In the ever-evolving landscape of cryptocurrency, keeping abreast of potential investment opportunities is crucial for anyone looking to maximize their portfolio. One such opportunity lies with Cardano (ADA), a blockchain platform that is not only drawing attention for its technological advancements but also for its potential integration into Bitcoin’s DeFi ecosystem. This unique positioning provides ADA with the potential to become a high-yield investment, transcending its current role in the market.

Cardano’s Ambitious Future: Potential Integration with Bitcoin’s DeFi Ecosystem

Understanding Cardano’s Distinctive Edge

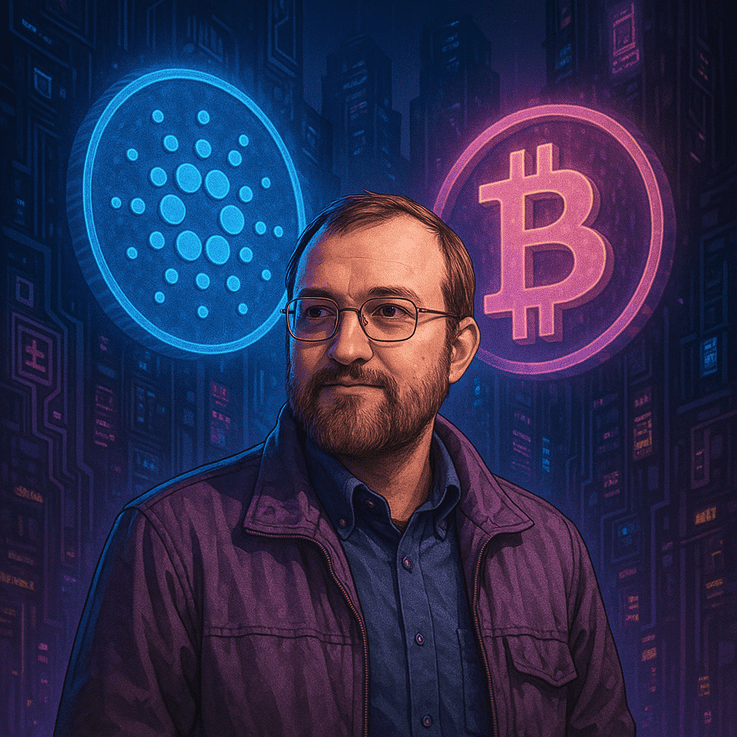

Cardano, conceived by Charles Hoskinson, is crafted to offer solutions that extend beyond Bitcoin’s primary function as a store of value. Unlike Bitcoin, Cardano introduces a plethora of utilities, including staking rewards and ecosystem token incentives. These features make ADA a prominent candidate for the yield-generating layer within Bitcoin’s DeFi ecosystem. Hoskinson’s vision suggests a meteoric rise for ADA, projecting it could surge between $80 and $800.

ADA Versus Bitcoin: Performance and Potential

Historically, Cardano has experienced phases of remarkable performance. Notably, in late 2024, ADA outperformed Bitcoin by 160%, although it later fell behind. This pattern began to shift in June when ADA surged by an impressive 30% over BTC. Despite these fluctuations, ADA’s long-term outlook reveals that it remains 88% down against Bitcoin since 2021.

Market sentiments toward Cardano are mixed, with short-term metrics like the spot taker CVD indicating increased selling pressure. Yet, the rise in ADA’s realized cap from $23.4 billion to $23.6 billion suggests growing investor confidence amidst market volatility.

Can ADA’s Integration With Bitcoin’s DeFi Ecosystem Elevate Its Market Position?

The potential integration of ADA as a yield layer within Bitcoin’s DeFi ecosystem stands to reshape Cardano’s market trajectory significantly. Currently, Bitcoin lacks the robust DeFi capabilities inherent to platforms like Cardano and Ethereum. If ADA becomes the pivotal link between Bitcoin and decentralized finance, it could witness enhanced adoption, elevated transaction volumes, and increased long-term demand.

However, this ambitious undertaking depends heavily on developing cross-chain infrastructure, securing developer support, and navigating regulatory frameworks. A successful integration would not only reinforce ADA’s standing as a utility-rich asset but also enhance its functionality and return prospects, potentially outpacing Bitcoin in these spheres.

Editorial Integrity and Standards

Our editorial commitment ensures the delivery of meticulously researched, accurate, and unbiased content. Our team of technology experts and editors rigorously reviews all content, maintaining strict sourcing standards and providing valuable insights to our readers.

Is Cardano (ADA) poised to become a key player in DeFi?

Cardano is strategically positioned to capitalize on Bitcoin’s DeFi gap. Its robust ecosystem, staking rewards, and potential integration with Bitcoin could elevate its status as a seminal figure in decentralized finance. However, this will require significant infrastructure development and regulatory navigation.

What distinguishes Cardano from other blockchain platforms?

Cardano’s distinguishing factors include its unique layered architecture, focus on sustainability and interoperability, and a rigorous academic research-driven approach. These elements enable Cardano to offer superior scalability and security, setting it apart from other blockchain networks.

How does Cardano plan to integrate into Bitcoin’s DeFi space?

The integration plan focuses on developing interoperable solutions that allow ADA to function as a yield-generating layer within Bitcoin’s ecosystem. This involves creating cross-chain bridges and leveraging Cardano’s technical capabilities to enhance Bitcoin’s DeFi offerings.

By exploring Cardano’s innovative strategies and potential market expansions, this comprehensive guide seeks to equip readers with the necessary insights to make informed investment decisions within the cryptocurrency arena.