Warren Buffett’s departure as CEO of Berkshire Hathaway has stirred both excitement and reflection in the financial world. As Greg Abel steps into his shoes by the end of 2025, Buffett’s impactful exit was marked by a critical observation on global currency trends. Despite his deep legacy in value investing, Buffett’s view on currency devaluation seems to resonate with the underlying principles of Bitcoin—an irony considering his long-standing skepticism towards cryptocurrencies. This backdrop sets the stage for understanding the intriguing intersection of traditional finance and digital currencies.

The Intersection of Traditional Finance and Bitcoin: Buffett’s Ironic Farewell

Buffett’s Perspective on Currency and Bitcoin’s Role

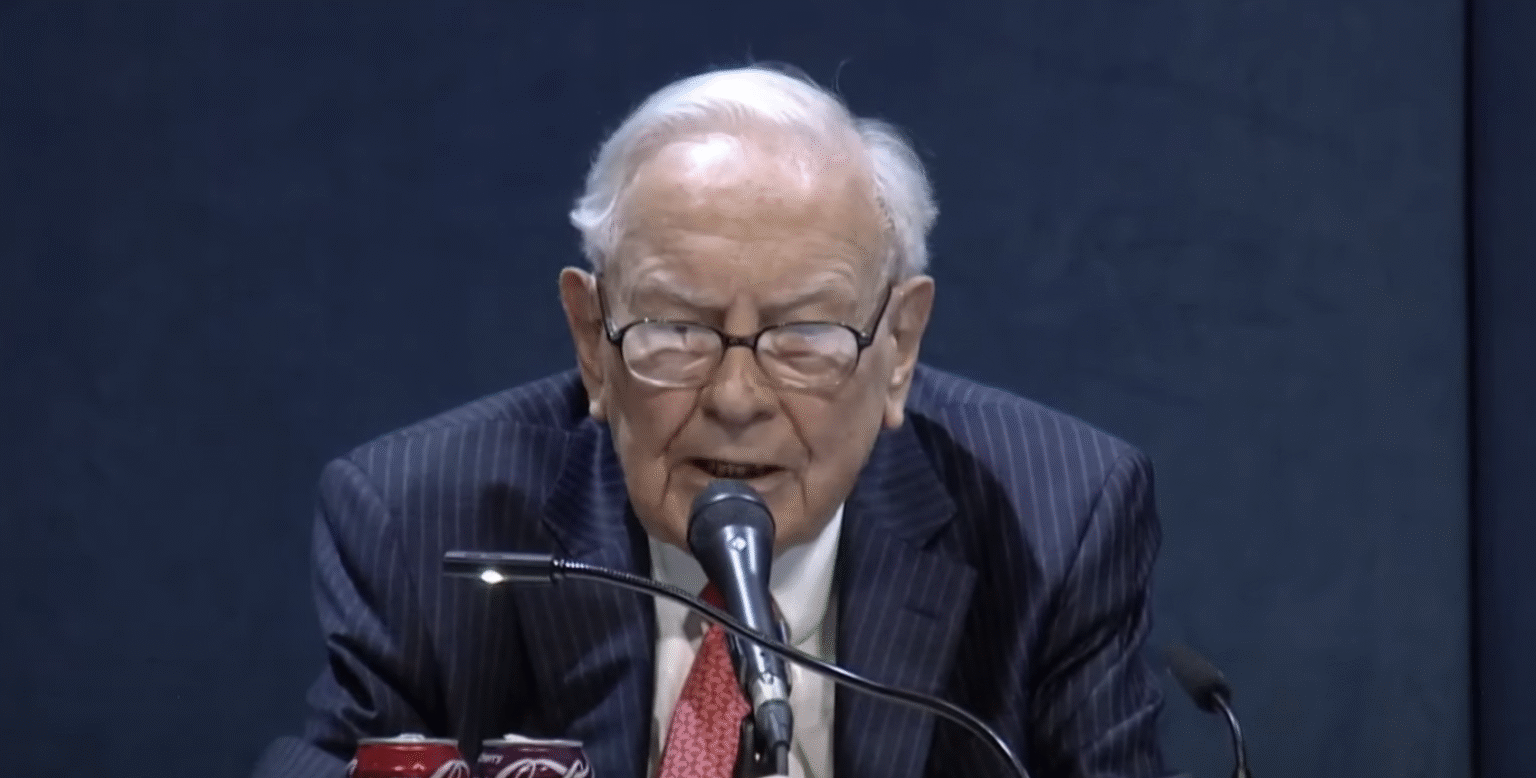

During a notable gathering at Omaha’s CHI Health Center, Warren Buffett shared his insights with shareholders, highlighting that the intrinsic danger to capital is government-induced currency debasement, rather than market downturns or economic recessions. He articulated his belief that governments naturally gravitate toward making currencies lose value, posing severe long-term implications.

His remarks, although void of explicit references to Bitcoin, rapidly gained traction among crypto enthusiasts. A pseudonymous commentator within the crypto community, Carl Menger, interpreted Buffett’s statements as inadvertently advocating for Bitcoin, suggesting a move to more decentralized and non-sovereign currencies. Menger provocatively noted Buffett’s preference for traditional currencies, critiquing his inability to appreciate Bitcoin’s value.

The Divergence: Bitcoin vs. Traditional Investments

Michael Saylor, the executive chairman of MicroStrategy, offered a sharp contrast to Buffett’s philosophy. Saylor, who once described Bitcoin as the solution to Buffett’s monetary concerns, reiterated his stance on Bitcoin’s superiority over traditional currency stashes. While Berkshire Hathaway cultivated a formidable cash reserve of $347.7 billion by Q1 2025, Saylor continued to channel resources into Bitcoin, aligning with the digital asset’s expanding prominence.

Buffett’s staunch stance against Bitcoin, branding it as “rat poison squared” and declaring its lack of intrinsic value, underscores a philosophical divide. His legacy of building a $1.16 trillion empire from a modest textile company speaks of his preference for tangible, productive assets over digital currencies.

Is Bitcoin the Answer to Currency Debasement?

Bitcoin, with its limited supply and decentralization, offers an alternative to fiat currency devaluation. However, it remains crucial to consider potential risks, such as regulatory challenges and market volatility, before embracing it as a hedge against inflation.

Why Does Warren Buffett Remain Skeptical of Bitcoin?

Buffett’s skepticism stems from his view that Bitcoin lacks inherent value, as it neither generates income nor holds utility in traditional economic activities. His investment philosophy favors assets with productive capabilities and tangible outputs.

How Does Berkshire Hathaway’s Strategy Contrast with Bitcoin Advocacy?

Berkshire Hathaway prioritizes large cash reserves and investments in productive enterprises over digital currencies, reflecting Buffett’s belief in tangible business growth. In contrast, Bitcoin advocates like Michael Saylor focus on digital assets as a hedge against currency debasement.

While Bitcoin continues to challenge traditional financial concepts, Warren Buffett’s expert opinions remain influential, prompting a broader conversation on the role of digital currencies in contemporary economics. This comprehensive guide to the evolving financial landscape navigates these discussions, offering insights into how Bitcoin and traditional investments might coexist or diverge.