The cryptocurrency market has captivated investors worldwide with its unprecedented growth and innovation. Bitcoin, the undisputed leader in the digital currency realm, continues to draw attention due to its significant market share and soaring valuations. As financial markets speculate about potential Federal Reserve interest rate cuts, Bitcoin presents intriguing possibilities. However, challenges persist, particularly regarding Bitcoin’s ability to handle increased transaction volumes efficiently. This in-depth analysis explores the current dynamics affecting Bitcoin and introduces Bitcoin Hyper, a promising Layer-2 solution aiming to enhance Bitcoin’s scalability while introducing smart contract capabilities.

Bitcoin’s Market Dynamics and the Role of Financial Policies

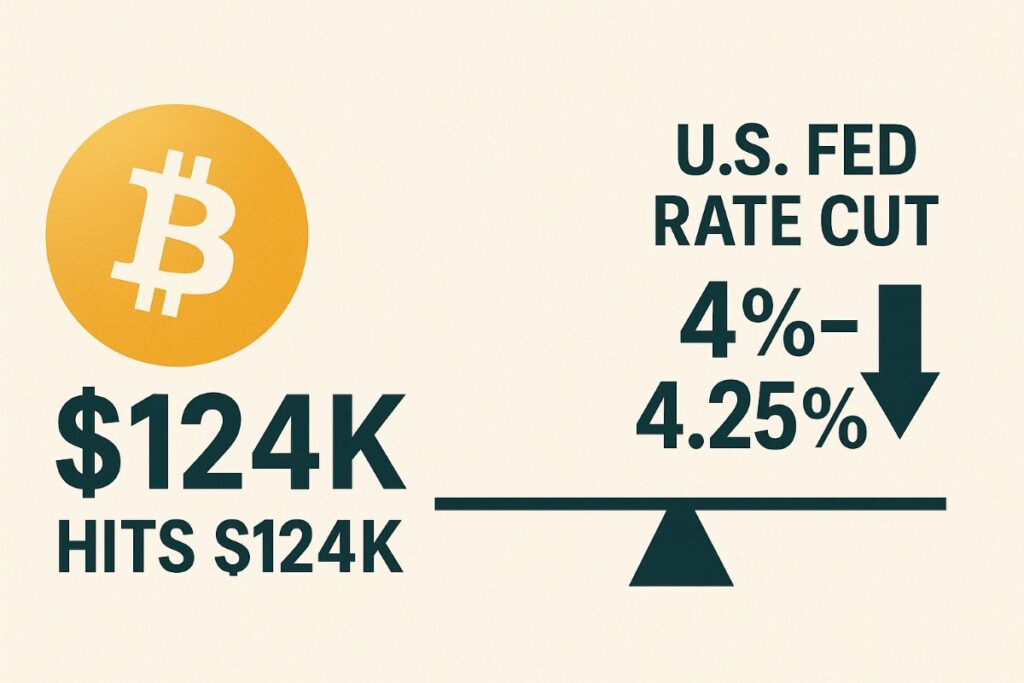

Impact of Potential Federal Reserve Interest Rate Cuts on Bitcoin

The cryptocurrency community is buzzing with anticipation as the Federal Reserve considers reducing interest rates. According to the CME’s FedWatch tool, there is a 92.5% likelihood of a quarter-point rate cut, marking the first such reduction since December 2024. Typically, lower interest rates encourage investors to seek higher-yielding, riskier assets. In this context, Bitcoin stands out as a prime candidate, with its prominence as the world’s leading cryptocurrency.

Institutional Investment and Supportive Regulatory Environment

Bitcoin’s allure extends beyond retail investors, with institutional investment playing a pivotal role in its sustained growth. US-listed spot Bitcoin ETFs alone amass an impressive $170.22 billion in assets, with BlackRock’s iShares Bitcoin Trust (IBIT) accounting for $86.83 billion of this total. Such substantial institutional involvement reduces Bitcoin’s available supply and fosters a culture of holding (HODLing), thereby supporting its price trajectory.

Furthermore, the United States is making strides in creating a crypto-friendly regulatory framework. Legislative initiatives like the ‘GENIUS Act’ and ‘Clarity Act’ promise to enhance the clarity surrounding digital asset regulations. These advancements, coupled with ‘Project Crypto’s’ efforts to modernize securities laws, pave the way for innovation and growth within the crypto industry.

Addressing Bitcoin’s Scalability Challenges

Bitcoin’s network, while secure, struggles with scalability issues. With the capacity to process only about 7 transactions per second (tps), Bitcoin lags behind other platforms like Ethereum, which handles 15–30 tps, and Solana, boasting 1,000 tps. The limitations in Bitcoin’s block size and block time often result in rising fees during periods of high demand.

Bitcoin Hyper: Enhancing Bitcoin’s Capabilities

Enter Bitcoin Hyper, a cutting-edge Layer-2 solution poised to revolutionize the Bitcoin network. Scheduled for launch this quarter, Bitcoin Hyper’s primary objective is to enhance transaction speeds and reduce costs while seamlessly integrating smart contract functionality. By batching transactions off-chain and settling them on Bitcoin’s base layer, Bitcoin Hyper aims to alleviate congestion and drive down fees.

The Solana Virtual Machine (SVM) integration will bring smart contracts to Bitcoin, unlocking new opportunities for decentralized finance (DeFi) protocols and decentralized applications (dApps). The use of Zero-Knowledge Proofs (ZKPs) ensures fast, trustless transaction verification, safeguarding Bitcoin’s security while enhancing its performance.

How can Bitcoin Hyper impact the cryptocurrency market?

Bitcoin Hyper holds the potential to make Bitcoin more competitive in the DeFi and dApp space by introducing smart contract capabilities and enhancing transaction efficiency. This development could increase Bitcoin’s utility and attract more developers and users to its ecosystem.

Why is Bitcoin’s scalability a concern?

Bitcoin’s scalability limitations, with its low transaction throughput, can lead to high fees and slow transactions during periods of increased demand. Addressing these issues is essential for Bitcoin to maintain its position as a leading cryptocurrency.

What sets Bitcoin Hyper apart from other solutions?

Bitcoin Hyper’s unique approach involves leveraging off-chain transaction batching and the integration of the Solana Virtual Machine. This combination enhances Bitcoin’s capabilities without compromising its security, making it a promising solution for long-standing scalability concerns.

Is investing in Bitcoin Hyper advisable?

As with any investment opportunity, potential investors should conduct thorough research and consider their risk tolerance. Bitcoin Hyper offers innovative solutions to enhance the Bitcoin network, making it an intriguing option for those looking to diversify their cryptocurrency portfolio.

This comprehensive guide delves into Bitcoin’s technological advancements, regulatory environment, and the potential impact of Bitcoin Hyper on the cryptocurrency landscape. By understanding these dynamics, investors and enthusiasts can make informed decisions in this ever-evolving market.