In the dynamic realm of cryptocurrencies, strategic investments can significantly influence market trends and token valuations. A recent example of this is the substantial investment in EOS, a cryptocurrency that experienced a notable surge following an endorsement from a high-profile entity. This article delves into the factors propelling EOS’s rise, analyzes the long-term potential of such investments, and provides essential insights for investors.

Understanding EOS’s Recent Surge and Investment Implications

The Influence of Strategic Investments on EOS

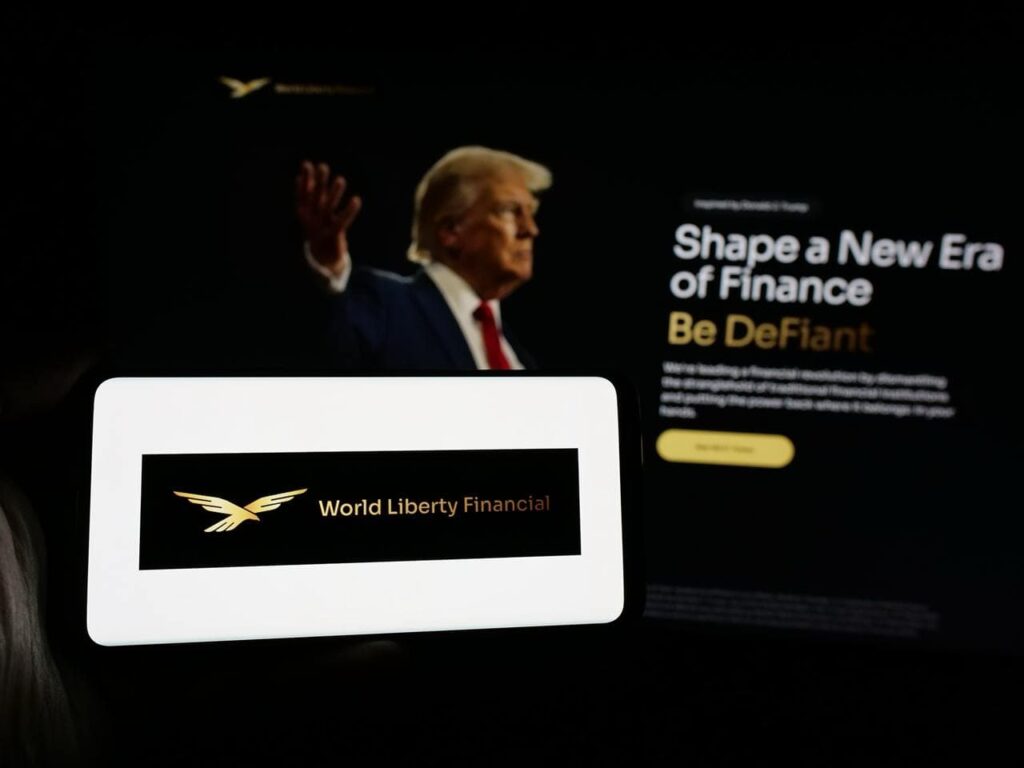

On May 16th, EOS witnessed a remarkable increase in its market value, most notably because World Liberty Financial, a firm associated with President Trump’s endorsement, invested $3 million into the token. This move sparked considerable interest, driving EOS’s price from $0.77 on Thursday morning to a peak of $0.86 by Friday. The purchase, executed during the night between Thursday and Friday, involved 2.996 million USDT, translating to 3.636 million EOS at an average price of $0.824, as per on-chain data.

This strategic injection not only boosted EOS’s value temporarily but also broke through its previous resistance levels, encouraging optimism among investors. Despite a slight correction, EOS maintained a value of $0.85 by the end of this trading day, marking a 9.39% rally over a 24-hour period.

The Market Context: EOS Against Broader Trends

The broader cryptocurrency market was in a phase of consolidation, targeting a valuation of $3.27 trillion after experiencing a minor correction from $3.34 trillion. Amid this consolidation, EOS’s leap was significant, reflecting the positive sentiment instigated by the investment. However, for a sustained upward trajectory, it’s crucial that EOS not only surpass its previous resistance levels near $0.84 but also consolidate these gains by converting resistance into support.

Why Investors Should Exercise Caution

Although EOS’s recent surge is promising, investors must remain vigilant. The token’s price increase seems primarily driven by the strategic purchase, and without a broader market resurgence, these gains could be short-lived. If EOS can stabilize above the resistance-turned-support level, the potential for reaching the $1 mark grows significantly. Nonetheless, careful analysis of market trends and potential volatility is advised.

WLFI’s Investment in EOS Amid Rebranding

The timing of this investment is noteworthy as EOS is currently rebranding to form a Web3 Banking network named Vaulta. This transformation, occurring at a 1:1 token swap ratio, began on May 14 and is backed by entities like Crypto.com. In March, Crypto.com established a robust partnership with Trump Media & Technology Group, further intertwining the cryptocurrency with high-profile endorsements and developments.

How will the rebranding to Vaulta impact EOS’s market positioning?

The rebranding to Vaulta signifies a strategic shift towards enhancing EOS’s technological framework and market appeal. This transition could attract new investors and partnerships, potentially strengthening its market position and investor confidence.

Is EOS a viable investment for risk-averse investors?

While EOS exhibits growth potential, it remains vulnerable to market fluctuations. Risk-averse investors should conduct thorough due diligence, considering both short-term market conditions and long-term strategic developments before making investment decisions.

What factors should investors consider when evaluating EOS’s future performance?

Investors should analyze EOS’s technological advancements, market trends, and partnerships, along with macroeconomic factors affecting cryptocurrency markets. Keeping abreast of rebranding efforts and key endorsements may also provide insights into its potential growth trajectory.

This comprehensive guide to EOS not only highlights its recent market behavior but also emphasizes critical considerations for potential investors. With a robust understanding of the factors influencing EOS, readers are better equipped to navigate the complexities of cryptocurrency investments.