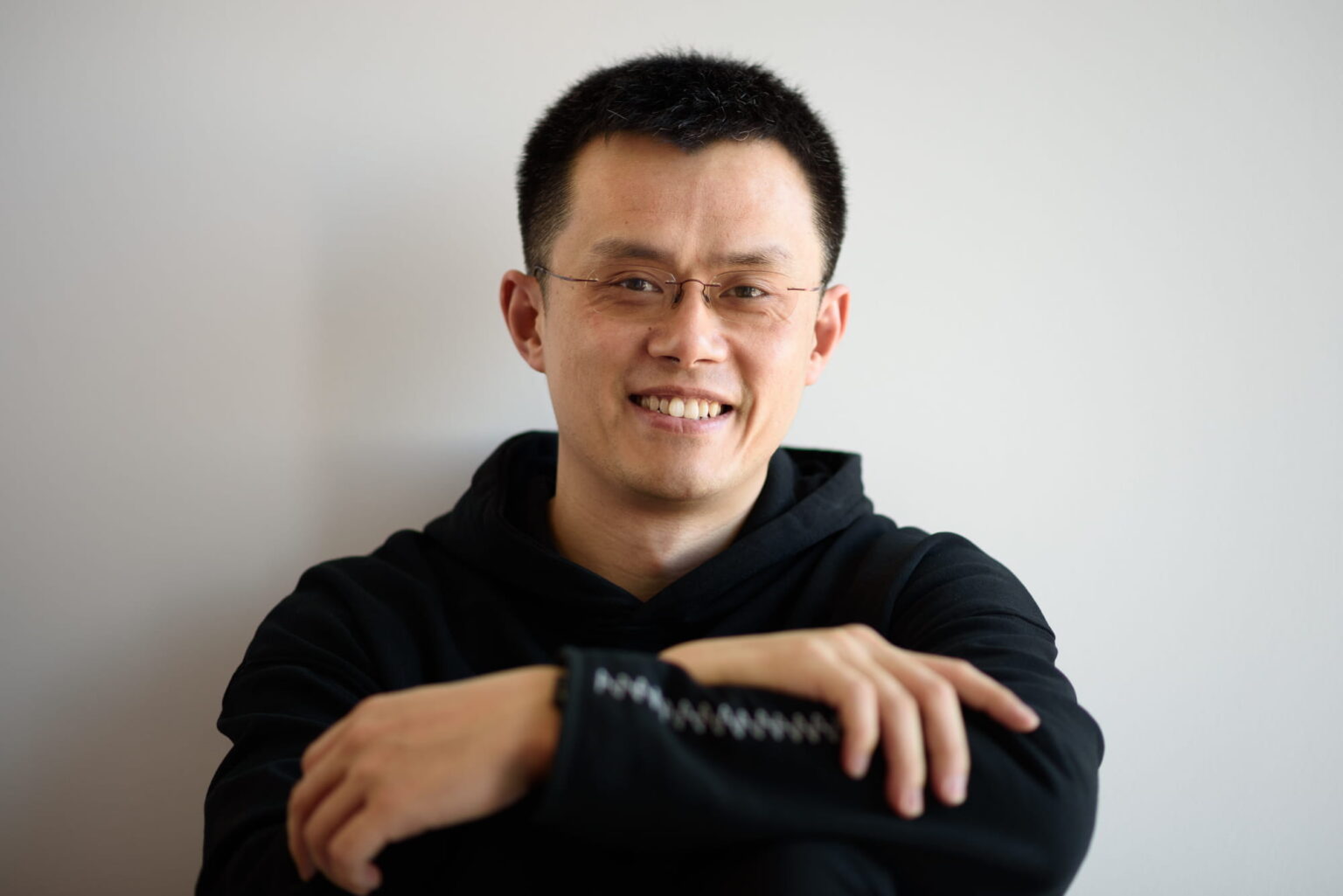

In the ever-evolving landscape of cryptocurrency, industry leaders often find themselves at the center of controversy and speculation. These narratives shape public perception and influence market behavior, making transparency and accuracy paramount. The story of Binance and its former CEO Changpeng “CZ” Zhao offers a compelling insight into the challenges faced by crypto pioneers amidst media scrutiny and regulatory landscapes.

Controversy Surrounds Binance and Changpeng Zhao

Renowned within the cryptocurrency community, Binance co-founder Changpeng Zhao, often referred to as CZ, recently confronted allegations reported by Bloomberg. These assertions linked him to a stablecoin launched by World Liberty Financial (WLF), associated with political figures in the United States. Zhao vehemently denied these claims, accusing the publication of defamation and considering legal action, as he has previously done in past disputes.

The Alleged Involvement in WLF Stablecoin

Bloomberg’s report suggested that Binance played a role in the development of smart contract code for WLF’s stablecoin (USD1). Further, it implied a link between this development and a substantial investment deal with a firm based in Abu Dhabi. As part of a settlement with the US Department of Justice involving a felony count, CZ reportedly sought a federal pardon from President Trump, with Bloomberg speculating that Binance’s facilitation of a significant transaction using WLF’s stablecoin might signal a conflict of interest.

Zhao’s rebuttal was unequivocal, calling the report a “hit piece” filled with inaccuracies, suggesting it was sponsored by competitors. He reminded the public of a previous legal altercation with Bloomberg, during which an apology was issued and a donation made to a Special Education Foundation.

Pattern of Targeting or Genuine Concern?

The controversy isn’t isolated, as evidenced by The Wall Street Journal’s (WSJ) claims that CZ had back-channel links with the Trump family’s enterprise. CZ staunchly denied these allegations, asserting no involvement in contact facilitation for the WLF’s international operations. He argues that such reports aim to undermine the credibility of the cryptocurrency sector in the U.S., stifling its potential growth.

Despite these challenges, Zhao remains a pivotal figure in the digital asset sphere, navigating through turbulent times with a focus on future achievements. His experiences underscore the need for thorough research and clarity in crypto journalism.

Editorial Integrity and Future Implications

The editorial approach at publications covering the crypto industry must prioritize factual accuracy and unbiased reporting. This ensures that readers receive information they can trust, critical in a sector as dynamic and impactful as digital finance. As the crypto landscape continues to attract widespread attention, maintaining rigorous standards in content creation will be crucial for fostering a well-informed audience.

What are the implications of defamation lawsuits in the crypto industry?

Defamation lawsuits, like those involving CZ and major publications, can have significant implications. They highlight the need for accuracy in financial reporting, potentially affecting public perception and investor confidence. Such cases also emphasize the importance of media accountability and fair journalistic practices in the rapidly evolving crypto landscape.

How does media scrutiny affect cryptocurrency markets?

Media reports significantly influence cryptocurrency markets. Positive news can boost investor confidence, driving up prices, while negative reports, especially involving key figures or institutions, can spark fear, uncertainty, and doubt (FUD), leading to market volatility. Therefore, accurate and unbiased reporting is crucial for market stability.

Why is transparency important in cryptocurrency exchanges?

Transparency in cryptocurrency exchanges fosters trust among users, regulators, and the broader financial community. It ensures that transactions are secure, traceable, and compliant with legal standards, thereby enhancing the legitimacy and adoption of digital currencies globally.

The case involving Binance and CZ epitomizes the delicate balance between innovation and scrutiny in emerging financial domains. As the narrative unfolds, the crypto world remains vigilant, poised to adapt and respond to the shifting sands of policy, perception, and technological evolution.