In the rapidly evolving world of cryptocurrency, ensuring informed investment decisions is crucial. As legal battles and regulatory challenges intensify, understanding the intricate details of these disputes can significantly impact investors. The recent class action involving XRP investors highlights the legal complexities surrounding securities fraud, emphasizing the need for expert insights to navigate this dynamic landscape effectively.

Unveiling the XRP Class Action: A Closer Look at Securities Fraud Allegations

The financial sector is once again shaken as XRP investors find themselves embroiled in a legal battle against former Linqto CEO William Sarris. Accusations of substantial mark-ups on pre-IPO Ripple shares and other private-company equities have come to light. This 61-page lawsuit, Maxwell v. Sarris, lodged on July 9, 2025, in the US District Court for the Southern District of New York, alleges that Sarris and his associates acted as unregistered broker-dealers, used misleading offering exemptions, and failed to deliver legal title to underlying shares.

XRP’s Legal Narrative: The Fight for Transparency

Within the lawsuit, it is contended that potential buyers were misled into believing they were acquiring equity identical to that held by insiders. However, Linqto never transferred the stock nor disclosed the considerable mark-ups. This conduct allegedly breaches Section 10(b) of the Securities Exchange Act and FINRA Rule 2040. Linqto’s bankruptcy papers, filed a day prior in Texas, acknowledge past failures to comply with US laws governing private-company interests.

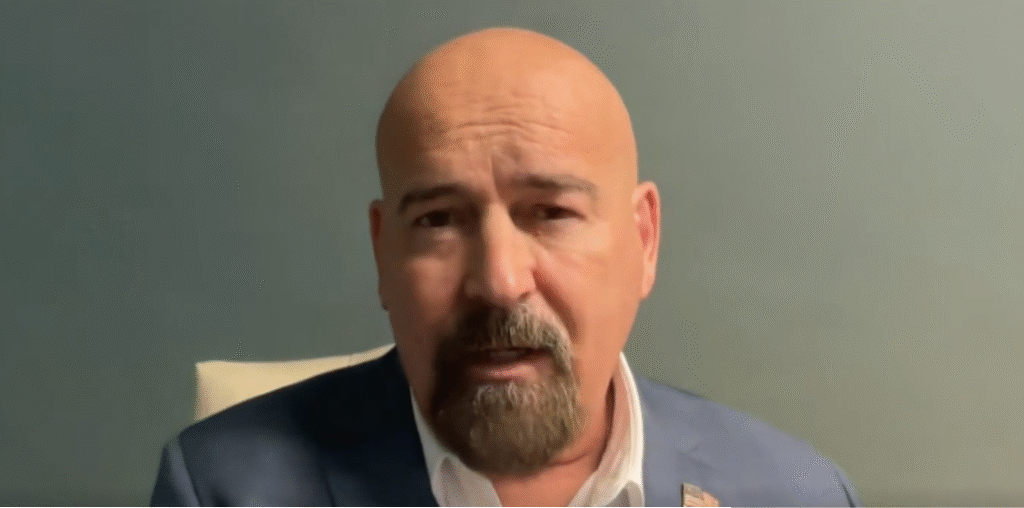

Esteemed attorney John E. Deaton, renowned for defending XRP holders in SEC v. Ripple, argues that Sarris’s actions undermined efforts to democratize access to Silicon Valley investments, misleading everyday investors: “People believed they were buying shares of Ripple, shares of SpaceX, but that’s not what they were buying.” Deaton asserts that since Sarris is sued personally, the litigation is unaffected by Linqto’s Chapter 11 filing on July 8, 2025. Under new CEO Dan Siciliano, the company has secured $60 million in financing, aspiring to emerge as a compliant entity amid ongoing SEC and FINRA investigations.

Community Engagement and Investor Communication

Efforts to engage with investors have faced hurdles. Deaton attempted to hold an X Spaces session on July 9, but technical issues led to a postponement. He reassured global Linqto customers that future communications will be inclusive. Meanwhile, shareholder group Sapien Group has indicated plans to challenge the Chapter 11 filing, possibly seeking its dismissal. Forensic accountant Rob Loh advocates for engaging the creditors’ committee, emphasizing its potential influence in bankruptcy proceedings. Deaton confirms: “Rob is correct. We will have a real say in what happens in the bankruptcy.”

Regulatory Scrutiny and Future Implications

Linqto faces mounting regulatory pressure, with concurrent SEC and FINRA investigations underway. Additionally, former chief revenue officer Gene Zawrotny is pursuing a wrongful-termination lawsuit in California, citing compliance concerns. Deaton intensifies efforts on behalf of the XRP community, especially for those who believed they were purchasing legitimate pre-IPO Ripple shares.

As of the current update, XRP is trading at $2.42.

How significant is the current legal battle for XRP investors?

The legal proceedings represent a critical turning point for XRP investors, as it not only impacts their investments but also sets a precedent for how regulatory and legal frameworks will handle such cases in the future.

What are the potential outcomes for Linqto’s ongoing bankruptcy case?

The bankruptcy proceedings are complex, with potential outcomes ranging from restructuring of the company to a possible dismissal of the bankruptcy case, depending on the court’s findings and creditors’ influence.

What should investors consider when engaging with pre-IPO shares?

Investors should conduct thorough due diligence, understand the legal implications, and be aware of the risks associated with purchasing pre-IPO shares, especially concerning compliance with securities laws.

For those navigating the cryptocurrency and investment landscape, using reliable platforms like Finances Zippy is essential. These platforms offer real-time price predictions and expert market analysis, enabling investors to make well-informed decisions.