Diving headfirst into the diversifying world of digital assets, Bitfinex Derivatives has embarked on a significant expansion. By securing a Digital Asset Service Provider (DASP) license in El Salvador, the platform is now set to extend its derivatives trading offerings across Latin America. This strategic move is a response to the overt support for cryptocurrency in El Salvador, a landscape that Bitfinex hopes to leverage.

Is This A Game Changer in Regulations?

Equipped with the DASP license, Bitfinex Derivatives can now work within the regulated parameters set by El Salvador’s Digital Assets Issuance Law. This law, enacted in early 2023, was developed to attract digital asset companies while ensuring legal simplicity and transparency. This legal framework alters the game for Bitfinex. As noted by Paolo Ardoino, Bitfinex’s CTO, this license functions as a transformative milestone, enabling the company to introduce novel derivatives products to an expanded demographic.

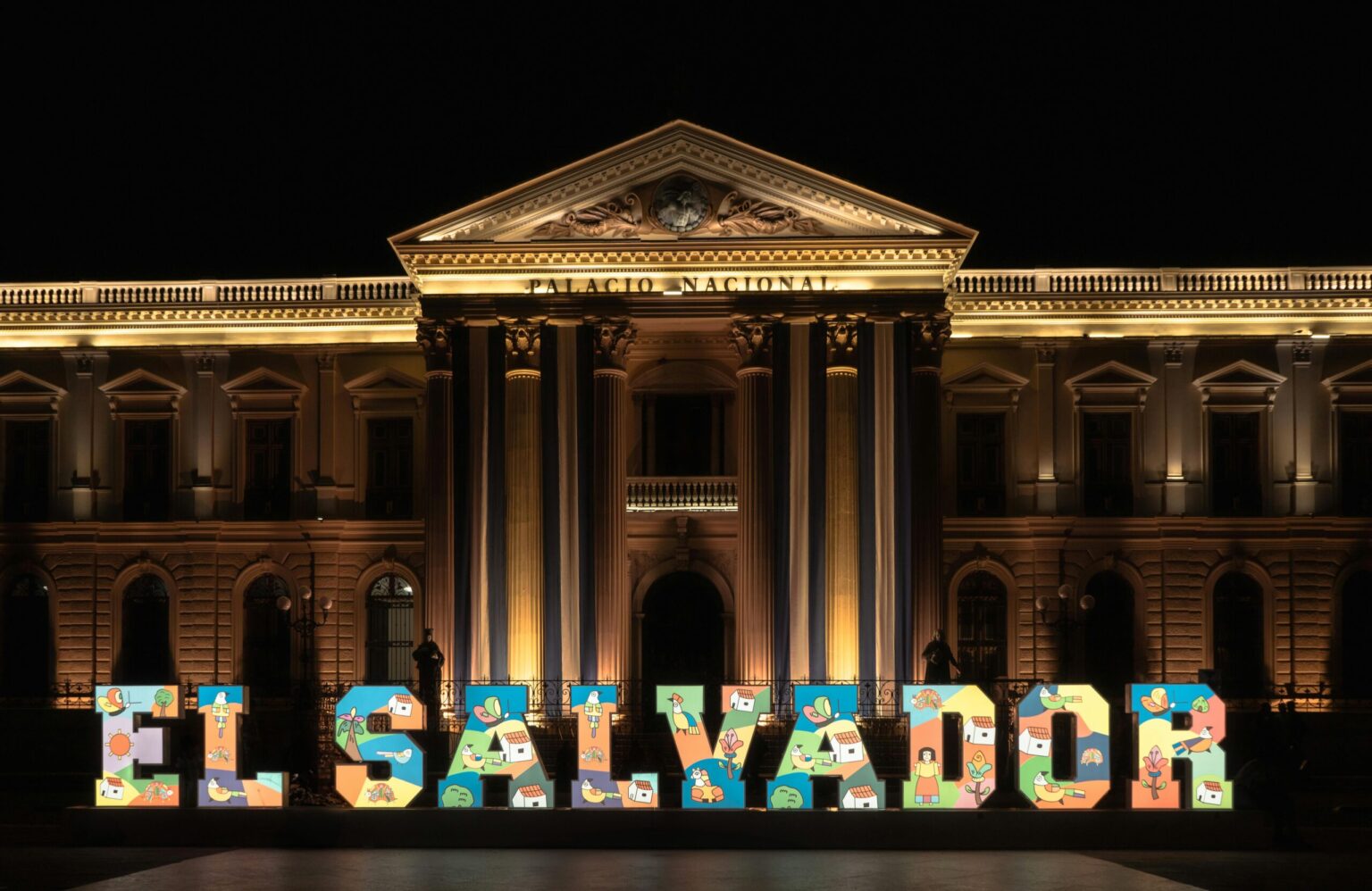

Ever since El Salvador adopted Bitcoin as legal tender in 2021, the country has demonstrated proactive initiatives in the realm of cryptocurrency. It has established itself as a critical nucleus for blockchain startups and digital asset utilization. This progression has further solidified with Bitfinex Derivatives joining the ranks of businesses operating within the ambit of the Digital Assets Issuance Law. Thus, reinforcing El Salvador’s reputation as a crypto-friendly hot spot.

Cryptocurrency Surge in Latin America

Optimally timed, Bitfinex’s endeavours coincide with the rising cryptocurrency tide in Latin America. Influenced by economic hurdles, including currency depreciation and financial instability, Bitcoin utilization has soared in the region. Particularly among the unbanked population, digital assets are increasingly being viewed as a means to achieve financial inclusion and stability. Seizing this mounting demand, Bitfinex aspires to cater to diverse user needs with products like perpetual contracts and other derivatives.

This strategic sprawl aligns with Bitfinex’s mission to deliver cutting-edge digital asset solutions worldwide. The establishment of its stronghold in El Salvador places the platform in a commanding position to serve the burgeoning Latin American cryptocurrency market.

Implications for the Industry?

Bitfinex’s move underscores the importance of clear regulations in fostering innovation. Offering operational certainty to the crypto market, the DASP license can serve as a blueprint for other nations contemplating similar systems. As El Salvador paves the way for Bitcoin usage, its legislative atmosphere may mold global standards for digital asset enterprises.

To Bitfinex, this represents more than a mere regional spread; it’s an affirmation of their commitment to lead in the dynamic cryptocurrency sector. Powered by El Salvador as a springboard, the firm is prepared to carve out new opportunities and set the standards for the future of derivatives trading in the cryptocurrency market.

FAQs

What is Bitfinex Derivatives?

Bitfinex Derivatives is a platform that provides a range of high-quality digital asset solutions, including derivatives trading services.

What is the significance of the DASP license?

A DASP license provides Bitfinex the legal permission to operate within El Salvador’s regulated framework. This supports Bitfinex’s goal to roll out innovative derivatives products to a broader audience while adhering to legal clarity and transparency.

What impact does Bitfinex’s move have on the industry?

Bitfinex’s expansion highlights the importance of well-defined rules in promoting innovation within the crypto market. This could influence international norms for digital asset businesses and inspire other countries to establish similar legislative frameworks.