The ever-evolving landscape of cryptocurrency can often be a whirlwind of news and developments, with some stories catching the attention of the entire financial world. One such event recently unfolded, casting a spotlight on the legal and regulatory dynamics shaping the crypto industry. The unexpected pardon of a prominent figure within this sector has stirred both commendation and controversy. Let’s delve into this intriguing saga, exploring its implications on the financial landscape and its potential ripple effects in the sphere of digital assets.

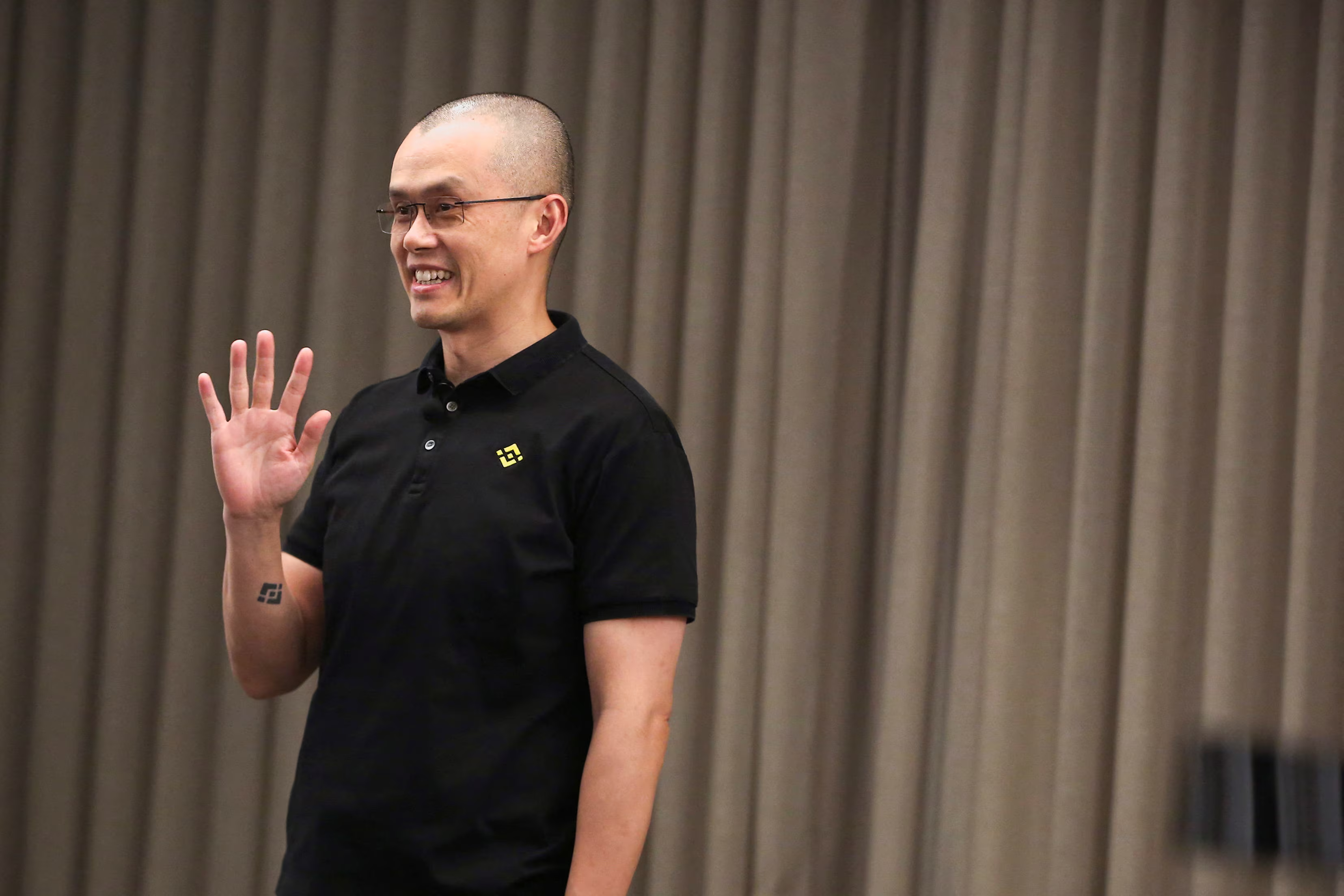

Trump Pardons Former Binance CEO Changpeng Zhao

In a surprising turn of events, former Binance CEO and co-founder Changpeng Zhao, widely known as CZ, received a pardon from former President Donald Trump. This decision emerged amidst considerable anticipation and speculation, grabbing headlines across the crypto and financial world.

Binance Applauds Presidential Pardon

During President Joe Biden’s tenure, the administration placed significant focus on digital currencies, scrutinizing major crypto companies, including Binance. In 2023, CZ admitted to certain infringements of US anti-money-laundering laws, resulting in a four-month prison term and a hefty $4.3 billion settlement with US authorities.

Following the pardon, Binance made its gratitude known on social media, particularly on platform X (formerly Twitter). The company thanked President Trump for his leadership and vision, emphasizing CZ’s pivotal role in establishing Binance as the world’s largest cryptocurrency exchange and propelling the global crypto movement. Binance reiterated its mission to maintain a secure, transparent, and user-focused platform while lowering fees and expanding financial access to everyone.

CZ himself conveyed heartfelt thanks for the pardon, applauding Trump’s dedication to fairness and innovation. He vowed to further efforts in establishing the United States as the leading hub for cryptocurrency and promoting the development of Web3 worldwide.

Critics Voice Concerns Over Pardon Implications

The pardon has raised eyebrows among various industry experts, including Adam Cochran, who criticized it as a questionable decision. Cochran directed attention to Zhao’s prior admissions, which included allegations of facilitating sanctions violations through Binance by groups like Hamas and Wagner.

Cochran also highlighted noteworthy connections between Zhao and Trump’s interests, notably Binance’s association with Trump’s World Liberty Financial and collaborations involving Dominari Holdings, operated in part by Trump’s sons from Trump Tower.

Another point of contention raised by Cochran was the tangible impact of the pardon, questioning its necessity given that Zhao had already completed his sentence. He suggested that the pardon might enable Zhao to reassume leadership roles within the financial sector without regulatory oversight, deeming this scenario an evident example of transactional justice, citing that “crime can be overlooked in America” if one has the means to secure a pardon.

In the aftermath of the pardon, Binance Coin (BNB) experienced a significant price increase, rising by 3.6% to reach $1,122.

What does the pardon mean for Binance’s future?

The pardon potentially allows Changpeng Zhao to re-engage with Binance and participate in the financial landscape without the restrictions previously imposed by his conviction. This could mean strategic shifts or expansions for Binance, affecting its business operations and market positioning. It also underscores a pivotal moment in regulatory attitudes towards cryptocurrency executives.

How does this affect the legal landscape for cryptocurrencies?

This pardon may set a precedent for how high-profile cases within the crypto industry are handled legally. It highlights the complex interplay between regulatory frameworks and executive powers in shaping the crypto market environment. Observers are keenly watching to see if this leads to any regulatory adjustments or changes in enforcement practices.

Is Binance still secure for users?

Binance has consistently emphasized its commitment to maintaining a secure and transparent platform. While the organization navigates regulatory challenges and leadership changes, users are advised to remain informed and cautious, ensuring they follow best practices for security and staying updated with Binance’s policies and announcements.

What might this mean for cryptocurrency regulations in the U.S.?

The pardon could influence ongoing regulatory debates and actions regarding cryptocurrencies in the U.S. It might prompt lawmakers to reassess current regulations and the role of executive power in financial oversight, potentially leading to more defined regulatory frameworks that address the rapid evolution of digital asset markets.

In conclusion, this intricate narrative surrounding Changpeng Zhao’s pardon not only sheds light on individual fortunes but also underscores broader themes within the cryptocurrency sector, such as legal scrutiny, regulatory dynamics, and the delicate balance between innovation and governance.