In recent years, the dynamic world of cryptocurrency has captured the attention of both individual and corporate investors alike. This surge in interest has propelled Bitcoin and Ethereum into the spotlight, with corporate treasuries embracing these digital assets as valuable components of their portfolios. As companies increasingly turn to Bitcoin to enhance their financial standing, we’ve witnessed a significant rise in corporate Bitcoin holdings, totaling an impressive 1 million BTC, equating to over $111 billion. This trend not only strengthens Bitcoin’s position as a viable reserve asset but also boosts market confidence in other cryptocurrencies, posing an intriguing opportunity for those exploring the altcoin market.

Corporate Bitcoin Acquisition: A Bold Leap Into Crypto Investment

MicroStrategy Leads Corporate Bitcoin Investments

In a groundbreaking move, MicroStrategy, a publicly listed company, has secured the top position as the largest holder of corporate Bitcoin, accumulating 636,505 BTC. This initiative began in August 2020, showcasing the company’s strategic decision to invest heavily in Bitcoin. With Bitcoin’s current value standing at approximately $112,000 per BTC and having been acquired at an average of $73,000, MicroStrategy’s portfolio has appreciated by nearly 50%, yielding a 25.7% annual return year-to-date. This bold approach has inspired 184 other companies to follow suit and incorporate Bitcoin into their treasuries.

New Entrants and Growing Enthusiasm

The landscape of corporate Bitcoin holdings has evolved with new players rapidly ascending the ranks. Notably, MARA Holdings, which currently possesses 52,447 BTC, and emerging companies like Jack Maller’s XX1 and the Bitcoin Standard Treasury Company, have aggressively increased their Bitcoin assets. Such investments are driving Bitcoin’s market value to new heights, with recent peaks reaching $124,450. Companies like Metaplanet and Semler Scientific have outlined ambitious plans to expand their Bitcoin holdings, further solidifying the trend of corporate confidence in cryptocurrency.

Ethereum and Altcoin Opportunities

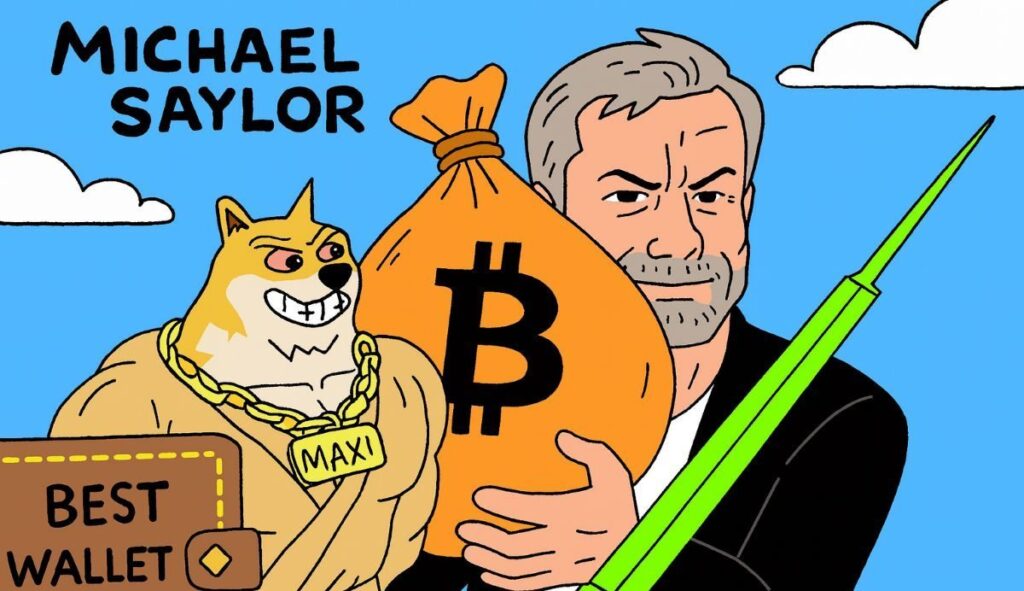

While Bitcoin remains the focal point for many, Ethereum is also gaining traction among corporate investors. SharpLink’s recent acquisition of 39,000 ETH signifies a growing interest in Ethereum’s potential. Furthermore, the surge in corporate investments creates a favorable backdrop for promising altcoins such as Maxi Doge ($MAXI), XPIN Network ($XPIN), and Best Wallet Token ($BEST), which offer unique use cases and strong profit potential.

Maxi Doge ($MAXI): A New Contender in the Meme Coin Space

Maxi Doge ($MAXI) is making waves in the cryptocurrency world with its goal to transcend the meme coin category and offer tangible utility through futures platform integrations and gamified tournaments. The token has already garnered significant interest, raising over $1.8 million in its presale phase. With future developments on the horizon, now is an opportune time to participate in the $MAXI presale at an attractive entry point of $0.0002555 per token.

XPIN Network ($XPIN): Revolutionizing Global Connectivity

The XPIN Network ($XPIN) is at the forefront of transforming global connectivity with its decentralized wireless infrastructure powered by blockchain technology. By offering eSIM technology, XPIN enables seamless and cost-effective internet access without the need for physical SIM cards or exorbitant roaming charges. The network’s recent launch of the XPIN FreeData Plan has fueled a surge in $XPIN’s value, doubling its price as more users embrace this innovative solution.

Best Wallet Token ($BEST): Pioneering Crypto Wallet Technology

Best Wallet Token ($BEST) is the native token of Best Wallet, a cutting-edge non-custodial crypto wallet poised to dominate the global market. With features like multi-network support, comprehensive security measures, and a Token Launchpad, Best Wallet offers a robust platform for buying, selling, and staking cryptocurrencies. The Best Wallet Token enhances the user experience by providing reduced gas fees, community governance, and higher staking rewards.

Conclusion: The Future of Corporate and Altcoin Investments

The growing corporate adoption of Bitcoin and Ethereum signals a promising future for cryptocurrency investments. With an impressive $111 billion in BTC now sitting on corporate balance sheets, it’s clear that digital assets are becoming integral to long-term financial strategies. As market confidence builds, altcoins with robust fundamentals, such as $MAXI, $XPIN, and $BEST, offer enticing investment opportunities. However, investors should conduct thorough research and consider their risk tolerance before making any financial commitments.

How does corporate investment in Bitcoin impact the cryptocurrency market?

Corporate investment in Bitcoin significantly enhances market confidence and legitimacy, leading to increased adoption and higher valuations for digital assets. It also sets a precedent for other businesses to consider cryptocurrency as part of their financial strategies.

What are the potential risks of investing in altcoins like $MAXI, $XPIN, and $BEST?

While altcoins offer substantial profit potential, they also come with inherent risks due to market volatility, regulatory challenges, and technological uncertainties. Investors should perform due diligence and assess their risk tolerance before investing.

Why is Ethereum gaining interest among corporate investors?

Ethereum’s versatile platform supports a wide range of applications, including smart contracts and decentralized finance (DeFi). Its potential for significant innovation and utility makes it an attractive option for corporate investors seeking diversification beyond Bitcoin.