In the volatile world of cryptocurrencies, investors and enthusiasts keenly observe the flow of capital across various digital assets. As the market evolves, understanding the movement and implications of these funds becomes crucial. In recent observations, there’s been a noticeable divergence in the realized capital inflows between major cryptocurrencies like Bitcoin and Ethereum. While Bitcoin and Solana have shown signs of slowing influx, Ethereum’s growth remains robust. Let’s delve into the dynamics shaping the cryptocurrency landscape today.

Analyzing Cryptocurrency Capital Flows: A Detailed Insight

Divergence in Realized Capital: Ethereum Versus Bitcoin

An insightful analysis by the on-chain analytics firm, Glassnode, has shed light on the changing landscape of realized capitalization in the cryptocurrency sector. Realized Capitalization, or “Realized Cap,” is a metric that assesses the cumulative value held by investors, evaluating each token based on the last transaction price. This measure offers a more nuanced understanding of market sentiment, reflecting the actual investment capital stored in any given digital currency.

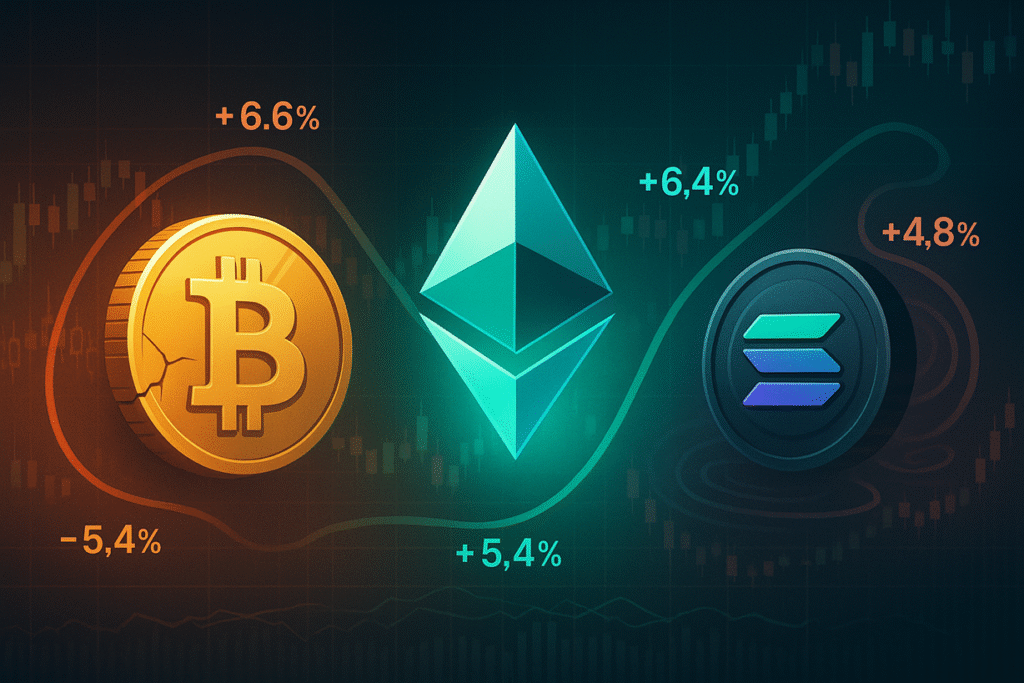

Recent data indicate a divergence among key cryptocurrencies. Despite a positive monthly change in Realized Cap for Bitcoin, Ethereum, Solana, and notable meme coins, the shorter-term figures reveal a different story. Specifically, while Bitcoin and Solana initially experienced substantial gains, their Realized Cap growth has decelerated over the past week, illustrating a possible cooling of investor enthusiasm. In contrast, Ethereum’s realized capital has seen an uptick, suggesting a potential capital shift into Ethereum as investors recalibrate their portfolios.

Shifts in Bitcoin Accumulation Patterns

In parallel with these developments, Bitcoin’s accumulation dynamics have attracted attention. The “Accumulation Trend Score,” another critical metric provided by Glassnode, paints an intriguing picture of investor behavior. This score indicates whether investors are predominantly acquiring or offloading their Bitcoin holdings, with scores close to 1 signaling active buying and scores near 0 indicating selling trends.

Recent observations show that both minor holders (those with less than 1 BTC) and major investors (those possessing over 10,000 BTC) have been actively accumulating Bitcoin. This trend suggests a buy-the-dip mentality amidst recent market corrections. However, Glassnode advises caution, noting that these signals are somewhat delayed, with investor behavior assessed over a 15-day timeframe.

Current Bitcoin Market Performance

As of this analysis, Bitcoin’s market presence remains turbulent, with its price hovering around $115,100, marking a decline of over 2% within the last week. The coin’s valuation has experienced fluctuations, indicating ongoing market volatility and investor uncertainty.

What is the Realized Cap, and Why is it Important?

The Realized Cap offers a more refined valuation of a cryptocurrency, based on the price at which each coin was last transacted. This approach provides a better insight into actual investor sentiment and market health, as it accounts for the price at which holders are willing to transact, rather than the market cap.

How does Ethereum’s growth affect the overall crypto market?

Ethereum’s continued growth can signify increased investor confidence in its ecosystem, potentially driving further interest and investment across the crypto sector. Its positive momentum may also reflect shifts in capital from other cryptocurrencies, as investors seek opportunities in Ethereum’s robust platform.

Is it risky to invest in Bitcoin during market corrections?

Investing in Bitcoin, particularly during market corrections, involves inherent risks. Prospective investors should conduct thorough research, considering factors such as historical trends, current market conditions, and long-term growth potential. Consulting with financial advisors can also aid in making informed investment decisions.

By understanding these dynamics and keeping abreast of shifts in investor sentiment, market participants can make more strategic decisions, capitalizing on the evolving cryptocurrency landscape with greater precision and foresight.