In the realm of cryptocurrency litigation, unexpected twists can often surface, challenging the path to resolution. Such is the case with Ripple’s ongoing legal battle. Despite what seemed to be a streamlined settlement path with the U.S. Securities and Exchange Commission (SEC) regarding XRP, a recent judicial decision has introduced unforeseen complexities. This development not only alters the timeline but also sheds light on the intricate legal procedures involved in cryptocurrency regulation. Let’s delve into the latest updates surrounding Ripple’s legal hurdles and what they mean for the future of XRP.

Ripple’s Legal Challenges: Analyzing the Latest Developments in the XRP Lawsuit

Understanding the Recent Setback in XRP’s Legal Proceedings

In an unexpected twist, Ripple’s expected resolution with the SEC faced a setback when Judge Analisa Torres refused to approve a joint motion aimed at lifting the ban on Ripple’s institutional XRP sales and reducing the civil penalty from $150 million to $50 million. This decision hinges on the requirement set by the Federal Rule of Civil Procedure 60, which mandates “exceptional circumstances” for such a settlement adjustment.

Examining the Court’s Rationale

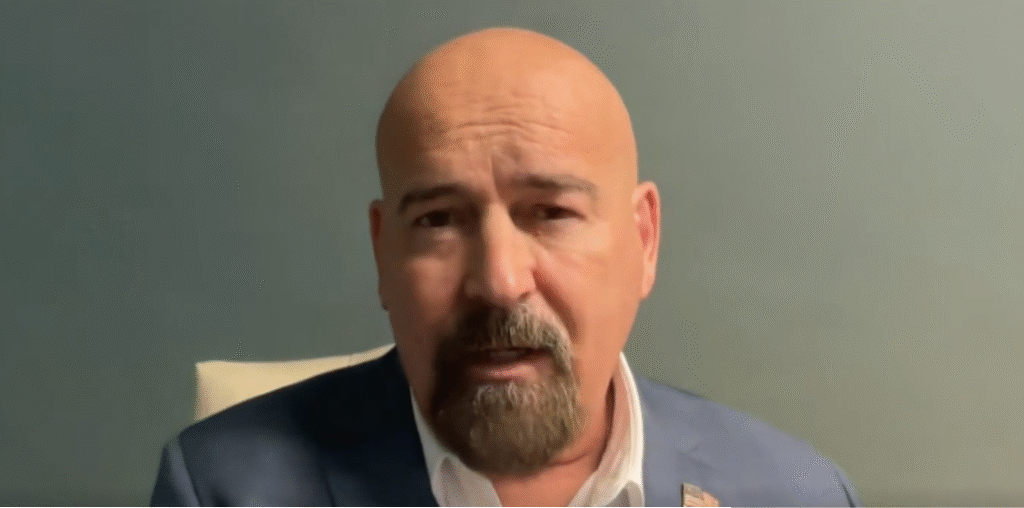

Attorney John E. Deaton provided insights into the court’s stance, highlighting that the motion failed to address the significant burden required to alter the injunction and civil penalty. This indicates the court’s insistence on a rigorously justified and public-interest-focused argument, rather than a mere agreement between the two parties.

The Implications for Ripple’s Legal Strategy

Judge Torres’s recent decision signifies a critical juncture in Ripple’s legal journey. The refusal to approve the joint motion without a compelling Rule 60 submission means that Ripple and the SEC must revisit their arguments, ensuring they convincingly demonstrate that their proposed settlement aligns with the broader public interest and regulatory standards.

The Financial and Strategic Impact

Deaton’s analysis suggests that this development does not undermine Ripple’s previous victories, such as the favorable ruling on secondary-market XRP trading. However, it does emphasize the need for a reassessment of Ripple’s legal and financial strategies in response to the court’s expectations and the evolving regulatory landscape.

What Lies Ahead for XRP and the Crypto Market?

This procedural twist points to a prolonged timeline for obtaining a final resolution. Both Ripple and the SEC are tasked with preparing a more robust legal argument that aligns with judicial expectations and contemporary digital asset regulatory frameworks. As Congress considers new crypto legislation, the outcome of this lawsuit could influence broader regulatory practices for digital assets.

Understanding the Public Interest Criterion

The core of the court’s directive is to substantiate that the removal of the injunction will not adversely affect investors or the market. This aspect requires Ripple and the SEC to convincingly argue that their settlement proposal meets regulatory criteria and adheres to public interest considerations.

Is Ripple Prepared for the Ongoing Legal Battle?

While the legal proceedings may seem daunting, industry experts like Deaton remain cautiously optimistic about Ripple’s eventual success in resolving the lawsuit. Nevertheless, achieving a comprehensive settlement will demand strategic maneuvering and diligent compliance with legal prerequisites set by the court.

The Potential Impact on XRP’s Market Position

Amidst these legal intricacies, XRP’s market value may experience fluctuations, influenced by the uncertainty surrounding the lawsuit’s resolution timeline. Investors should remain informed about the legal proceedings and regulatory developments that may impact XRP’s future market standing.

FAQs on Ripple and the XRP Lawsuit

What are the main challenges Ripple faces in the current lawsuit?

Ripple’s primary challenge lies in meeting the court’s requirements to justify the modification of legal injunctions and penalties. The company must convincingly align its settlement proposal with the public interest to secure judicial approval.

How does this legal hurdle affect XRP’s market outlook?

Legal uncertainties can lead to market volatility. While XRP’s secondary-market trading remains unaffected, potential delays in the lawsuit’s resolution could influence investor sentiment and XRP’s valuation.

What are the next steps for Ripple and the SEC?

Both parties must reframe their legal arguments to meet the court’s stringent criteria for public-interest compliance. This involves preparing a detailed Rule 60 submission that addresses the court’s expectations and regulatory standards.

As Ripple navigates these legal complexities, the cryptocurrency community keenly observes the unfolding developments, aware of their potential to shape the future of digital asset regulation.