In a rapidly evolving financial landscape, digital currencies have emerged as a pivotal asset class, capturing the attention of investors worldwide. The surge in Bitcoin’s popularity is reshaping traditional notions of value and investment, with influential figures advocating its potential as a modern-day financial instrument. Understanding the dynamics driving this shift is crucial for investors aiming to navigate the complexities of the cryptocurrency market successfully.

Bitcoin: A Modern Financial Asset

The increasing interest in Bitcoin, often referred to as “digital gold,” highlights its potential as a superior store of value compared to traditional assets. Unlike the illiquidity often associated with high-value real estate, Bitcoin offers unparalleled portability and ease of transfer, making it an attractive option for those seeking efficient value exchange.

Bitcoin’s Growing Appeal Among Investors

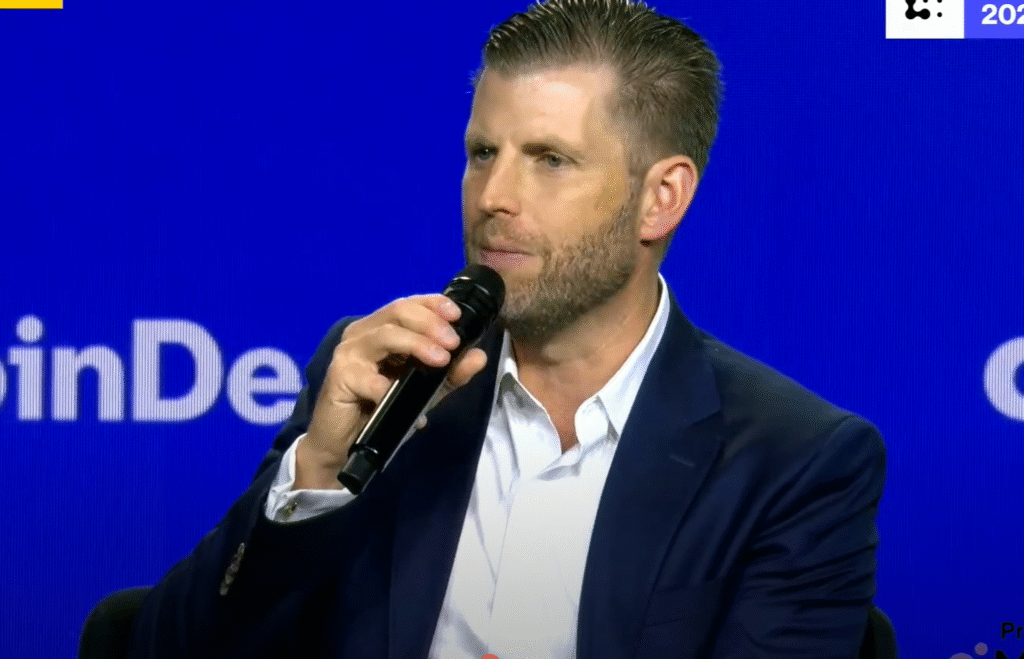

Prominent industry leaders have pointed out the accelerating interest in Bitcoin among diverse investor groups. The adoption rate is rising notably among sovereign wealth funds, affluent families, and major corporations, all recognizing Bitcoin’s transformative potential. This trend was underscored by Eric Trump during his presentation at Consensus 2025, where he announced a new mining venture poised to leverage Bitcoin’s advantages in the public markets.

The Competitive Edge of American Bitcoin

Eric Trump, serving as the Chief Strategy Officer for American Bitcoin, elucidated the benefits of Bitcoin during his speech. He highlighted the ease of managing Bitcoin compared to traditional real estate, sharing personal experiences of the cumbersome processes involved in property transactions. Trump’s vision for American Bitcoin emphasizes leveraging low-cost energy sources to maximize mining profitability.

Strategic Market Moves and Investor Response

The strategic merger between Hut 8 and Gryphon Digital Mining exemplifies the dynamic shifts within the Bitcoin mining sector. This merger, driven by a sense of urgency, aims to capitalize on Bitcoin’s growing market position. The rapid response from investors, evidenced by the substantial pre-market trading increases, underscores the market’s confidence in these strategic initiatives.

The Role of Sovereign Wealth Funds in Bitcoin Accumulation

Sovereign wealth funds have become significant players in Bitcoin accumulation, reshaping the cryptocurrency’s market dynamics. Notable investments, such as Mubadala’s substantial holdings in BlackRock’s spot BTC ETF, signal a broader acceptance of Bitcoin as a viable asset for institutional portfolios. This development is indicative of a broader trend where traditional financial entities are integrating digital assets into their strategies.

The Political and Economic Context

Eric Trump also addressed the political influences motivating his involvement in the cryptocurrency space. He emphasized Bitcoin’s resilience as a liquid, censorship-resistant asset, positioning it as a countermeasure to challenges faced by conventional assets. Despite the political undertones, Trump’s focus remained on Bitcoin’s potential as a transformative financial tool.

FAQs

Is Bitcoin truly considered ‘digital gold’?

Bitcoin is often referred to as ‘digital gold’ due to its limited supply and perceived value retention capabilities. Like gold, it is seen as a hedge against inflation and economic uncertainty, attracting investors seeking stable assets in volatile markets.

What are the key benefits of investing in Bitcoin?

Investing in Bitcoin offers several advantages, including decentralization, global accessibility, and the potential for significant returns. Its status as a non-correlated asset makes it appealing for portfolio diversification, especially in times of economic instability.

How do institutional investments affect Bitcoin’s market dynamics?

The influx of institutional investments into Bitcoin significantly influences its market behavior, often leading to increased price stability and liquidity. As more institutions include Bitcoin in their portfolios, it strengthens the asset’s credibility and drives broader adoption.

In this comprehensive exploration of Bitcoin, we’ve delved into its technological foundations, market potential, and strategic positioning. By addressing key questions, we aim to empower investors with the knowledge needed to make informed decisions in this dynamic financial landscape.