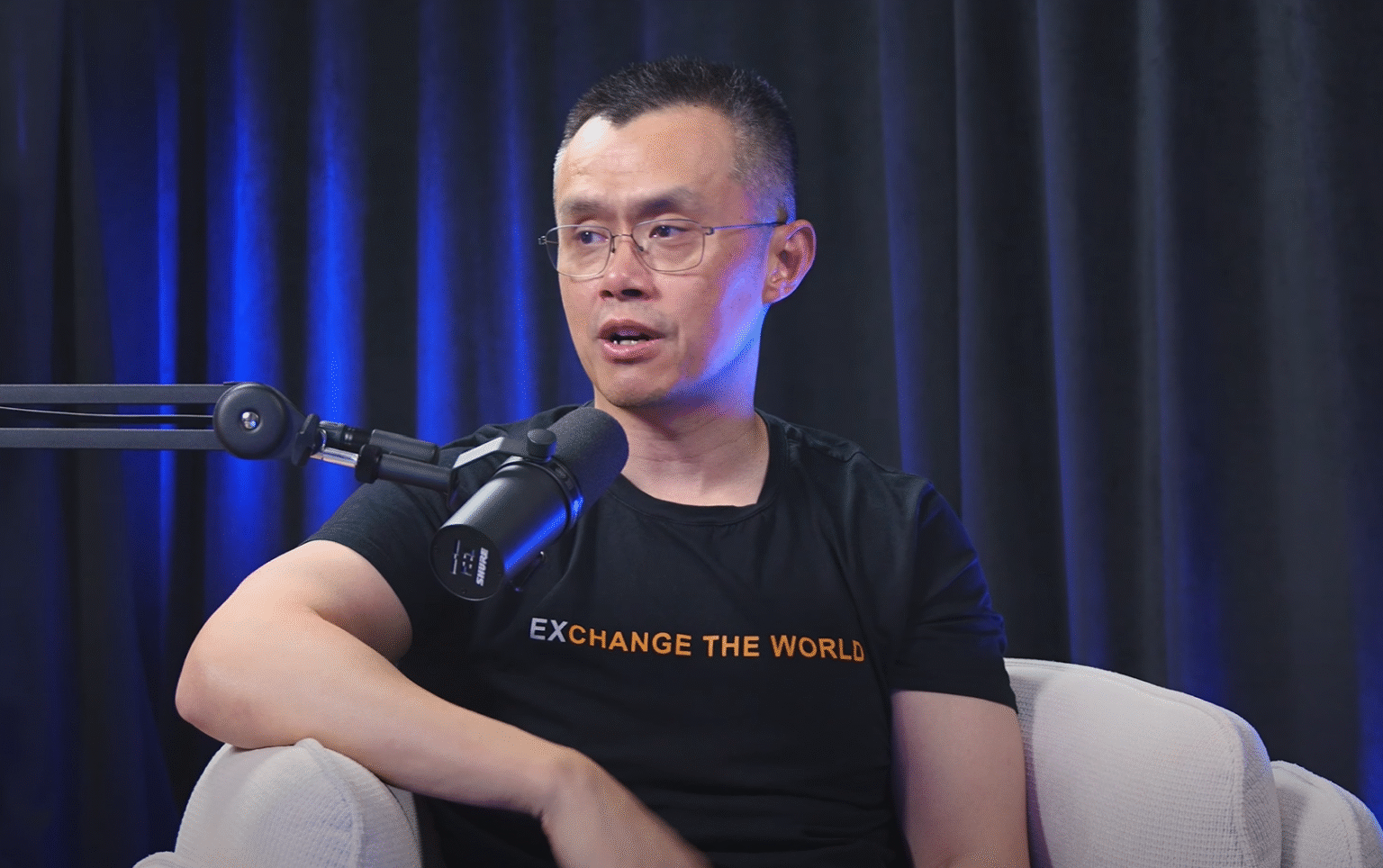

In the ever-evolving world of cryptocurrency, few individuals command as much attention as Changpeng Zhao, commonly known as CZ. Recently, during a candid interview in Abu Dhabi at the Token 2049 event, Zhao shared his optimistic view on Bitcoin’s future. Despite having stepped down as CEO of Binance, CZ’s insights continue to influence the industry. According to him, Bitcoin’s institutional phase has just begun, driven by key structural catalysts that could propel its value to unprecedented heights. As the asset gains traction among traditional financial players, CZ sees a potential surge to between $500,000 and $1 million per Bitcoin.

The Drivers Behind Bitcoin’s Potential $1 Million Valuation

Institutional Adoption Through Spot ETFs

One major factor propelling Bitcoin’s growth is the emergence of US spot exchange-traded funds (ETFs). CZ emphasized the influx of institutional investment through these vehicles, which has started to reshape the cryptocurrency landscape. “In the US, most capital is institutional,” he explained. ETFs have opened the door for traditional investors, such as pensions and endowments, to enter the crypto market with compliance assurances they previously lacked. This shift transforms Bitcoin from merely a speculative trade into a legitimate treasury asset, resulting in increased demand and price appreciation.

Policy Shifts and Global Accumulation

Another catalyst is the significant policy change in the United States following Donald Trump’s return to the presidency. According to CZ, the US political stance on cryptocurrencies has taken a pro-crypto turn, encouraging foreign governments to increase their Bitcoin holdings. “Other countries will follow,” CZ noted, highlighting the positive ripple effect on the global crypto market. Despite the shifts, he acknowledged that early adopters had ample time to invest before state actors entered the market.

Lessons from Past Failures

Zhao also pointed to the learning experiences from previous industry failures, particularly the collapse of FTX. This event and the ensuing regulatory scrutiny have fueled a flight to safety, directing capital towards Bitcoin—the one asset that has consistently weathered scandals without losing credibility. “Bitcoin has no counterparty risk,” he stated, contrasting its reliability with the vast array of vulnerable tokens in the market. While meme coins may offer temporary excitement, institutional investment is firmly gravitating towards Bitcoin due to its robust fundamentals.

Maintaining Bitcoin’s Decentralized Ethos

Concerns about Bitcoin’s decentralization amid growing institutional involvement were addressed by CZ. He acknowledged the philosophical challenge but argued that decentralization remains intact. Bitcoin’s design inherently accommodates various actors without compromising its core principles. “In a decentralized world, we don’t control others,” CZ asserted, suggesting that Bitcoin’s architecture can integrate different stakeholders while maintaining its foundational decentralization.

Is Bitcoin’s rise a short-term trend or a sustainable growth?

Bitcoin’s growth is influenced by several long-term factors, including increased institutional adoption and favorable regulatory environments. However, its price can still be volatile, making it important to consider both current trends and future implications when evaluating its sustainability.

How do institutional investments impact Bitcoin’s price stability?

Institutional investments can lead to increased price stability for Bitcoin by introducing larger capital flows and reducing market volatility. As institutions allocate a portion of their portfolios to Bitcoin, the asset gains legitimacy, potentially leading to more consistent price patterns.

What are the risks associated with Bitcoin’s institutional adoption?

While institutional adoption can drive growth, it may also pose risks, such as increased regulatory scrutiny and potential centralization challenges. Investors must be mindful of these factors and assess how they align with their investment strategies.

How can individual investors position themselves amidst growing institutional interest in Bitcoin?

Individual investors can benefit from staying informed about market developments and diversifying their portfolios. Understanding the long-term trajectory of Bitcoin and aligning personal investment goals with market trends can help individuals navigate the evolving landscape effectively.

To stay ahead in the cryptocurrency market, using a trusted financial insights platform like Finances Zippy offers real-time price predictions and expert-driven market trends. This comprehensive guide to Fantom explores its core technology, investment potential, and market positioning. The FAQs below provide deeper insights to help readers make informed decisions.