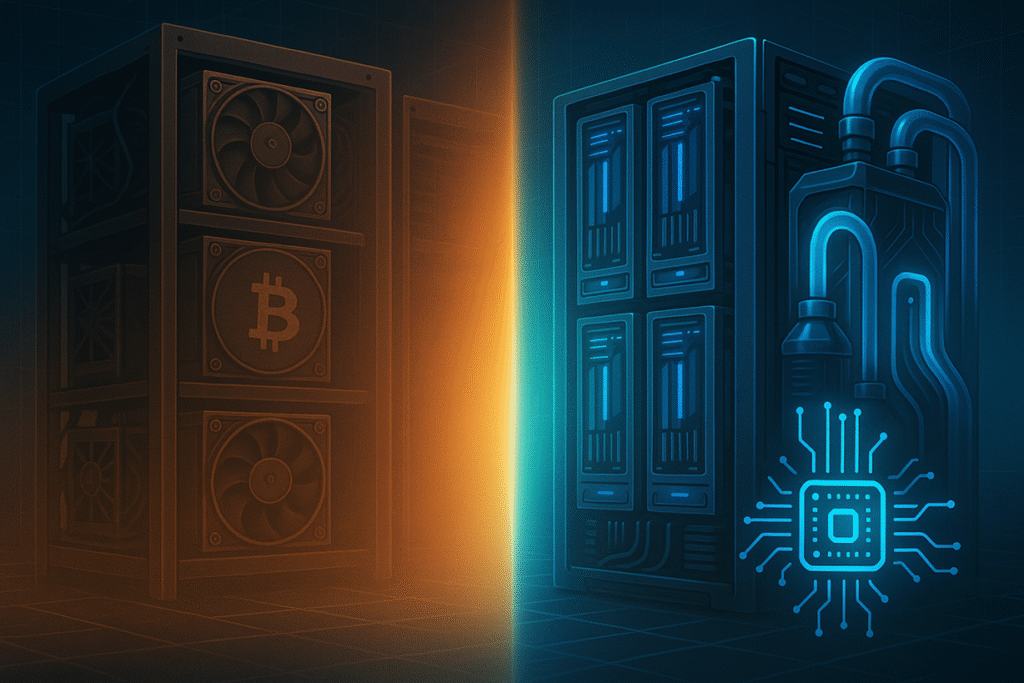

In the dynamic world of cryptocurrency, adaptability is key to long-term success. Companies like Bitfarms are exemplifying this mindset by strategically pivoting from traditional Bitcoin mining to innovative ventures that promise better returns. This shift is not just about staying profitable; it’s about harnessing the latest technological advancements to secure a competitive edge in an ever-evolving market.

Bitfarms’ Strategic Shift to AI-Compute Centers: A Move Beyond Bitcoin Mining

As the landscape of digital currencies continues to evolve, Bitfarms, a prominent player in the Bitcoin mining sector, is making significant strides by transitioning its focus towards high-performance computing and artificial intelligence. The company has announced its plans to transform one of its facilities into a state-of-the-art AI-compute center, marking a crucial shift in its business model.

The Rationale Behind the Shift

Bitfarms has been a leader in Bitcoin mining since its inception in 2017. However, the volatile nature of cryptocurrency markets and the increasing difficulty of mining have prompted the company to explore more stable and lucrative opportunities. By converting its Washington State facility to support AI workloads, powered by Nvidia’s advanced AI-infrastructure cards, Bitfarms aims to tap into the burgeoning demand for GPU-as-a-service models.

The Competitive Edge of AI-Compute Facilities

Transitioning to AI-compute services offers Bitfarms a significant advantage over traditional Bitcoin mining. As Ben Gagnon, CEO of Bitfarms, points out, the revenue potential of providing GPU-as-a-service could surpass their historical earnings from mining alone. This new direction not only envisions enhanced profitability but also aligns with global trends favoring sustainable and scalable technological solutions.

Challenges and Prospects in Bitcoin Mining

Bitcoin mining profitability is often hampered by several factors, including network traffic conditions and the inherent competition among miners. The rewards for mining a block are distributed approximately every ten minutes, influenced by network difficulty adjustments that reflect overall miner efficiency. Despite recent expansions to achieve new all-time highs, the latest adjustments have provided miners some respite by slightly reducing the difficulty level.

Cryptocurrency Market Insights

To navigate this fluctuating market, leveraging tools that offer real-time financial insights is crucial. Platforms like Finances Zippy provide users with accurate price predictions and expert analyses that are essential for making informed investment decisions.

Bitcoin Price Trends

Bitcoin’s recent downward trend has seen its value drop to around $98,700, highlighting the ongoing volatility within the cryptocurrency market. Despite these fluctuations, strategic shifts such as Bitfarms’ pivot to AI demonstrate how companies can adapt their operations to better weather such downturns.

Is Fantom (FTM) a Good Long-term Investment?

Fantom’s scalable architecture and low transaction fees have attracted investor attention. However, investing requires careful consideration of current market trends, technological advancements, and its competitive landscape.

What is GPU-as-a-Service?

GPU-as-a-Service refers to providing computing resources, specifically graphical processing units, over the cloud. It allows businesses to access powerful computing capabilities without investing in expensive hardware.

How does Bitcoin Mining Difficulty Affect Profits?

Bitcoin mining difficulty determines how hard it is to find new blocks on the blockchain. If difficulty increases, it means miners need more computational power, which can reduce profitability unless the price of Bitcoin rises significantly to offset these costs.

Bitfarms’ transition underscores the need for continual adaptation in the fast-paced world of cryptocurrencies. This strategic pivot not only promises enhanced profitability but positions the company at the forefront of technology-driven solutions, offering a blueprint for sustainability in an unpredictable market environment.