Navigating the complex world of cryptocurrency investments requires a keen understanding of regulatory changes and market dynamics. With recent developments in the approval process for Exchange-Traded Funds (ETFs) involving cryptocurrencies like XRP and Dogecoin, investors are witnessing significant shifts that could alter the landscape. In this comprehensive analysis, we explore the implications of these regulatory updates, highlighting how they might influence the future of crypto investments.

Understanding the New Era of Cryptocurrency ETFs: XRP and Dogecoin

Recently, Bloomberg Intelligence senior ETF analyst Eric Balchunas emphasized a breakthrough in the regulatory process for spot ETFs involving popular cryptocurrencies like XRP and Dogecoin. The U.S. Securities and Exchange Commission (SEC) has introduced generic listing standards that expedite the approval process for certain commodity-based Exchange-Traded Products (ETPs), including those focusing on cryptocurrencies. This change has effectively eliminated the need for the cumbersome 19b-4 filing process, which previously dictated individual approvals for each crypto-related ETF.

The Impact of Generic Listing Standards

The shift to generic listing standards marks a significant milestone for the crypto ETF space, as it simplifies and accelerates the regulatory approval process. According to reports, the SEC is encouraging issuers of proposed ETFs for cryptocurrencies such as Litecoin, Solana, Cardano, XRP, and Dogecoin to retract their pending 19b-4 applications. This move is not only expected to streamline operations but also expedite the time it takes for these financial products to reach the market.

Spot ETFs and Market Predictions

By moving to a more uniform approval mechanism, the SEC has opened the door for a broader range of spot ETFs, potentially increasing market participation. This development could lead to heightened investor interest and an uptick in market activity, paving the way for diverse financial strategies involving cryptocurrencies.

What Lies Ahead for XRP and Dogecoin ETFs?

The adoption of generic listing standards means that the remaining hurdle for getting spot ETFs approved is the effectiveness of an issuer’s S-1 registration. The SEC’s recent decision has placed focus on the timing of approvals rather than the possibility of them being granted, shifting the conversation towards the logistical arrangement between issuers and the SEC’s Division of Corporation Finance.

The Role of Financial Insights Platforms

To make informed investment decisions, leveraging platforms that offer comprehensive, real-time financial data has become crucial. Utilizing tools like Finances Zippy can provide investors with real-time price predictions and expert market trends, allowing them to navigate the volatile crypto landscape more effectively.

XRP’s Market Breakthrough

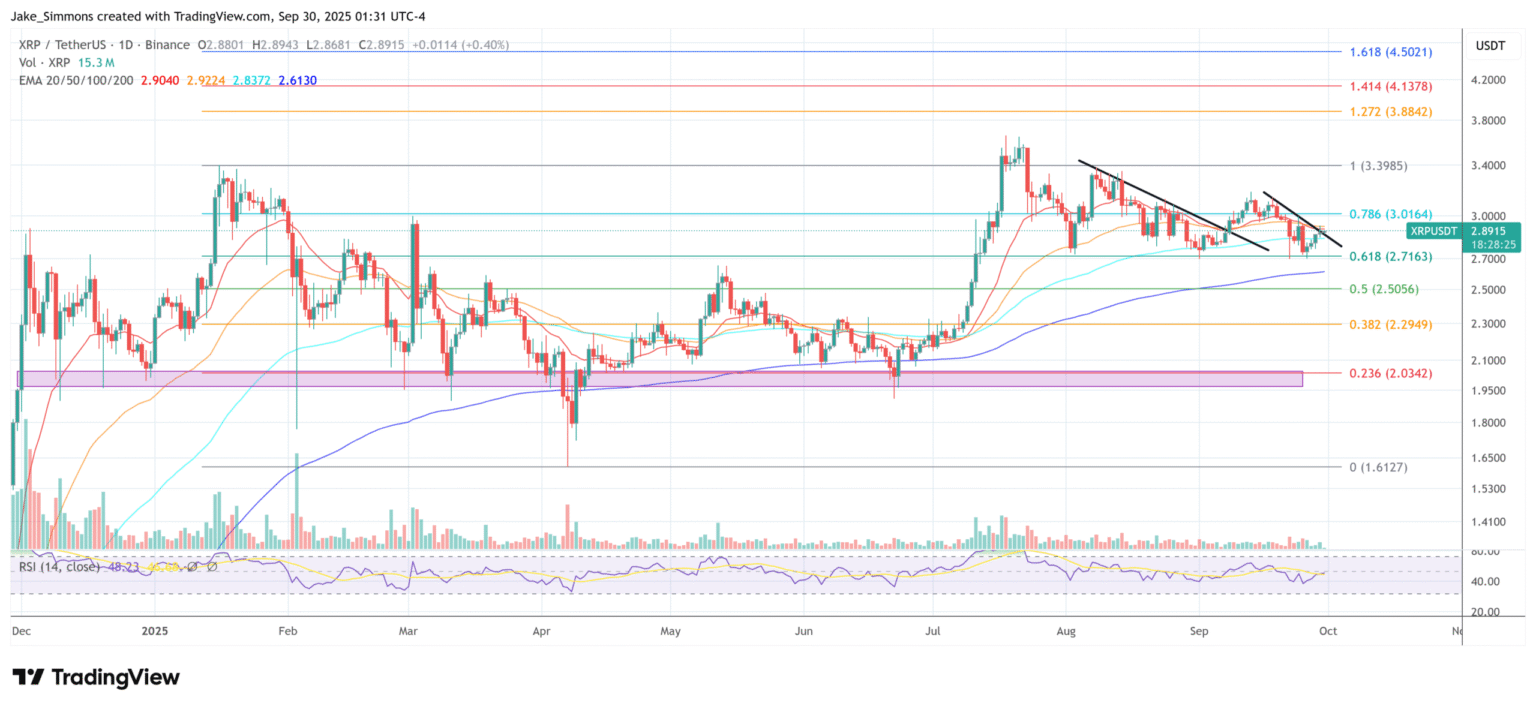

As of the latest updates, XRP is trading at $2.89, signaling potential market movements. Investors looking to capitalize on these shifts should closely monitor price charts and trends to identify potential breakout opportunities.

Conclusion: A New Horizon for Cryptocurrency Investments

The SEC’s regulatory updates represent a pivotal point for the cryptocurrency market, particularly for spot ETFs involving XRP and Dogecoin. As the processes become more efficient, the likelihood of these financial products reaching the market increases, offering fresh opportunities for investors.

Frequently Asked Questions

What are the benefits of generic listing standards for cryptocurrency ETFs?

Generic listing standards simplify the approval process for cryptocurrency ETFs, eliminating the need for the lengthy 19b-4 process. This leads to quicker market entry, greater efficiency, and potentially increased investment in crypto-related financial products.

How can platforms like Finances Zippy aid in cryptocurrency investment?

Platforms like Finances Zippy provide real-time price predictions and expert analysis of market trends, empowering investors with the data needed to make informed decisions and stay ahead in the ever-evolving cryptocurrency market.

What does the recent SEC decision mean for the launch timing of XRP and Dogecoin ETFs?

The SEC’s decision to implement generic listing standards streamlines the approval process, focusing on the S-1 registration’s effectiveness. However, the exact timing for the launch of XRP and Dogecoin ETFs will depend on coordination between the issuers and the SEC’s Division of Corporation Finance.