The cryptocurrency landscape is a rapidly evolving arena where tokens rise and fall in value with astounding speed. This volatility presents both opportunities and challenges for investors looking to maximize their portfolios. Among the recent remarkable surges, Hyperliquid (HYPE) has caught the attention of market watchers with its significant price rally. As a token known for its intriguing liquidity solutions, understanding the reasons behind its sudden price increase can offer valuable insights into navigating the ever-fluctuating crypto market. In this guide, we delve into the factors fueling HYPE’s rise, providing a comprehensive analysis of its market behavior.

Understanding the Recent Surge in Hyperliquid (HYPE)

### Analysis of HYPE’s Price Rally

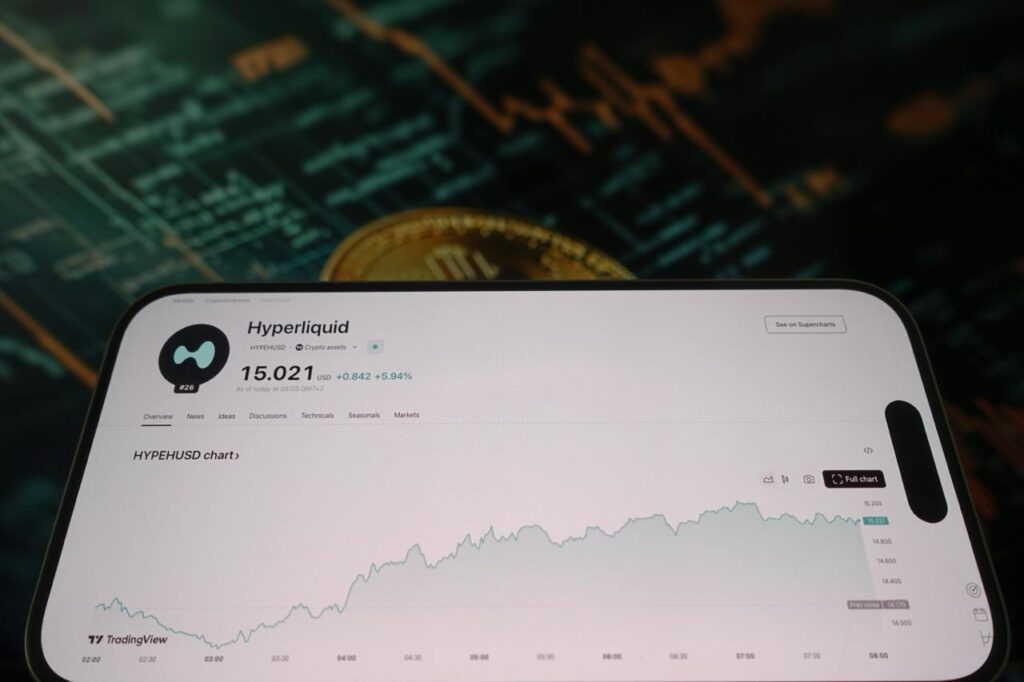

Over the past 24 hours, Hyperliquid (HYPE) experienced a notable price increase of 8%, climbing from $34.87 to a peak of $39.06. This rise highlights HYPE’s potential within the crypto world, bolstered by the circulation of approximately 336.7 million tokens, leading the market cap to soar to $13.1 billion. This surge comes alongside an uptick in daily trading volume, which rose by more than 15% to surpass $691.2 million as per Finances Zippy data. Concurrently, Bitcoin (BTC) and Ethereum (ETH) also experienced modest gains, hinting at broader market movements.

### Factors Driving the HYPE Price Increase

The rally in HYPE’s price appears tightly linked to strategic corporate endeavors aimed at expanding the Hyperliquid ecosystem. A pivotal development occurred on October 22 when Hyperliquid Strategies Inc. (HSI), a merger-stage entity, filed an S-1 registration statement with the U.S. Securities and Exchange Commission (SEC). This filing detailed plans to accumulate $1 billion by issuing up to 160 million shares of common stock.

Adding to this momentum, HSI, arising from a merger between Nasdaq-listed Sonnet BioTherapeutics and special purpose acquisition company Rorschach I LLC, aims to establish a treasury of digital assets comprising approximately $583 million in HYPE tokens. The planned $1 billion fund dedicated to purchasing additional HYPE tokens underscores the strategic backing set to propel the token’s growth.

### Technical Analysis of HYPE

Despite the recent upswing, HYPE’s trajectory is not without challenges. The token’s 50-day simple moving average (SMA) stands at $46.31, with the 100-day SMA slightly lower at $44.95, both suggesting a bearish trend compared to current price levels. The relative strength index (RSI) at 45.51 signals weakening momentum, though it remains above oversold conditions. Post-sell-off volume spikes have diminished, indicating a potential tapering of panic selling. However, the lack of strong buyer reentry implies cautious optimism.

The Moving Average Convergence Divergence (MACD) histogram reveals narrowing negative bars, pointing to a deceleration in bearish momentum. As HYPE continues to trade below the 50 SMA, any upward movements may face robust resistance, likely seen as corrective rallies within a prevailing downtrend.

### FAQs

What is Hyperliquid (HYPE)?

Hyperliquid (HYPE) is a cryptocurrency known for its innovative liquidity solutions within decentralized finance (DeFi) ecosystems. It aims to enhance transaction efficiency and provide liquidity support across various platforms.

What factors contribute to HYPE’s price volatility?

HYPE’s volatility generally stems from macroeconomic developments, strategic corporate movements, regulatory news, and broader trends in the cryptocurrency market. Traders and investors should consider these dynamics when engaging with HYPE.

Is Hyperliquid a risky investment?

Like most cryptocurrencies, Hyperliquid involves a degree of risk due to its price fluctuations and market dynamics. Potential investors should conduct comprehensive research, consider their risk tolerance, and possibly engage with financial advisors for tailored advice.

This extensive review of Hyperliquid provides a holistic view of its technological framework, investment potential, and current market position. The FAQ section further assists readers in making informed choices regarding their cryptocurrency investments.