In today’s ever-evolving digital landscape, the intersection of finance and technology is reshaping traditional economic structures. As governments worldwide begin to recognize the potential of cryptocurrencies like Bitcoin, strategic discussions are taking place at the highest levels. This intriguing narrative unfolded at the Bitcoin 2025 conference, where a significant policy announcement signaled a potential shift in U.S. economic strategy under former President Donald Trump’s administration. This could redefine the way nations think about digital assets.

U.S. Moves Toward a Strategic Bitcoin Reserve

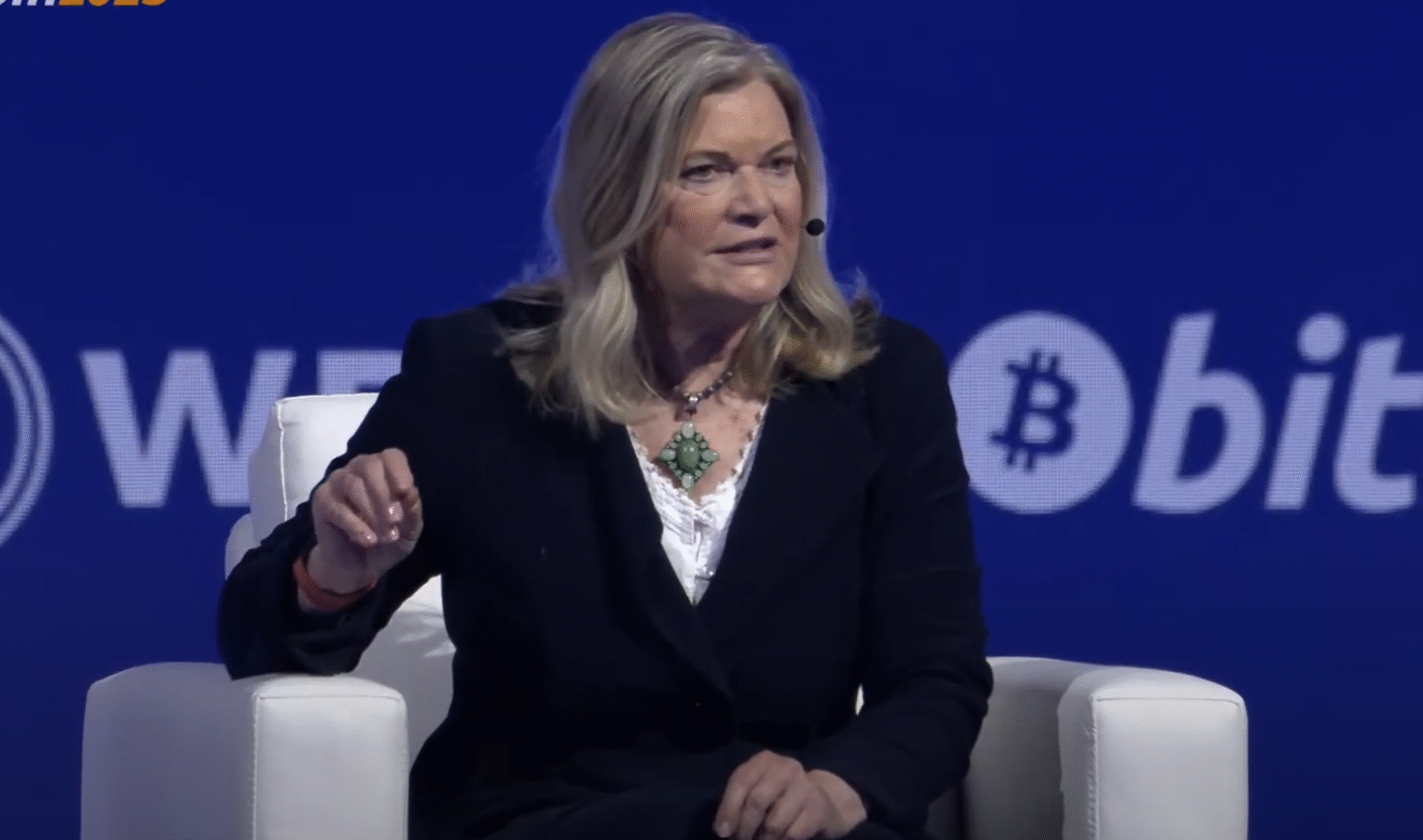

The opening of the Bitcoin 2025 conference set the stage for a groundbreaking policy revelation: former President Trump has endorsed a legislative proposal for establishing a strategic Bitcoin reserve in the United States. This announcement was made by Wyoming Senator Cynthia Lummis, who, alongside Senators Marsha Blackburn and Jim Justice, highlighted the administration’s commitment to advancing this legislative agenda.

Advancement of the Bitcoin Bill

Senator Lummis shared insights into the timeline for implementing this strategic initiative. “President Trump is fully behind the proposed legislation,” she stated, underscoring the administration’s active engagement in digital asset matters, ranging from stablecoins to comprehensive market structures. The first step in this legislative journey is the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, which successfully passed through the Senate Banking Committee and is poised for a full Senate vote post-Memorial Day.

The Bitcoin strategic reserve is to follow, modeled after the iconic Fort Knox gold holdings, with the BITCOIN Act authorizing the Treasury to amass up to one million BTC over a five-year period through budget-neutral channels. With Bitcoin’s market price hovering around $108,900, this reserve could represent a monumental $108.9 billion investment, accounting for 2.6% of the FY 2025 discretionary budget.

Strategic and Geopolitical Implications

Senator Lummis positioned the Bitcoin reserve as a crucial component of national energy and security policy. The U.S. fortuitously benefitted from China’s prohibition on Bitcoin mining, leading to an increase in domestic mining activities. This domestic dominance in hash rate, coupled with a federal Bitcoin reserve, would significantly bolster America’s geopolitical stance, according to Lummis and several military leaders.

State-Level Initiatives and Global Influence

Momentum at the state level is complementing federal efforts. States like Arizona, Texas, and New Hampshire have enacted strategic reserve laws, and over 30 additional states are deliberating similar measures. These initiatives not only serve as testing grounds for national policy but also reinforce the U.S. position in the global arena where countries like the UAE and the Czech Republic are exploring Bitcoin as a reserve asset.

Despite an executive order from the White House to prepare the groundwork for a federal Bitcoin reserve, only Congressional approval can allocate necessary funds or adjust debt management statutes. The BITCOIN Act addresses these legislative hurdles, with a vote anticipated soon. Senator Lummis encouraged stakeholders to engage with their legislators to emphasize the strategic importance of this initiative.

The Road Ahead

While the Senate plays a pivotal role in this legislative process, the political landscape is evolving with President Trump’s influence, Pentagon approval, and state legislatures progressively aligning with the concept of a Bitcoin reserve. Despite the legislative path’s inherent challenges, this strategic initiative signals a new era of digital asset integration into national economic strategies.

Will the Strategic Bitcoin Reserve Affect the U.S. Dollar?

While a strategic Bitcoin reserve may enhance the U.S.’s digital asset profile, it’s unlikely to directly impact the status of the U.S. dollar as the world’s reserve currency in the short term. However, it could diversify the nation’s financial tools and influence global economic dynamics.

What Are the Implications for Bitcoin Miners?

With increased government interest, domestic Bitcoin miners may experience heightened scrutiny and potential regulatory changes. However, federal support could also lead to new investments and advancements in mining technology.

How Does This Affect Global Cryptocurrency Adoption?

A U.S. government-backed Bitcoin reserve would likely accelerate global adoption, lending legitimacy to cryptocurrencies and encouraging other nations to explore digital asset reserves.

This comprehensive guide examines the potential impact of a U.S. Bitcoin reserve on economic policy, market trends, and geopolitical strategy, offering valuable insights for informed decision-making in the evolving financial landscape.