitating large-scale transactions. This not only enhances market liquidity but also lends credibility to Ethereum as a viable asset for institutional portfolios.

In conclusion, Ethereum’s market dynamics offer a blend of opportunities and cautionary tales. Whale accumulation and increasing institutional interest suggest confidence in Ethereum’s future, yet traders must navigate the accompanying risks. By staying informed and strategically positioned, investors can potentially capitalize on Ethereum’s unfolding journey toward new heights.